On Friday, November 4th at 8:30 AM ET, the Bureau of Labor Statistics is set to release the latest US Nonfarm Payrolls and Unemployment Rate numbers, here are some views on what to expect:

Wells Fargo

Nonfarm Payrolls Forecast: 190K

Unemployment Rate Forecast: 3.5%

The labor market is cooling, but employment growth remains strong. Nonfarm payrolls increased 263K in September, a deceleration from recent months, but still a heady pace relative to the previous expansion.

While overall growth prospects have weakened considerably, we expect employers to continue to hire at a solid pace in the near term and forecast payrolls to increase by 190K in October.

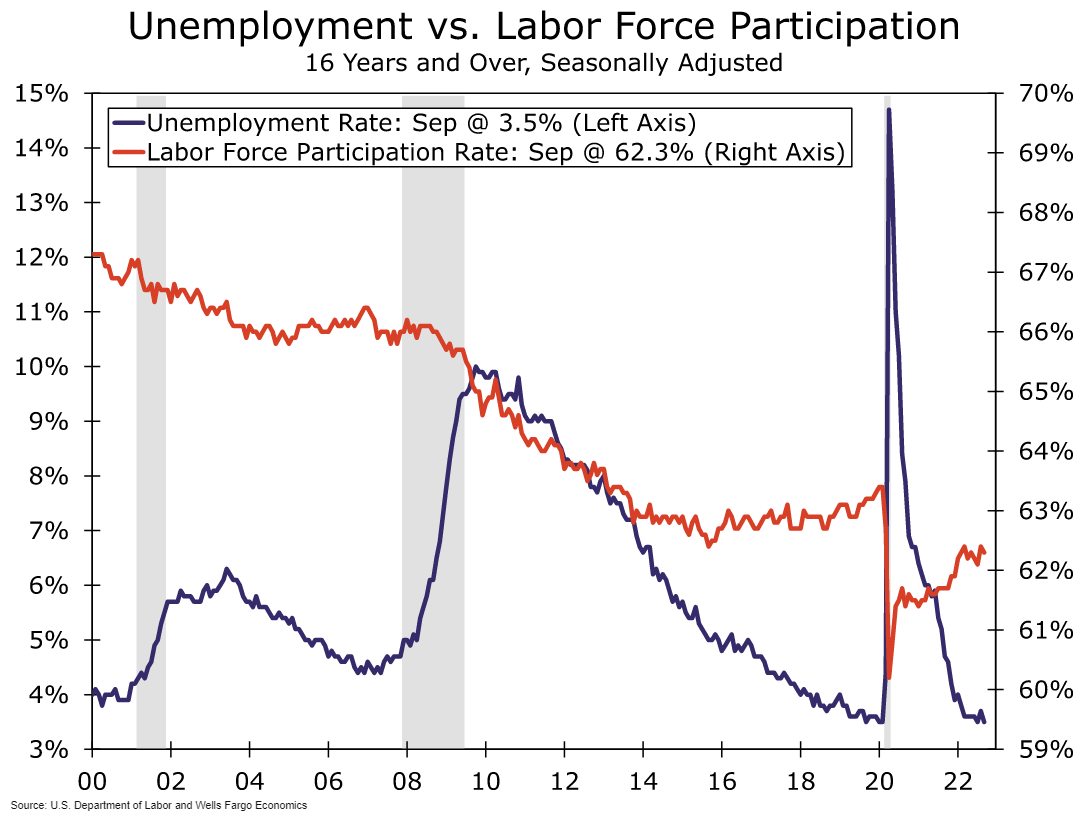

Meanwhile, gauges of labor supply are more subdued, with the labor force participation rate largely remaining range-bound over the better part of this year.

The unemployment rate dipped back to a 50-year low of 3.5% last month, suggesting there isn't much slack in the labor force. We anticipate the unemployment rate will hold steady at 3.5% in October and look for average hourly earnings to rise by 0.3% over the month.

ING

ING

Nonfarm Payrolls Forecast: 220K

Unemployment Rate Forecast: 3.6%

The outcome of Friday’s jobs report will help markets firm up expectations for what the Fed may do in December. There have been hints that officials could open the door to a slower pace of rate hikes, and after 375bp of interest rate increases, there is a strong argument for taking stock of the situation.

Citigroup

Nonfarm Payrolls Forecast: 190K

Unemployment Rate Forecast: 3.5%

JPMorgan Dr. David Kelly

Nonfarm Payrolls Forecast: 255K

Unemployment Rate Forecast: 3.4%

Our models suggest a gain of over 200,000 non-farm payroll jobs with the unemployment rate edging down to a fresh 53-year low of 3.4%. This continued momentum should help soothe fears of an imminent recession. However, an equally important issue will be the growth in average hourly earnings. We expect a 0.4% gain which would cut the year-over-year increase to 4.8% in October from 5.0% in September.

If this occurs, it should send important messages to both the Federal Reserve and investors. For the former, it would provide further evidence that the labor market is, in fact, not causing an acceleration in inflation and, with real wages down even as productivity rises, wage growth is merely slowing the deceleration in inflation.

For investors, it should provide a further demonstration of the power of American business to hold costs in check, even in the face of a very tight labor markets. With just over half of the market cap of the S&P500 reporting, fewer companies are reporting positive earnings surprises than in any quarter since the onset of the pandemic. However, despite the challenges of rising interest rates, tight labor markets, a strong dollar, and slowing nominal GDP growth, companies appear to be doing a good job preserving margins.

Bank of America

Nonfarm Payrolls Forecast: 225K

Unemployment Rate Forecast: 3.5%