Sentiment -

September 6th: BoE Gov. Bailey: We are no longer in a phase where it was clear that rates needed to rise, we are now data-driven as policy restrictive.

September 14th: BoE rate to peak at 5.5%, according to narrow majority of economists (same as August poll) - Poll.

September 20th: Traders cut probability of BoE 25 BPS hike on Thursday to 50%.

September 20th: UK CPI YoY Actual 6.7% (Forecast 7%, Previous 6.8%)

JPMorgan: “It is too early for the Bank of England to be sufficiently confident that the current level of interest rates - even if held for a longer time - will be enough to return inflation to target,” said Kim Crawford, global rates portfolio manager at JPMorgan.

Goldman Sachs: "The Bank of England is likely to hold rates tomorrow".

Deutsche Bank: "We now expect the BoE to hold rates at 5.25% on Thursday after UK CPI vs the previous expectation for a 25 bps hike".

ING: We're still tempted to say the Bank of England will hike rates tomorrow, and some of the downside surprise in services inflation is down to volatile travel categories. But it's a close call, and both wage and inflation data suggest the end of the current tightening cycle is very close to its conclusion.

Markets have lowered expectations for the peak bank rate:

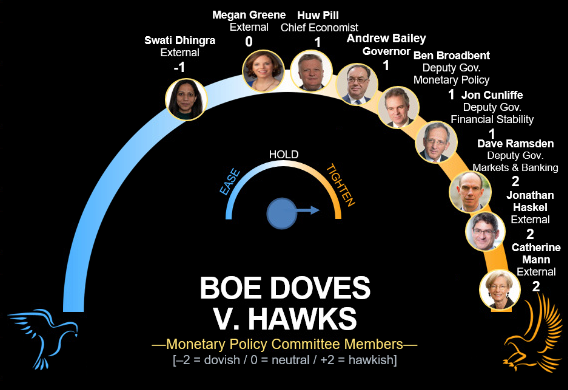

BoE Hawks vs Doves:

Previous Rate Decision Reaction: