At 10:02 AM ET on Friday the 25th of August, Fed's Powell's text release from his address at the Jackson Hole Symposium was released.

Here are some of the key comments.

"We are prepared to raise rates further if appropriate."

The ongoing high inflation situation has resulted from a combination of strong demand and pandemic-related supply constraints. The Federal Open Market Committee recognized that reducing inflation would require addressing these distortions and tightening monetary policy. Both factors are working to lower inflation, but there's still progress to be made.

The "headline" PCE inflation, which households and businesses directly experience, has declined to 3.3% as of July. However, food and energy prices, influenced by global factors, can be volatile and misleading indicators of inflation trends.

Core PCE inflation, which excludes food and energy, gradually decreased to 4.3% in July.

"I see July PCE at 3.3%, core at 4.3%."

Core goods inflation, especially for durable goods like vehicles, has fallen due to both tighter monetary policy and the resolution of supply-demand imbalances.

Housing sector inflation responded to monetary policy changes, causing housing starts, sales, and price growth to decrease. Nonhousing services inflation, which makes up a significant part of core PCE, has slightly declined over the past three to six months, but further progress is necessary.

"We are in a position to proceed carefully."

The outlook suggests that while pandemic-related distortions will continue to decrease inflation, restrictive monetary policy will play a bigger role.

Achieving sustainable 2% inflation may require a period of below-trend economic growth and some softening in labor market conditions.

The impact of restrictive monetary policy is evident in higher real yields and tightened lending standards, contributing to slower economic growth.

While signs of cooling are present, strong GDP growth and consumer spending could pose a risk to progress on inflation.

The labor market is rebalancing, with improved labor supply and moderated demand. This has helped ease wage pressures, slowing wage growth but increasing real wage growth as inflation falls.

Uncertainties arise from factors such as the neutral policy rate and lags in monetary policy effects. Unique supply and demand imbalances add complexity, with job openings decreasing without raising unemployment and inflation becoming more responsive to labor market conditions.

Balancing risks is crucial, as tightening policy too much or too little could have detrimental effects on the economy. The Federal Reserve will carefully assess data, outlook, and risks to decide whether to tighten policy further or maintain the current stance to restore price stability and support labor market conditions.

Market Reaction

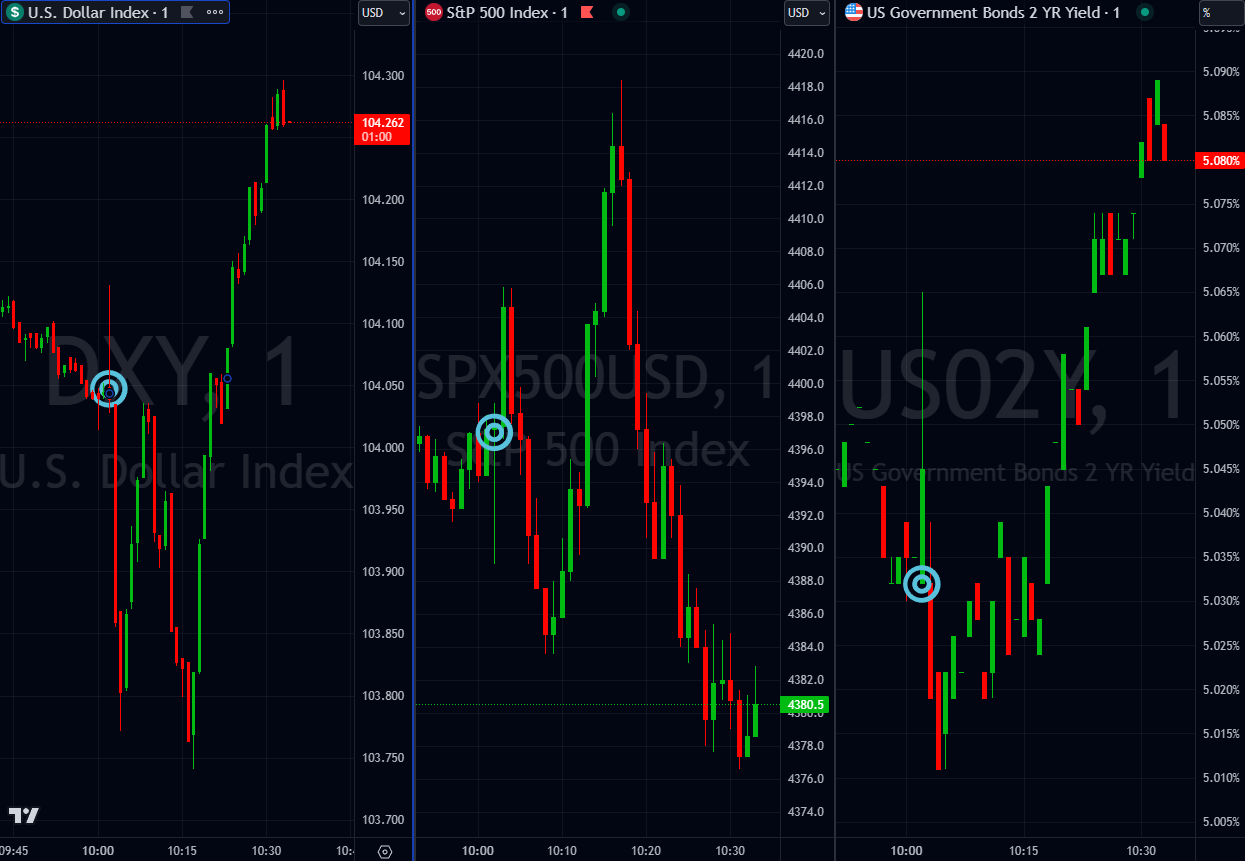

Following this, the markets saw a sporadic market reaction, and some large whipsawing in both directions.

As the market digested some of the more nuanced comments, such as "We are in a position to proceed carefully.", the stocks initially saw some upside movement following an initial whipsaw.

But as the more hawkish overtones from his comments sank in, implying that inflation was not coming down as the Fed might like and that more hikes may be needed, stocks weakened, and the Dollar and US government Bond Yields strengthened.