Sentiment:

August 31st:

- ECB Accounts: It was argued that it was quite probable that the September ECB staff projections would revise the inflation path sufficiently downwards towards 2%, without the need for another interest rate hike in September.

- ECB Account: The preference was initially expressed for not hiking.

- ECB's de Guindos: The ECB is entering the final stretch of rate hikes.

September 6th:

- ECB's Knot: Investors may be underestimating the likelihood of a hike in September.

September 7th:

- Poll: ECB deposit rate to hike to 4.00% by year-end - 33 of 69 economists.

- The ECB is to hold the deposit rate at 3.75% on Sept 14 - 39 of 69 economists.

September 12th:

- Money Markets price in around an 80% chance of an ECB 25 bps rate rise by year-end and a 45% chance of a hike this week.

September 13th:

- Money Markets fully price a 25 bps ECB rate rise by the year-end and a 75% chance of a hike this week.

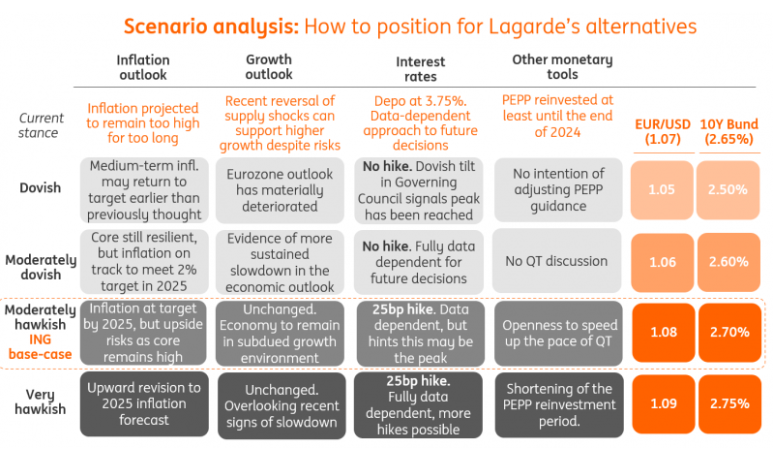

ING:

We admit that it is a very close call, but still too high inflation, a focus on actual rather than on predicted developments, and the fear of stopping prematurely will tilt the balance towards a final 25bp rate hike this week.

RBC Capital Markets:

As forward looking growth data has been identified as having disappointed lately, we expect this to be sufficient to justify staying on hold this week

Unicredit

If the ECB does not hike, it will sound hawkish and will try to convince financial markets that rates could be moved higher at one of its subsequent meetings.

Previous Reaction:

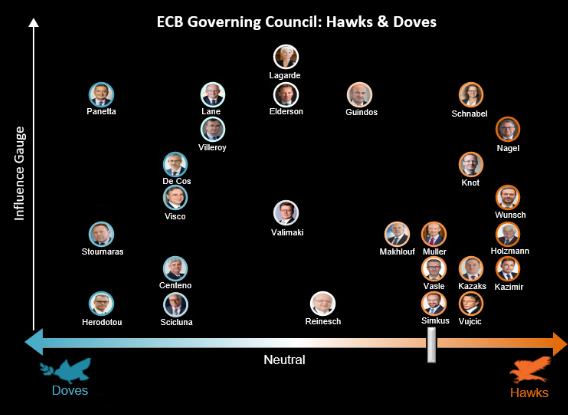

Hawkish & Dovish ECB Members: