Jan 12th

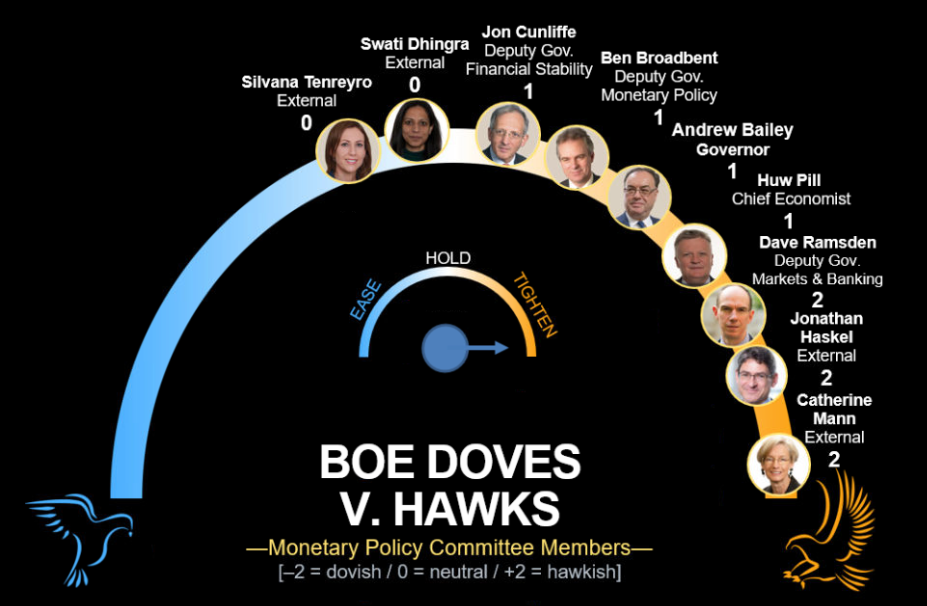

Traders bet that The Bank of England interest rates will peak below 4.5%.

Traders trim peak BoE rate bets to 4.43%, the lowest since September.

Jan 19th

"With inflation continuing to eat away at salary growth and the threat of some stunning energy bills arriving shortly," said Joe Staton, client strategy director at GfK. "One thing we can be certain of is that 2023 will be a rocky trip."

Jan 20th

MUFG's Lee Hardman, retail sales have only "slightly countered" optimism from other economic indicators this week. "A stronger UK economy would put additional pressure on the BoE to deliver more rises."

Jan 21st

"The BoE is going to have to maintain pressing down on inflation for quite a long time," said Robert Wood, Bank of America's senior UK economist.” The UK "stands out" as having the greatest issues in the United States and Europe, and that underlying pricing pressures and high wage growth indicate that "this inflation is likely to last.

Markets are looking at another 50 BPS hike for Feb to take the rate to 4%, the highest rate since February 2008 and then another by the third quarter

The first rate cut is not fully priced in by investors until February 2024