On July 12th at 8:30 AM ET, the BLS released its Consumer Price Index report for the month of June.

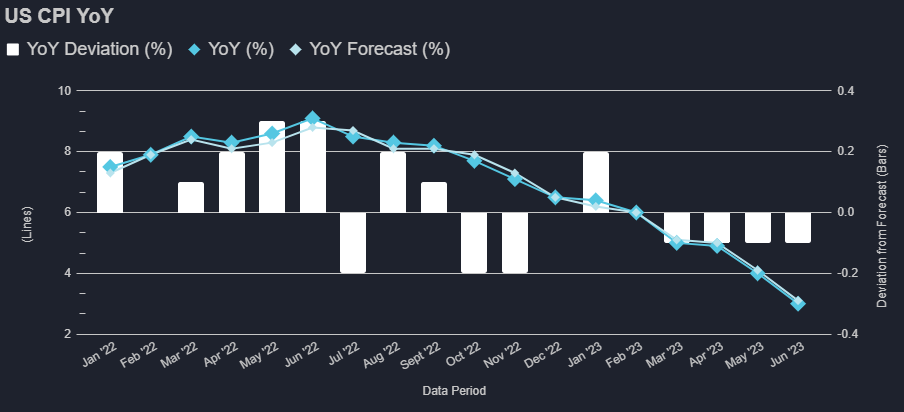

US CPI YoY was 3%, slightly below the forecasted value of 3.1%, and lower than the previous rate of 4%. The MoM CPI increased by 0.2%, slightly below the predicted value of 0.3%, and higher than the prior rate of 0.1%.

Top 3 positive contributors to the latest CPI:

Shelter: Contributed positively with increases of 0.4% in June and 7.8% over the 12-month period, indicating rising housing costs.

Food away from home: Showed a positive contribution with a 0.4% increase in June and a 7.7% increase over the 12 months, suggesting higher prices for dining out.

Transportation services: Made a positive impact with a 0.1% increase in June and an 8.2% increase over the 12 months, implying higher costs for transportation-related services.

Top 3 negative contributors to the latest CPI:

Energy commodities: Despite an overall positive CPI, energy commodities had a negative contribution due to declines in prices, particularly for fuel oil, gasoline, and other energy-related commodities.

Utility (piped) gas service: Showed a negative contribution with a decrease of 1.7% in June and an 18.6% decrease over the 12 months, indicating lower costs for piped gas services.

Used cars and trucks: Had a negative impact with a decline of 0.5% in June and a larger decrease of 5.2% over the 12 months, suggesting lower prices for used vehicles.

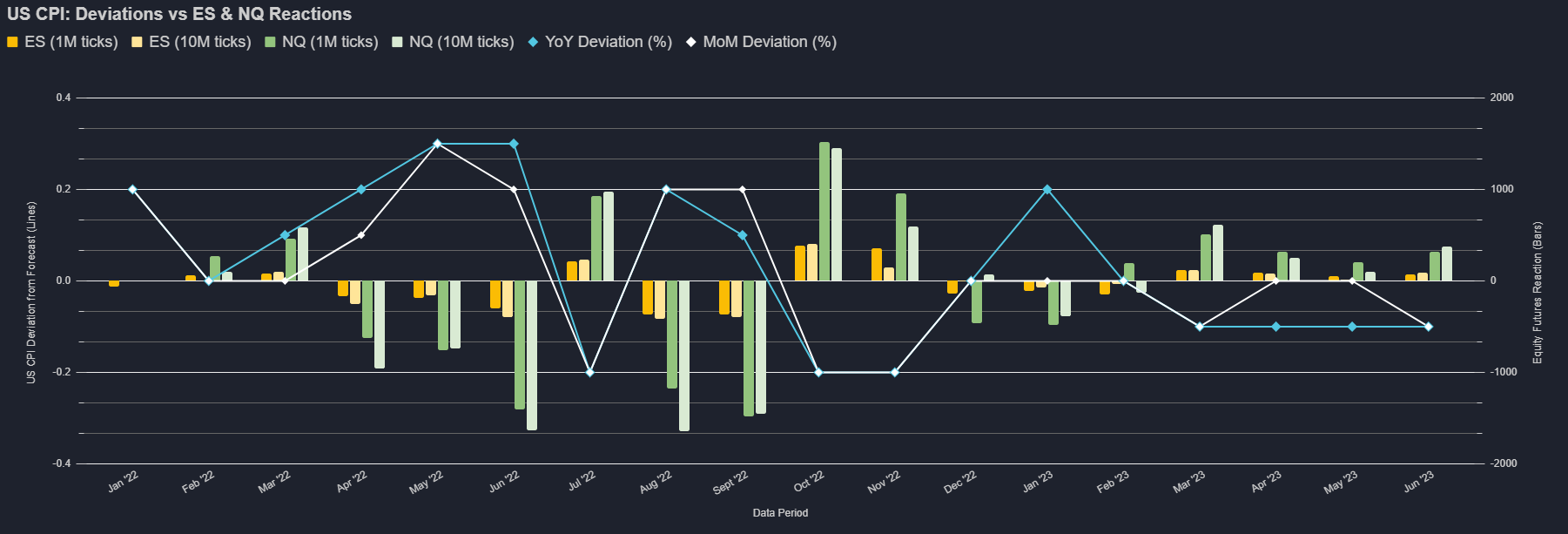

Market Reaction

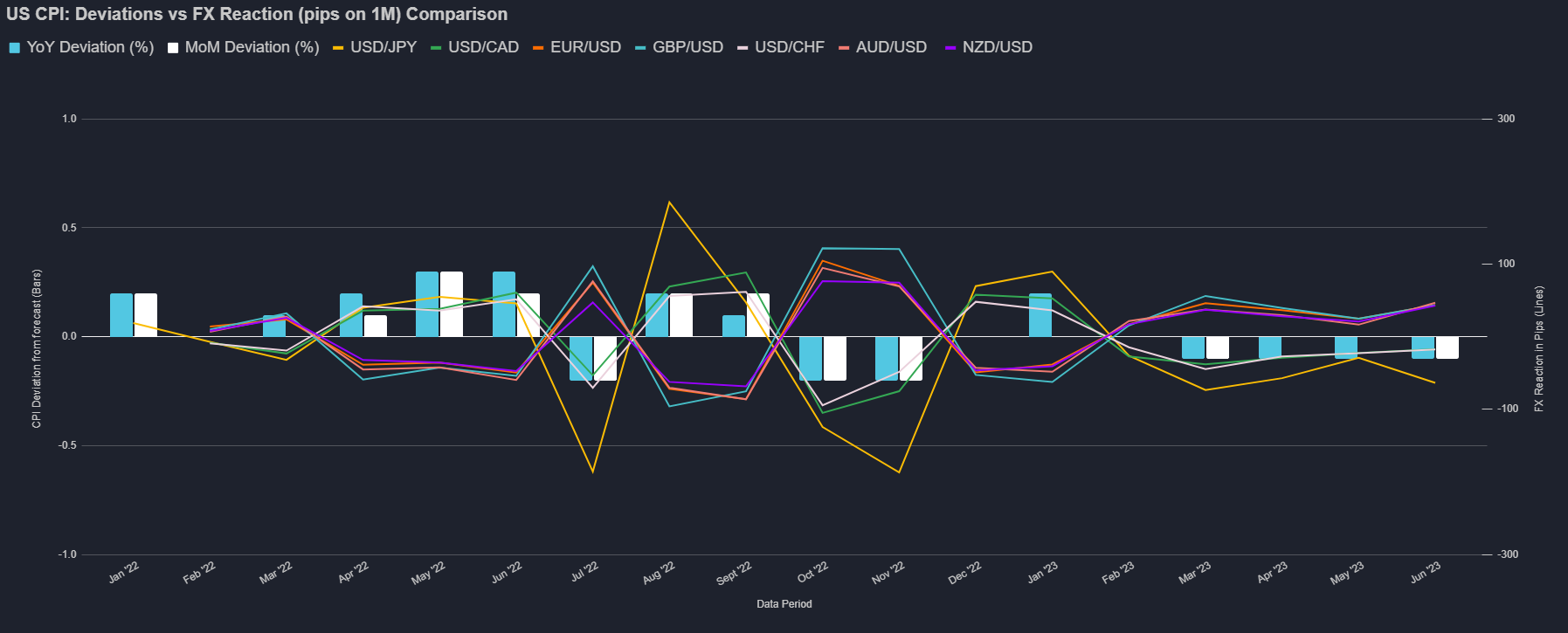

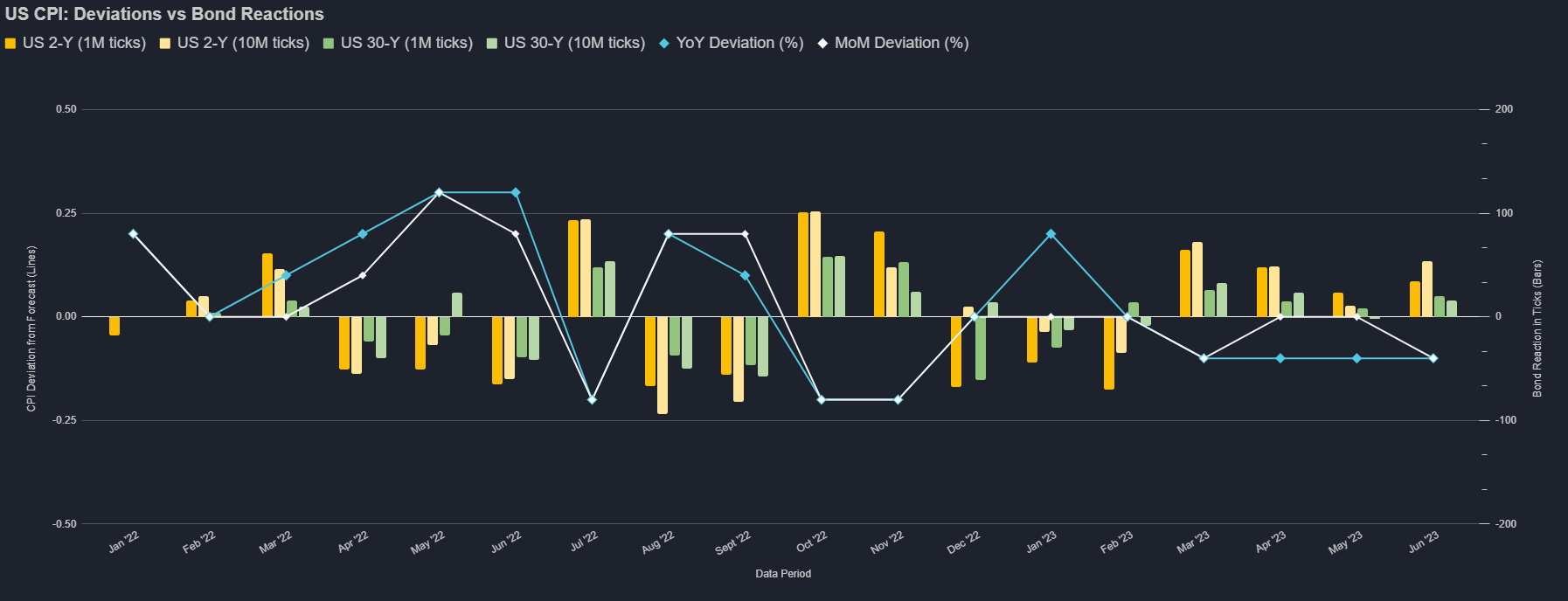

Following the release, market reactions were observed after the first minute, with ES rising by 74 ticks, NQ increasing by 316 ticks, USD/JPY declining by 63.5 pips, and the US 2-year bond increasing by 34 ticks.

A slight decrease in the YoY inflation rate and a modest increase in the MoM CPI can signal a moderation in inflationary pressures. This may indicate that the central bank's tightening measures are effectively controlling inflation without significantly disrupting economic growth, which was perceived positively by the markets.

The dollar weakened on signals that inflation is dropping as the Fed would like, which shows that more central bank tightening may not be warranted, as is backed up by US short-term interest-rate futures rising after the inflation data, as traders pare expectations for Fed rate hikes after July.

Due to the market repricing of future Fed rate hikes, the US 2-year bonds, which are most sensitive to imminent policy moves, led the reaction.