Goldman Sachs' View

According to Goldman Sachs, which does not expect policy decisions, the European Central Bank's monetary policy meeting Thursday will be a key marker as markets wait for a signal on the pre-announced policy decision at the December meeting. According to Goldman Sachs, the ECB is anticipated to acknowledge near-term impediments to economic activity and restate that it will look past a transient increase in prices, but identify upside risks to the medium-term inflation outlook. "However, we believe the [ruling] council will refrain from labelling market pricing as incongruous with the ECB's forward guidance," Goldman Sachs adds.

Santander's View

Markets are getting ahead of themselves by pricing in an interest rate rise by the European Central Bank before the end of 2022; we do not expect an ECB interest rate rise at that point; the ECB is likely to push back against these early rate-rise expectations at its policy meeting on Thursday, while in December it should clarify the steps it will take to exit its ultra-easy policy.

ING's View

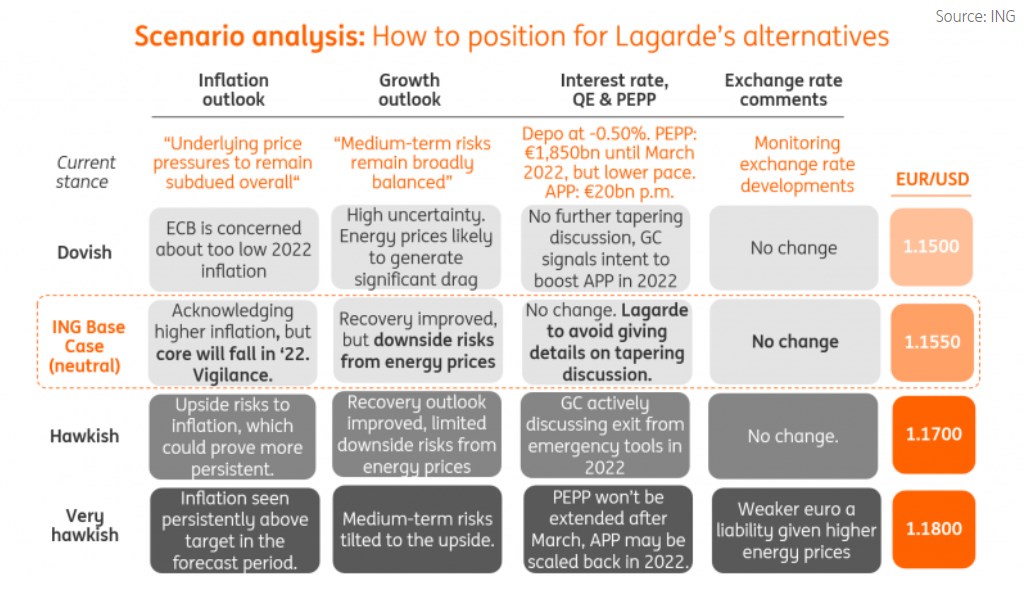

We anticipate making the first statement on asset acquisition reductions by the end of the year. This will imply a transition from PEPP to the Asset Purchase Programme, with only a very modest decline in overall purchases at first. The ECB's revised inflation approach, on the other hand, may result in a faster and more dramatic decline in monthly asset purchases in the second half of 2022.

At the European Central Bank's September meeting, the Governing Council opted to slow the rate of asset purchases under the Pandemic Emergency Purchase Programme (PEPP), while leaving all other measures unchanged. Since then, a strong jump in global energy costs has added upside risk to the inflation outlook, and a number of central banks, including the neighbouring Bank of England, have adopted a more hawkish tone.

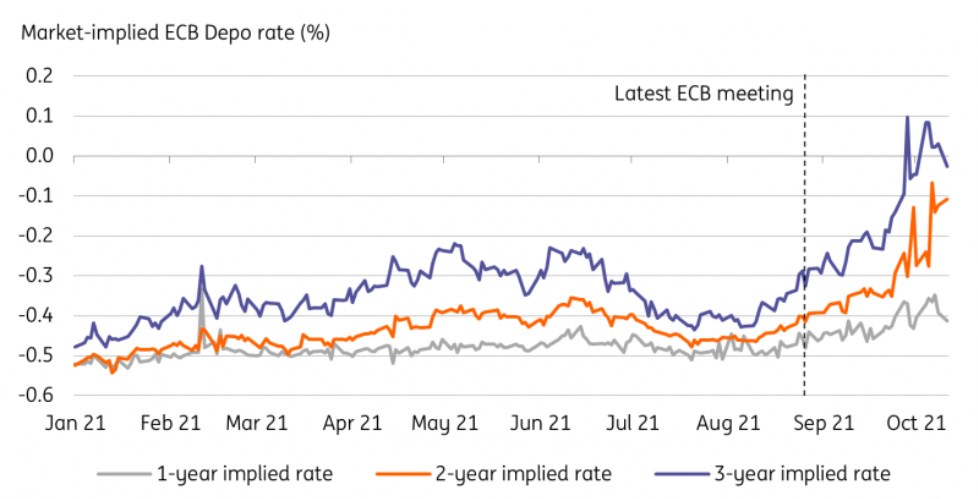

As indicated in the figure below, the market reaction to increasing energy prices has been channelled through a widespread hawkish re-pricing in rate expectations, which has also engaged the ECB. Markets are now pricing in a 10bp deposit rate increase in late 2022.

ING Crib Sheet

Previous ECB Comments

European Central Bank maintained its monetary policy but slowed the rate of net asset purchases under its economic emergency purchase programme. The Governing Council decided to keep the interest rate on the ECB's main refinancing operations at 0%, 0.25% on the marginal lending facility, and -0.5% on the deposit facility.

The ECB said in a statement, “Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council judges that favourable financing conditions can be maintained with a moderately lower pace of net asset purchases under the (PEPP) than in the previous two quarters.”

Net purchases under the asset purchase programme (APP) will continue at a monthly pace of €20 billion. The Governing Council continues to expect monthly net asset purchases under the APP to run for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates.