The ECB is expected to raise rates by 50 BPS despite the recent turmoil in the banking sector.

Credit Suisse following the collapse of SVB left analysts scratching their heads as to whether the ECB would still go ahead with a 50 BPS hike, as traders started to pare bets nearer to 25 BPS which Deutsche Bank also sees as the expectation. However, the recent news of Credit Suisse will borrow 50 bln swiss francs from the Swiss National Bank, which had helped to temper the bloodbath the markets faced yesterday.

Expectations

Société Générale - March 15th

Société Générale Chairman Smaghi warns against 50 BPS ECB rate hike. With the SVB fallout and its effects on the US banking system, holding onto 50 BPS as if nothing happened would be a tougher stance than previously thought. The ECB could delay the increase or raise rates by 25 BPS.

ING - March 13th

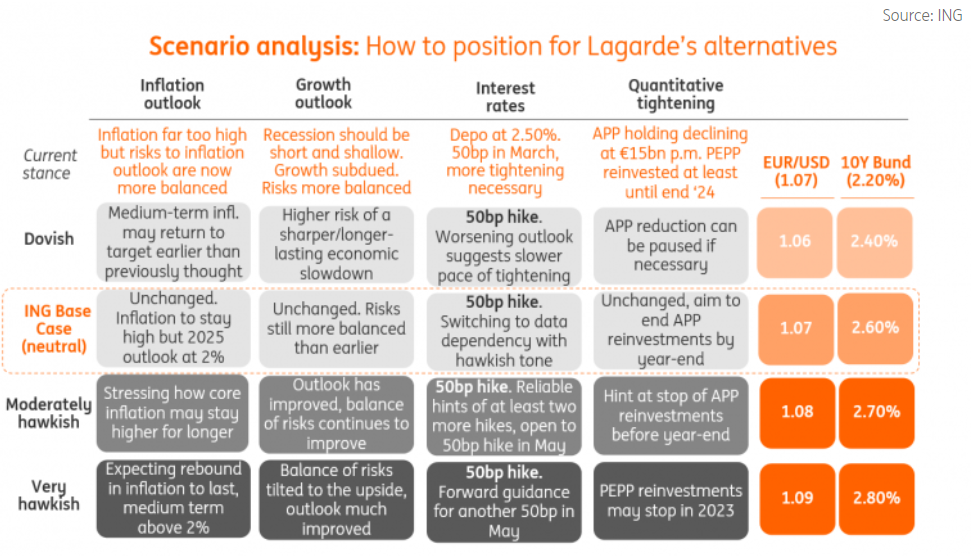

Inflation data support ongoing hawkish rhetoric at the ECB but financial stability risk has markets substantially re-pricing the path for policy rates lower. The risk of miscommunication is high at this meeting; our call for one last spike in rates before the end of this cycle is now conditional.

Previous Market Reaction

EUR/USD whipsawed. There was nothing out of the blue from the ECB, as they reaffirmed what markets were expecting. That was the ECB expected to do another 50 BPS hike on all rates at the upcoming meeting. Lagarde didn't really add anything new, just more of the repeated rhetoric that other ECB members have been spouting of the need to continue raising rates "significantly and steadily".

TRADE ECB RATE DECISION LIVE WITH FJ'S TONY!

Tony will walk you through what to expect from the ECB about 30 mins before the release. CLICK HERE TO JOIN, FREE!