ING: They won't want to take any chances, and they really don't want to see markets price in rate cuts. Data has started to go tentatively in their favor, but central banks have learned that inflation data has tended to come in on the upside.

Natwest: Recent geopolitical events will probably induce a modicum of monetary policy caution, reinforcing the likelihood of unaltered policy settings.

Barclays: We expect that the data-dependent guidance is unlikely to change, with the MPC preserving, at least in theory, the possibility of further hikes in order to prevent expectations of cuts being brought further forward.

Nomura: Rising international bond yields and geopolitical concerns (notwithstanding the potential impact on energy prices of the latter) also suggest against higher rates.

IMF: We think that the ECB and BoE are now in the right spot on rates, but flexibility is needed given uncertainty.

Goldman Sachs: The baseline forecast is that the BoE will hold rates until late 2024.

Traders: Traders trim BoE bets, chance of final 25bps hike seen at 50%. [October 23rd]

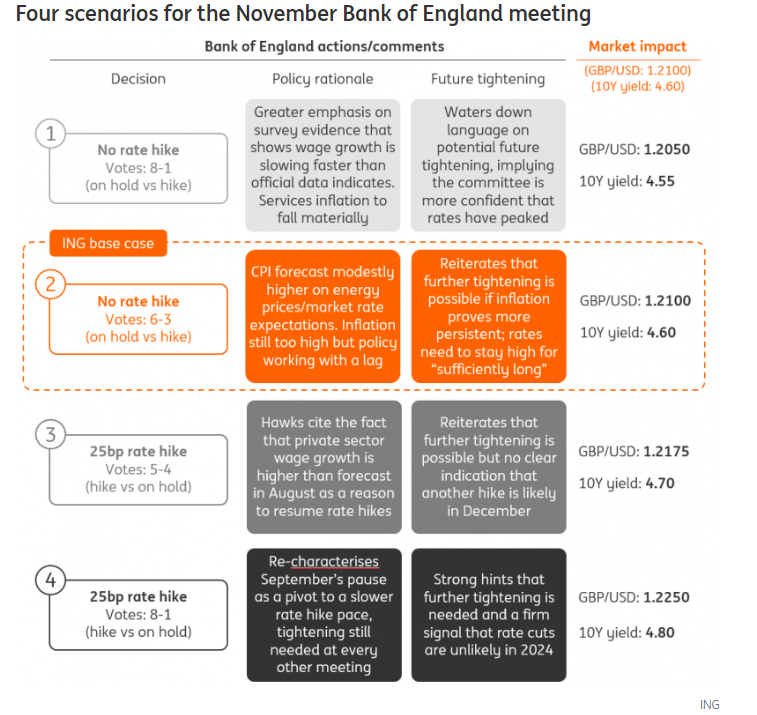

ING's four scenarios for the November BoE Meeting:

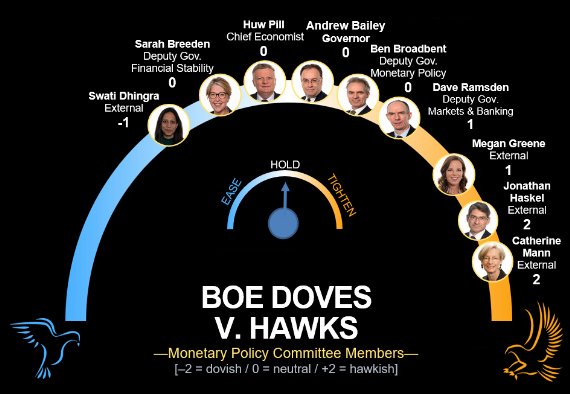

BoE Hawks vs Doves Spectrum:

Previous Reaction: