IFO: Data suggests that the ECB is at the end of the hiking cycle. We see little reason for more ECB rate hikes.

Capital Economics: All indications since the last meeting in September were that the ECB's current tightening cycle was "over

Generali Investments: We think the discussion is increasingly shifting towards the timing of a cut rather than whether there should be another hike

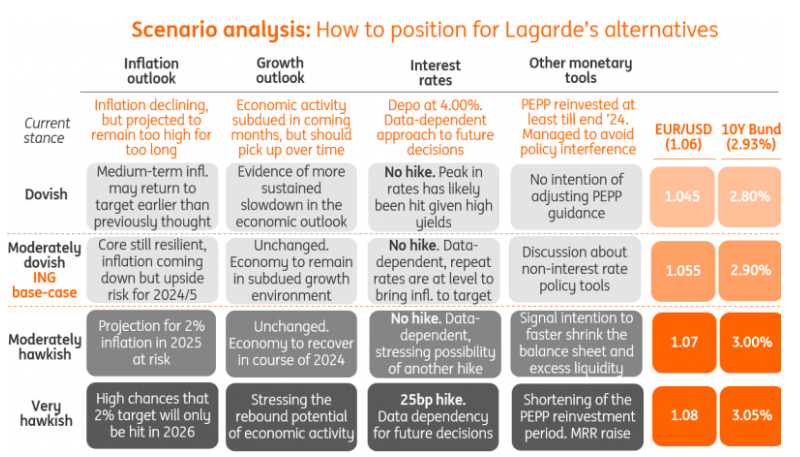

ING: We expect the European Central Bank to pause this week after inflation slowed, rates spiked and new geopolitical risks emerged. The Governing Council may limit offering rate guidance to markets and shift the focus to non-rate monetary policy tools. Ultimately, the market impact is set to be relatively contained.

Goldman Sachs: Despite showing that the EU economy is stagnating, the rate of inflation is "too high for comfort", which supports the case for the European Central Bank holding rates unchanged at the current high level for the next year.

Comments from ECB Governing Council Members:

- [October 17th] ECB's Holzmann: Further shocks may require additional ECB rate hikes.

- [October 16th] ECB's Lane: The ECB will keep interest rates high until inflation returns to 2%, but this may take some time.

- [October 9th] ECB's de Guindos: ECB rates are likely to remain at current levels for some time.

- [October 8th] ECB's Villeroy: There is no justification for extra ECB hikes at present.

- [September 27th] ECB's Elderson: ECB rates haven't necessarily peaked.

- [September 21st] ECB's Stournaras: ECB rates are likely to be at peak for a few months.

Previous Reaction: