On Wednesday 12th of March, the Bank of Canada will set its rate.

All signs point to no change, so eyes will turn to the Bank of Canada Rate Statement, and the subsequent press conference with Governor Macklem.

Here are some views on what to expect.

Wells Fargo

BoC Rate Forecast: No Change at 4.5%

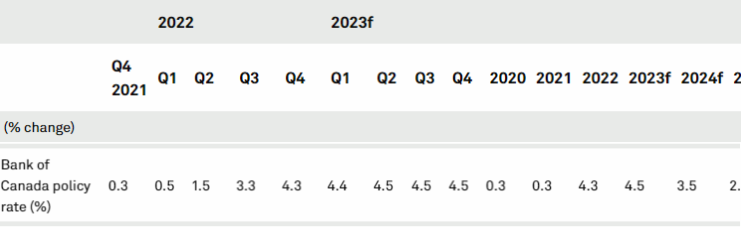

The Bank of Canada (BoC) holds its next monetary policy meeting Wednesday, a meeting at which we expect the central bank to hold its policy rate steady at 4.50% for the second meeting in a row.

The BoC moved to a neutral stance earlier this year, given some signs of slower inflation and moderate growth, and as it assessed the effects of its previous monetary tightening.

Since that time, activity indicators have been somewhat mixed. There have been hints of strength, including a 0.5% month-over-month rise in January GDP, and an average employment gain of 68,800 per month during the first quarter. On the flip side, the drop in the BoC's business outlook indicator to -1.1 in Q1 still points to softer growth ahead, while the three-month annualized rate of core inflation for the BoC's preferred measures have slowed to a 3-4% range. That is, core inflation is still running above the central bank's inflation target but is well down from the highs seen last year. Against this backdrop, we do not expect the Bank of Canada to raise rates further, but nor do we expect the central bank will be in any rush to lower its policy rate either. For now, we see the Bank of Canada monetary policy as comfortably on hold at the April monetary policy meeting.

S&P Global Research

BoC Rate Forecast: No Change at 4.5%

The recent financial turmoil stemming from U.S. bank failures adds downside risk to our forecasts, particularly for the US economy, with knock-on effects for the Canadian economy. However, these forecasts assume recent measures by regulators to stabilize the financial markets are successful. A rate cut by the Bank of Canada may be on the table sooner than expected if global financial concerns spread to the real economy, but this is not built into our March forecast. We expect the Bank of Canada's policy rate to hold at 4.5% until early 2024 when we expect it will start easing.

ING's

BoC Rate Forecast: No Change at 4.5%

At the 8 March Bank of Canada policy meeting, officials outlined their view that “weak economic growth for the next couple of quarters” and increasing “competitive pressures” will bear down on inflation and allow it to “come down to around 3% in the middle of this year”. Today’s data should give them more confidence in this happening and reinforce the market view that 4.5%, reached in January, will be the peak for the policy rate.

We still think the next move in the BoC policy rate will be downward and that the first cut is likely to come before the end of the year. Canada’s greater exposure to interest rates rate hikes via a high prevalence of variable rate borrowing means consumer activity should slow through 2023. High household debt levels in Canada - equivalent to more than 180% of disposable income versus 103% in the US – mean that Canada is especially exposed to the risk of a housing market correction in a rising interest rate environment. Falling inflation rates will give the BoC the room to respond with looser monetary policy, especially with the Finance Minister Chrystia Freeland suggesting her upcoming budget will “exercise fiscal restraint” to help in the battle against inflation.

Previous Release

On Wednesday 8th of March, The Bank of Canada decided to leave the rate unchanged, in line with what was forecasted, and the reaction was muted to this rate decision.

The last Rate Statement said that the BoC Repeats that it expects to hold the key rate at its current level conditional on the economy developing broadly in line with its forecasts. However, it also said BoC reiterates its willingness to raise policy rates further if necessary to return inflation to the 2% target.