Hey Traders, hope you enjoyed your weekend.

Here is a list of the biggest releases for this week, starting August 6th, including what they represent, and how the markets could perceive them.

Wednesday 9th August

10:00 AM ET

EIA Crude Oil Inventories

This weekly report by the Energy Information Administration shows US commercial crude oil inventories from domestic and imported sources, along with refinery utilization data. The market's reaction is based on simple supply and demand dynamics.

Last week saw a surprise draw of 17 million, one of the largest on record, which was preceded by a 15 million drop in the API Crude oil stock change reported the night before.

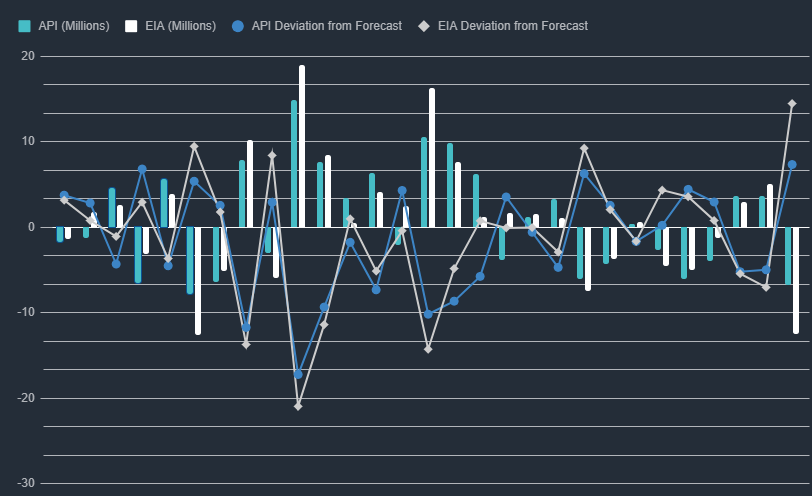

In fact, API has done a surprisingly good job of predicting the results of the EIA stock change, which is handy, as it comes out 1 night before the EIA report every week.

Correlation can even be found between EIA and API's deviations from their respective forecasts, as shown in the graph above.

What to Expect

Higher-than-expected inventories usually lead to lower oil prices, suggesting a surplus.

Lower-than-expected inventories tend to raise oil prices due to potential supply shortages.

Thursday 10th August

8:30 AM ET

US CPI

The headline event for the week

The Consumer Price Index measures the percentage change in prices paid for goods and services. The CPI is seen as one of the headline gauges for inflation in the US.

Although CPI is not the Fed’s preferred gauge of inflation, it is still observed by investors and market participants to gauge how the Fed’s monetary policy is affecting prices for consumers.

Core CPI removes the volatile food and energy components from the basket of goods measured and is better for seeing how the central bank's interest rates are affecting the economy as it removes the elements that are out of the central bank's control.

A higher-than-expected CPI would indicate that the Fed’s higher rates are not doing enough to quell demand, which could lead to additional hikes, or the market's pricing in a higher terminal interest rate, which is bearish for equities and bullish for the dollar.

A lower-than-expected CPI would show that interest rates are working to reduce demand and bring it into better balance with supply, bringing inflation closer to the Fed’s 2% target and making further policy moves less likely, which would be bullish for equities and bearish for the dollar.

US Initial Jobless Claims

The Department of Labor's weekly report shows changes in unemployment insurance filings, indicating the strength of the US labor market. It includes Initial Claims and Continuing Claims, reflecting new and ongoing unemployment insurance requests.

Friday 11th August

8:30 AM ET

US PPI

The US Producer Price Index (PPI) is a key economic indicator that measures the average change in prices received by domestic producers for their goods and services over a specific period of time.

It is a crucial tool for analyzing inflationary trends at the producer level within the United States. The PPI provides insight into the cost pressures faced by producers, which can influence consumer prices down the line.

It is composed of various sub-indices that track price changes for different stages of production, such as crude materials, intermediate goods, and finished goods. By monitoring fluctuations in the PPI, economists, policymakers, and businesses can gain a better understanding of potential inflationary pressures in the broader economy and make informed decisions regarding monetary policy, pricing strategies, and resource allocation.

Inflation dropping is a good thing in a Fed tightening cycle, so it is right to assume stocks would go up and the dollar, in turn, would go, down on a cooler-than-expected PPI reading. Whereas a higher than expected would do the inverse, as it may pressure the Fed to do more on rates.

10:00 AM ET

The University of Michigan Sentiment

The University of Michigan Consumer Sentiment Index, often known as U-M Consumer Sentiment, is a prominent economic indicator gauging the confidence and outlook of US consumers toward the overall economy.

Compiled through surveys by the University of Michigan's Survey Research Center, the index reflects consumer perceptions and expectations on matters like personal finances, employment prospects, inflation, and general economic conditions. This index holds significance for economists, policymakers, and businesses, as it offers insights into consumer spending behaviors that strongly influence economic growth.

A rise in consumer sentiment typically corresponds to increased spending and economic expansion, while a dip can lead to reduced spending and economic slowdown, making the index a key tool in anticipating economic shifts.

Consumer sentiment is always an important consideration. And, as officials have repeatedly stated, the US economy is strong and resilient.

A significant increase in sentiment may indicate the potential for increased consumer spending, which in turn may raise inflation, signaling the Fed to raise rates further, resulting in lower stocks and a stronger Dollar.

Whereas sentiment dropping would worry an economy teetering on the edge of growth and decay.