Previous ECB Rate Statement:

Inflation has been coming down but is projected to remain too high for too long. The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner.

The Governing Council’s future decisions will ensure that the key ECB interest rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to the 2% medium-term target and will be kept at those levels for as long as necessary. The Governing Council will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction. In particular, its interest rate decisions will continue to be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the strength of monetary policy transmission.

ING:

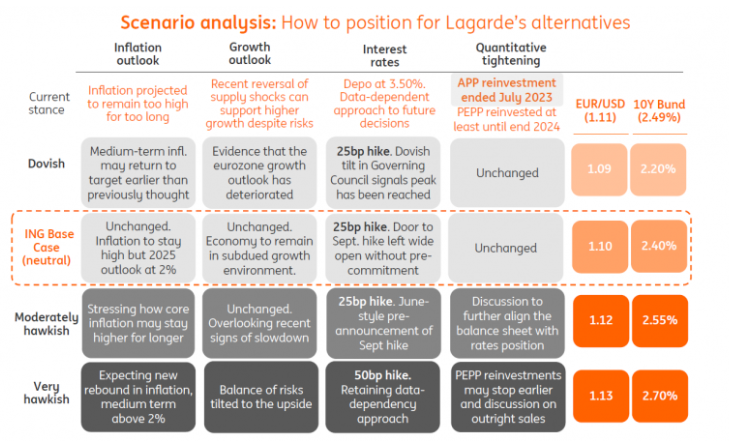

A 25bp rate hike at Thursday meeting is a ‘no brainer’. Not only did Christine Lagarde basically pre-announce the rate hike at the June meeting, macro data released since that meeting have not fundamentally changed. In fact, the worsening of soft indicators continued, headline and producer price inflation continued to come down, while core inflation slightly increased, and hard macro data confirmed that the Eurozone economy has not left stagnation (yet) in the second quarter. Against this background, the ECB’s June macro projections look once again too optimistic; particularly as regards growth.

Wells Fargo:

The European Central Bank (ECB) announces its monetary policy decision next week, where a 25 bps increase in the Deposit Rate to 3.75% is widely expected, including by us. The Eurozone economy experienced a shallow recession around the turn of the year, and a decline in both the manufacturing and services PMIs in more recent months suggests an economy that has limited momentum. That said, headline inflation (5.5% year-over-year) and core inflation (also 5.5%) are still well above the ECB's 2% target, suggesting that policymakers will follow through on the July rate hike that was foreshadowed at the June meeting. Given the softening in confidence surveys and some tentative signs of a potential slowing of inflation pressures, we will also be paying close attention to any signals about the potential path of monetary policy beyond July. To date, ECB policymakers have highlighted the need for further monetary tightening. In early July, ECB President Lagarde said there is still some work to be done to bring inflation back down to target. ECB policymaker Nagel said he expects a 25 bps hike in July, but, despite overall hawkish comments, he also said we must wait and see what the data signal for September. We don't expect the ECB to offer a clear signal of future rate hikes at its July announcement, which may be taken as a sign that a peak in policy rates is close at hand. Ultimately, it should be the disinflation progress (or lack thereof) in the July and August CPI readings that will largely determine whether the ECB follows up with another rate hike in September.