On Tuesday the 13th of June at 8:30 AM ET, the BLS is set to release the US CPI numbers for the month of May.

Here are some views on what to expect.

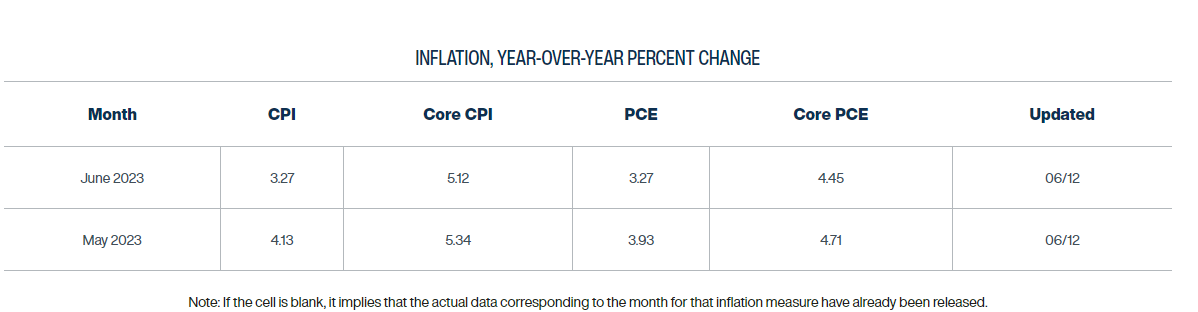

According to median analyst estimates, US CPI YoY is expected to drop to 4.1%, from its prior of 4.9%. The highest estimate is 4.3%, with the lowest at 4%, the MoM read is forecast to drop to 0.2% from 0.4%.

Core CPI YoY is expected to fall to 5.2%, from 5.5%. The highest estimate is seen at 5.4%, with the lowest at 4.9%.

JPMorgan's Dr. David Kelly

CPI YoY Forecast: 4.2%

MoM Forecast: 0.2%

Overall, we estimate that consumer prices rose 0.2% in May and were up 4.2% year-over-year. This will mark the 11th consecutive decline in the seasonally adjusted year-over-year inflation rate since it peaked at 8.9% last June. A look at CPI components and what’s driving them suggests that inflation should continue to decline. We estimate that energy prices fell 9.9% year-over-year in May.

We estimate that shelter, which has a huge 35% weight within the CPI, rose 8.0% year-over-year in May, accounting for two-thirds of CPI inflation. The shelter share of CPI can be broken down into roughly 1% for hotels, 8% for actual rent of property, 25% for “owners’ equivalent rent” and 1% for other small pieces.

Looking further out, we expect continued mild inflation in June, with another 0.2% month-to-month increase cutting year-over-year CPI growth to just 3.2%. Thereafter, year-over-year inflation should drift sideways for the rest of the year and then resume its downward trend in 2024, reaching 2.3% by the end of 2024. This would be roughly in line with the Fed’s 2% target for the personal consumption deflator.

Wells Fargo

CPI YoY Forecast: 4%

MoM Forecast: 0%

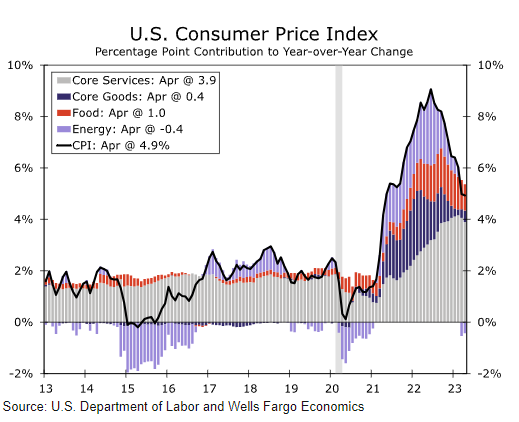

Recent inflation data have come in largely as expected. The Consumer Price Index rose 0.4% in April, bringing the year-ago change down to 4.9%. While April's increase was stronger than March's 0.1% headline gain, declining grocery store and energy services prices have provided some meaningful relief to consumers. Excluding food and energy, the core CPI rose 0.4% in April, matching the prior month's increase. A surge in used vehicle prices boosted core goods' inflation, while a cooling in travel services helped to somewhat offset gains in shelter, recreational and other personal care services.

Overall consumer price inflation likely moderated in May. We forecast the headline CPI was flat during the month, as gasoline prices fell and food prices appeared to hold steady. Core inflation, on the other hand, likely remained firm. Auction data suggest used vehicle prices rose again last month, and we look for ongoing strength in core services. Specifically, we suspect the core CPI rose 0.4% for the third consecutive month, which would leave the year-over-year change little improved at 5.3% in May.

Morgan Stanley

CPI YoY Forecast: 4%

MoM Forecast: 0.1%

Cleveland Fed Inflation NowCasting

Previous Release

On May 1oth at 8:30 AM ET, the BLS released the last US CPI print for the month of April.

This Release saw the headline CPI YoY moderate slightly to 4.9% from the forecasted no change of 5%, however, the CPI MoM did rise to 0.4% (in line with expectations) from 0.1%.

The Core CPI YoY moderated as expected to 5.5% from it's prior of 5.6% and the Core MoM remained at 0.4%, in line with the median forecast.

The Headline CPI YoY cooling off was enough to offset the rise in the MoM figure, Causing upside in the S&P 500 and downside in the DXY and 2-Year yields.

The CPI Print we get today may shape the move the Fed takes in tomorrow's FOMC. Currently, the CME Fedwatch tool shows a chance of no change at 73.5%.