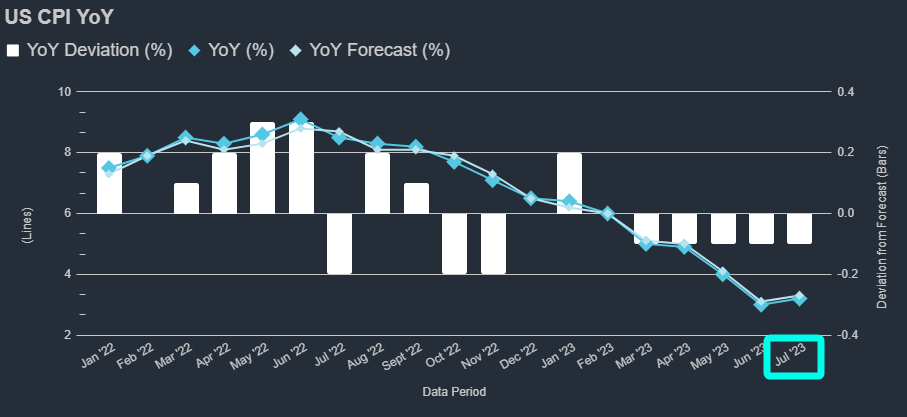

On August 10th at 8:30 AM ET, the BLS released the CPI numbers for the month of July.

CPI YoY was 3.2%, lower than the expected 3.3% and up from the previous 3.0%. The MoM US CPI and core were 0.2%, in line with both the forecast and the previous month's value.

Core CPI YoY also came in as expected, moderating down to 4.7% from the prior 4.8%.

Following this release, Fed Swaps price in lower odds of another rate hike this year.

Top 3 Positive Contributors (YoY)

Transportation services: 9.0%

Shelter: 7.7%

Food away from home: 7.1%

Top 3 Negative Contributors (YoY)

Fuel oil: -26.5%

Gasoline (all types): -19.9%

Used cars and trucks: -5.6%

These values represent the percentage change in each category over the twelve months ending in July 2023. Positive values indicate that these categories contributed to the overall increase in the CPI, while negative values indicate they contributed to a decrease.

Top 3 Positive Contributors (MoM)

Fuel Oil: 3%

Food at Home: 0.3%

Energy and Commodities: 0.3%

Top 3 Negative Contributors (MoM)

Used Cars and Trucks: -1.3%

Electricity: -0.7%

Medical Care and Services: -0.4%

Given the current state of CPI on a YoY basis, some analysts have stated that the MoM read is more important in this particular report, the 0.2% read seen in the headline and core MoM numbers are consistent with getting inflation back to the Fed's 2% target.

What does this mean for the Federal Reserve? They have a lot more data to go through before their meeting on September 19th-20th, but this report indicates that inflation is moving in the right direction.

Yes, the headline figure appeared this month, but it was led by one category that is already showing signs of weakness.

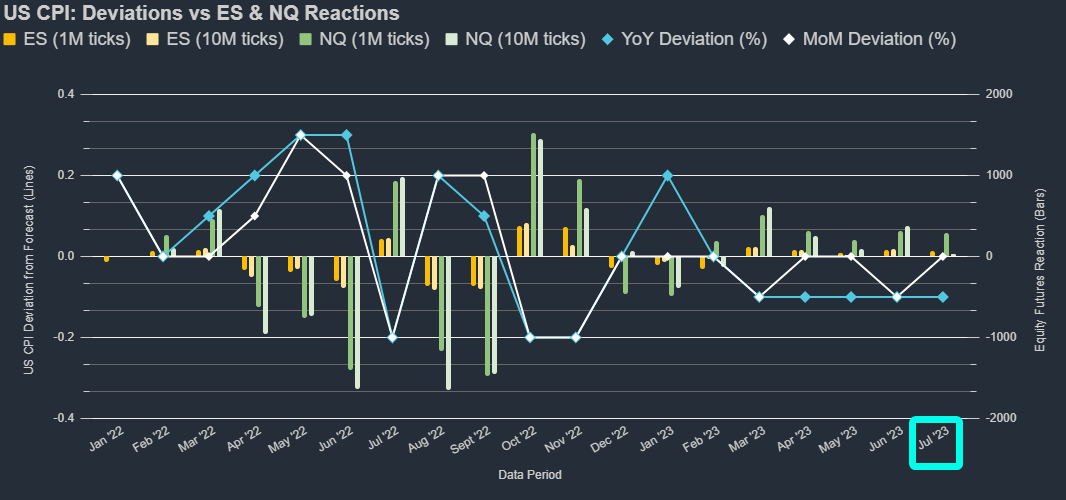

Immediate market reactions after 1 minute:

ES increased by 66 ticks.

NQ increased by 292 ticks

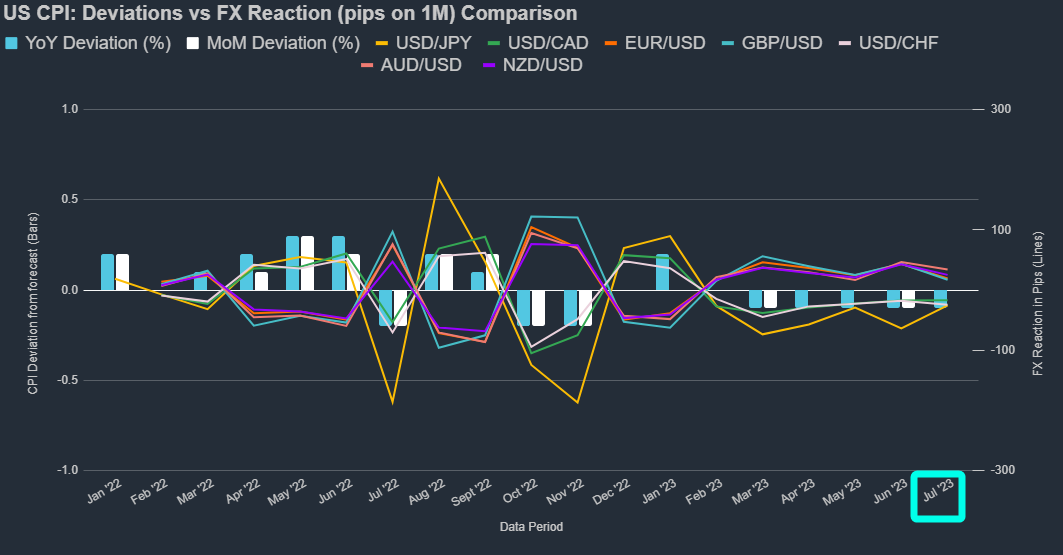

USD/JPY decreased by 25.2 pips.

Market Reaction per 10 bps (0.1%) Deviation:

ES market reaction: 66.00 ticks (median since Jan '22: 84 ticks)

USD/JPY market reaction: 25.20 pips (median since Jan '22: 46.08 pips)

It is clear that the market reactions are no longer as pronounced as they have been, especially during Q3 last year when the Fed's tightening cycle had no end in sight.

In fact, market reactions to this, and other data points, have been muted in comparison since the beginning of 2023, as the markets perceive this data as being less important to the trajectory of the Fed's monetary policy.