On Wednesday 7th of June, the Bank of Canada will set its rate.

Median forecasts point to no change however, outliers believe a hike could be in the works. Here are some views on what to expect.

Wells Fargo

Forecast: No change, rate to remain at 4.5%

The Bank of Canada holds its June monetary policy meeting next week, and in our view, the central bank will opt to keep rates on hold at 4.50% for the third meeting in a row, in line with consensus expectations.

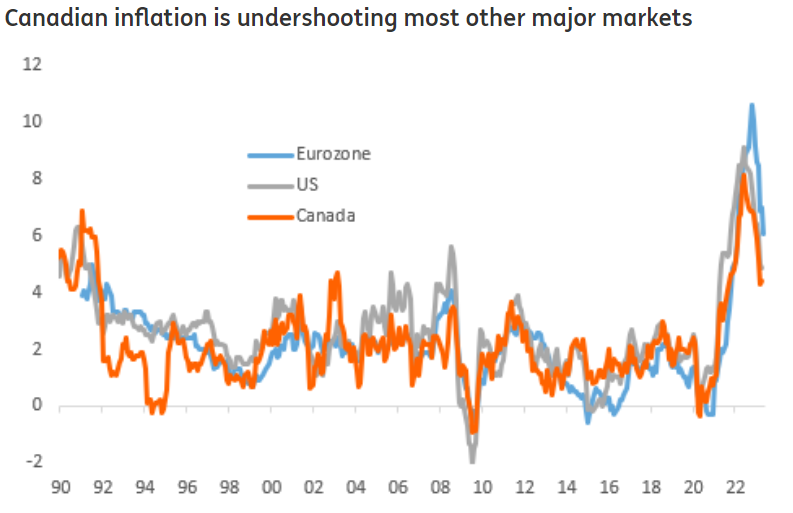

Inflation dynamics in Canada have been mixed recently when it comes to the headline rate versus underlying inflation. While April's headline CPI ticked up to 4.4% year-over-year, the core inflation measures have receded compared to a year ago and have shown overall downward momentum over the past few months. If inflation trends remain elevated and activity remains resilient, there certainly remains a risk the Bank of Canada will raise its policy rate further beyond 4.50%. However, in our view, the more relevant debate is how quickly the BoC turns to monetary easing in the quarters ahead.

With our expectation for the Fed to begin monetary easing in 2024, and with inflation in Canada slowing down steadily but gradually, we also now expect Bank of Canada rate cuts to be delayed until the first quarter of next year, compared to our previous forecast for rate cuts to begin in Q4-2023.

ING

Forecast: No change, rate to remain at 4.5%

The RBA's move to restart its tightening cycle may throw extra focus on tomorrow's Bank of Canada (BoC) meeting after paused rate hikes at its March and April meetings. A 25bp BoC rate hike tomorrow (now priced with a 43% probability) would probably cause ripples across core bond markets around the world and could keep the dollar bid on the view that the Fed might be closer to hiking than first thought. Let's see.

We expect the BoC to leave the policy rate at 4.5% next week, but after stronger-than-expected consumer price inflation and GDP and with the labor data remaining robust, we cannot rule out a surprise interest rate increase.

We have had additional warnings from Governor Tiff Macklem that the bank remains concerned about upside inflation risks with the latest CPI report showing a month-on-month increase in prices of 0.7% versus a consensus forecast of 0.4%, resulting in the annual rate of inflation rising to 4.4%. The economy added another 41,400 jobs in April, more than double the 20,000 expected with wages rising and unemployment remaining at just 5%. The resilience of the economy was then emphasised further by first quarter GDP growth coming in at 3.1% annualised, beating the 2.5% consensus growth forecast. Consumer spending was the main growth engine, rising 3.1%.

Scotiabank

Forecast: 25 bps hike to 4.75% from 4.5%

Scotia Economics expects a 25bps rate hike at this meeting accompanied by continued guidance that leaves the door open to further tightening by largely retaining something either identical or very similar to the final paragraph’s guidance in recent statements that has said:

“Governing Council continues to assess whether monetary policy is sufficiently restrictive to relieve price pressures and remains prepared to raise the policy rate further if needed to return inflation to the 2% target.”

If the BoC does not hike this week, then the effect of hawkish guidance on the front end of the Canada rates curve is likely to be tantamount to a hike as an imperfect substitute toward buying time into July.

Previous Release

On Wednesday 12th of April, The Bank of Canada decided to leave the rate unchanged for the second time, in line with what was forecasted, and the reaction was muted to this rate decision.

Key Comments from the last Rate Statement:

BoC: The governing council continues to assess whether monetary policy is sufficiently restrictive, and remains prepared to raise rates if needed.

BoC drops language about likelihood of a couple of 2023 quarters with slightly negative growth being roughly the same as that of a couple of quarters with slightly positive growth.

BoC expects inflation to fall quickly to around 3% in mid-2023 and then decline more gradually to 2% target by end-2024.