July 14th

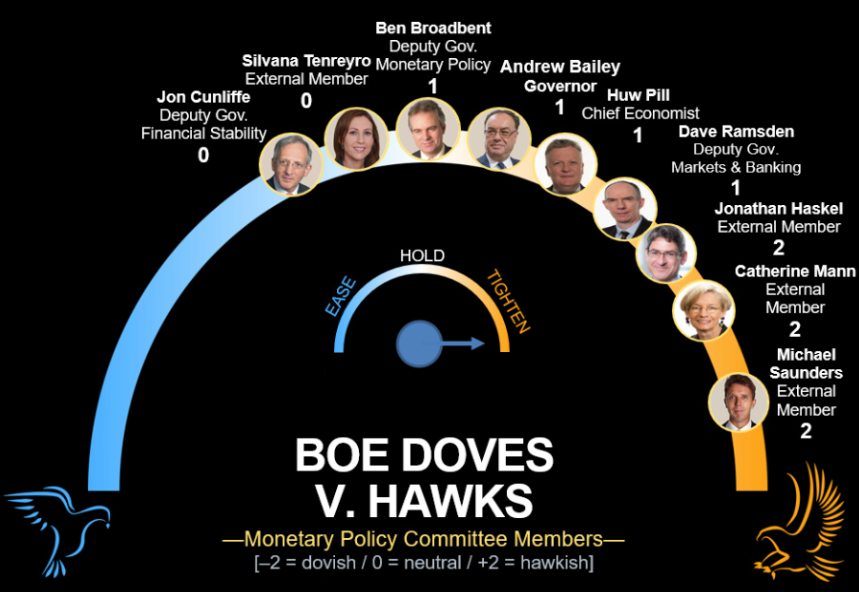

BoE's Ramsden: It is very likely that interest will have to go up further.

July 18th

BoE’s Saunders: I don't think we're done yet on rate hikes. Not correct to say the neutral rate is 1%, it is higher.

June 20th

BoE's Mann: A 50 basis-point move reduces the risk of domestic inflation being boosted by a weaker sterling.

July 24th - Commerzbank

UK's long-standing problem of falling productivity, and "the incoming UK administration is taking over in a tough scenario," according to Ulrich Leuchtmann, head of the currency strategy. "The risk of a terrible spiral of rising inflation and a lower currency is always present."

July 29th - Wells Fargo

We forecast that the U.K. economy will fall into recession by early next year, pushed over the edge by a US recession at the start of 2023. Although we have acquired somewhat of a pessimistic outlook for the U.K. economy, we still expect the BoE to continue hiking rates to tame inflation. Specifically, we expect a steady series of 25 bps policy rate increases at upcoming meetings in August, September and November, which would lift the policy rate to 2.00% by the end of 2022. In 2023, we expect the BoE to eventually begin lowering its policy rate as inflation comes down and economic growth falters

August 1st - Financial Times

Analysts say the decision will be finely balanced, as policymakers weigh relentless inflationary pressures against the rising risks of a recession. But a growing number of forecasters think the balance of opinion on the MPC will swing in favour of the first 50 basis point rise since its independence.