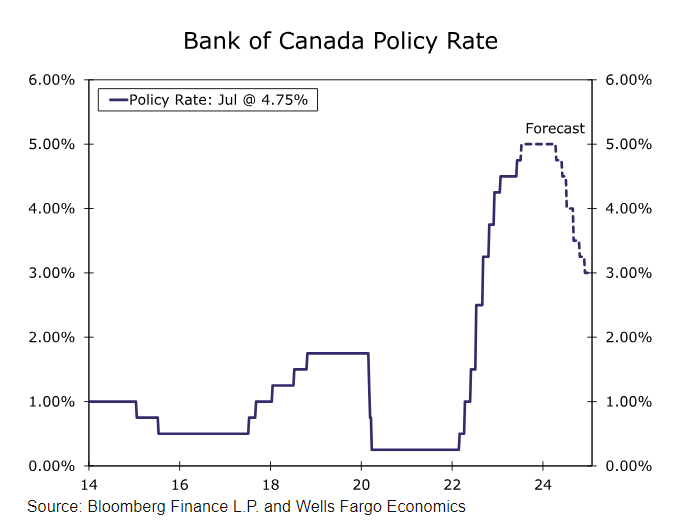

On Wednesday 12th of July, the Bank of Canada will set its rate.

Median forecasts point to a 25bp hike. Here are some views on what to expect.

Black Rock

Forecast: 25 bps hike to 5% from 4.75%

The Bank of Canada hiked after a pause – and markets are leaning toward odds of another hike this week. We think central banks will be forced to keep policy tight to lean against inflationary pressures.

Wells Fargo

Forecast: 25 bps hike to 5% from 4.75%

The Bank of Canada (BoC) announces its monetary policy decision next week and, much like June, the July decision appears to be a finely balanced call. The BoC raised rates 25 bps at its June meeting, and for July, we lean toward another 25 bps rate hike, to 5.00%. That is in line with the consensus forecast, with an overall majority of economists also looking for a 25 bps rate hike.

Mixed recent data make the July decision a close call. The May CPI slowed to 3.4% year-over-year, and the average of the core inflation measures slowed a bit more than expected to 3.9%. However, the core inflation measures in particular remain some way above the central bank's inflation target range. April GDP was flat on the month, although Statistics Canada's early estimate for May GDP is for a decent-sized 0.4% month-over-month gain. Separately, Canadian employment rebounded by 60,000 in June, including a 109,600 gain in full-time jobs. Finally, the BoC's Q2 Business Outlook Survey saw a further drop in the business outlook indicator to -2.2, but also reported fewer firms expecting a drop in future sales. While mixed, we believe recent figures have shown enough resilience in activity, and still elevated enough underlying inflation trends, for the central bank to hike its policy rate another 25 bps this month. We will also be paying close attention to the Bank of Canada's updated economic projections, which, regardless of the outcome of the July meeting, should also provide insight into whether we can expect further monetary tightening beyond this month.

ING

Forecast: 25 bps hike to 5% from 4.75%

Having hiked interest rates to 4.5% in January the Bank of Canada had been on hold but, after a five-month hiatus, decided to tighten monetary policy further and raised rates by 25bp in early June. Policymakers argued that demand had proven to be more resilient than expected and inflation more persistent, and left the door ajar to further policy tightening at subsequent meetings.

Last month, the BoC suggested that it would continue to evaluate inflation, wage and demand dynamics to determine its next steps. Since that meeting, the data has been mixed. Inflation slowed to 3.4% year-on-year from 4.4%, which was in line with expectations, but the core rate undershot, coming in at 3.9% versus 4.3% previously. GDP was flat in April, but the flash estimate for May was better at +0.4% month-on-month. Then, the labour market data showed the economy adding 60,000 jobs in June, three times the 20,000 consensus expectation, but unemployment rose to 5.4% having been stable at 5% in the first four months of the year. Wage growth slowed to 3.9% from 5.1%, which is a very encouraging outcome.

To restart hiking after a five-month break suggests the BoC feels it hasn’t done enough to be certain that inflation will return sustainably to the 2% target. To us, this means the odds certainly favour at least one additional move and we see little reason for them to wait – hence our call for a 25bp hike on 12 July. Nonetheless, the encouraging inflation and wage story should bring into doubt the need for aggressive additional hikes thereafter.

Goldman Sachs

Forecast: No change

Previous Release

On Wednesday 7th of June, The Bank of Canada decided to hike by 25 bp, this resulted in strong Canadian Dollar upside.