ING's View

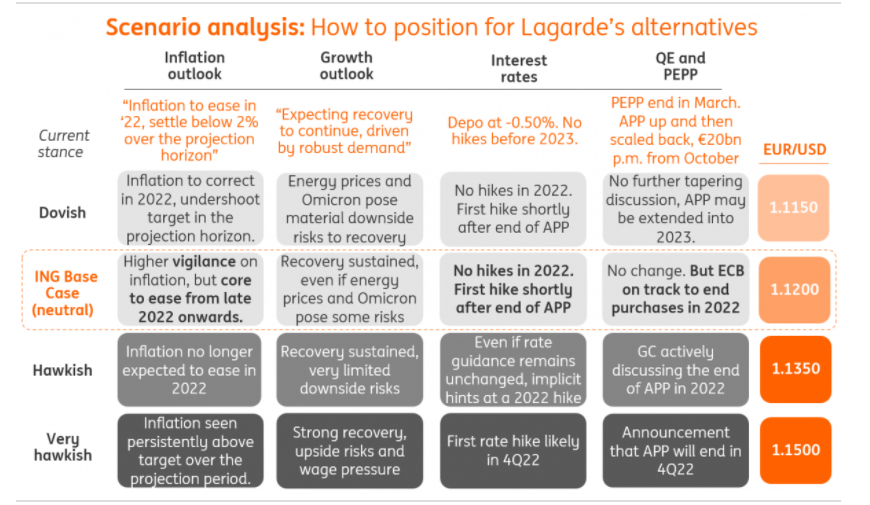

This week’s ECB's rate announcement is highly unlikely to bring any changes to the Bank’s policy. Instead, most focus will be on how the ECB addresses the inflation risk and whether there will be any tweaks to rates and quantitative easing (QE) guidance.

Barclay's View

The ECB's first interest rate hike could occur in early 2024, with a 25 basis point increase. We see some risks of a rate hike already a quarter earlier, or even in mid-2023, subject to inflationary developments. If inflation does not fall below 1.5% in 4Q 2022-1q 2023, as per our and the ECB's current forecasts, but converges to 2% from above, the lift-off date would likely be brought forward to the first half of 2023.

Fitch Ratings' View

The ECB is unlikely to follow the Fed as it raises US interest rates in the next two years. We expect no interest rate rises for the Eurozone in either 2022 or 2023. For starters, the central bank’s inflation forecasts still do not warrant a rate increase under its own forward guidance. The ECB would raise rates if inflation reaches 2% “well ahead of the end of its projection horizon” – which is currently 2024 – provided it does so “durably”.