ING - Central banks to keep hiking amid uncomfortably high inflation

The ECB has clearly passed the stage of discussing whether and even when policy rates should be increased. The only discussion seems to be on whether the ECB should start with a 25bp rate hike in July, or move faster with a 50bp hike. It is the ECB’s self-determined ‘sequencing’, i.e. first, to end net asset purchases before hiking rates, which stops the ECB from hiking in June. The 21 July meeting will be the crucial meeting for the rate lift-off.

June 6th

Barclays: Now expect ECB to hike in 25 basis-point increments at each meeting from July to December 2022, and once more in Q1 2023.

Wells Fargo:

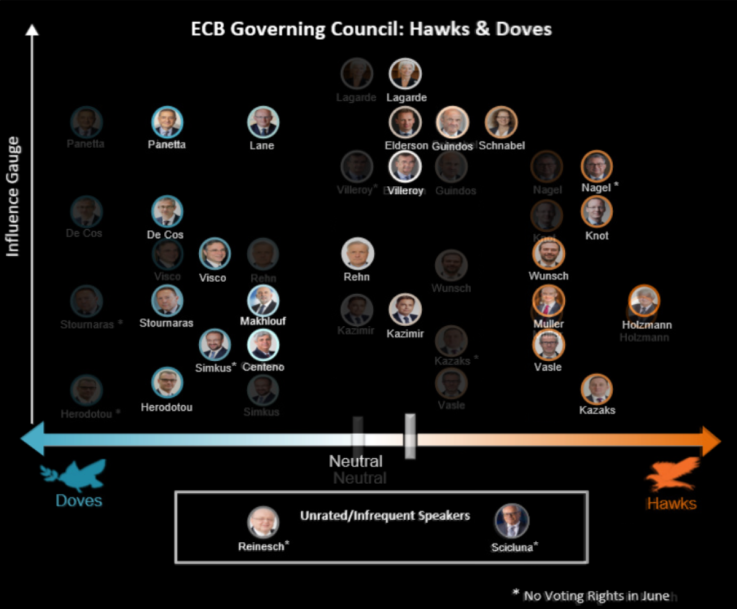

ECB policymakers continue to lean in a hawkish direction on monetary policy, and we think next week the central bank will signal a rate hike is imminent. President Lagarde has opted for language consistent with tighter monetary policy, while other ECB officials have signalled the need for higher interest rates. Inflation is the key issue in the Eurozone, as CPI topped 8% year-over-year in May. Right now, inflation is trending at the highest pace on record in the Eurozone.

Next week, we expect the ECB to announce an end to its bond-buying program and that net asset purchases will be completed by the end of the month. In our view, ending asset purchases should clear the way for interest rate hikes. While we do not expect any adjustments to policy rates next week, we do expect the ECB to start lifting rates at the July meeting. We believe ECB officials will start with a 25 basis-point hike in July and steadily lift the Deposit rate over the second half of 2022 and in 2023.