BoE's Bailey

Nobody should interpret 75 basis points as the new rate hike norm.

November 16th

The BoE would not intervene in FX markets.

Inflation in the UK is the result of a series of supply shocks.

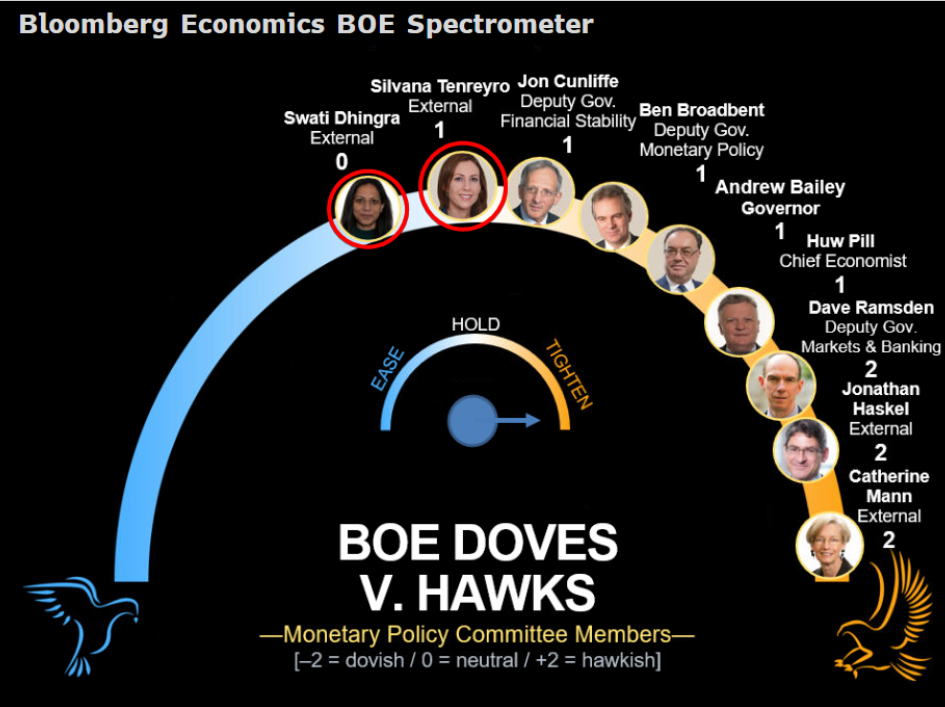

BoE's Dhingra: Overtightening is now a risk.

BoE's Dhingra voted for 50 BPS rise and BoE’s Tenreyro voted for 25 BPS.

November 11th

BoE’s Tenreyro: In 2024, policy needs to be loosened.

In Q4 2022, the UK is likely to be in a recession, mostly due to lower real incomes.

My vote for a 25 BPS rate rise is for risk management

December 8th

Traders pare BoE wagers, see less than 100 BPS of hikes by February.

November 14th

Morgan Stanley sees 150 basis points of BoE interest rate cuts in 2024, sees the central bank stopping hiking in March 2023.

Markets could see a 3-4-2 vote (Three for a 75 BPS Mann, Haskel & Ramsden. Four 50 BPS, Two 25 BPS Tenreyro & Dhingra)

13 December

For the first time in two weeks, traders bet the 4.75% BoE peak rate.