On Wednesday 14th, at 2 PM ET, the FOMC hiked rates by 50 BPS to 4.5%, as expected.

Following this, we saw the release of the Rate Statement, the Summary of Economic Projections, and the subsequent press conference with the Fed's Chairman Powell, which will be summarized here.

Rate Statement Summary

Rhetoric from the rate statement was nothing to shout home about - but does note that the FOMC will remain flexible to changes in economic conditions and that rates will have to go higher.

"Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures."

"The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time."

"The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals."

SEP Summary

Now, this is why the market moved.

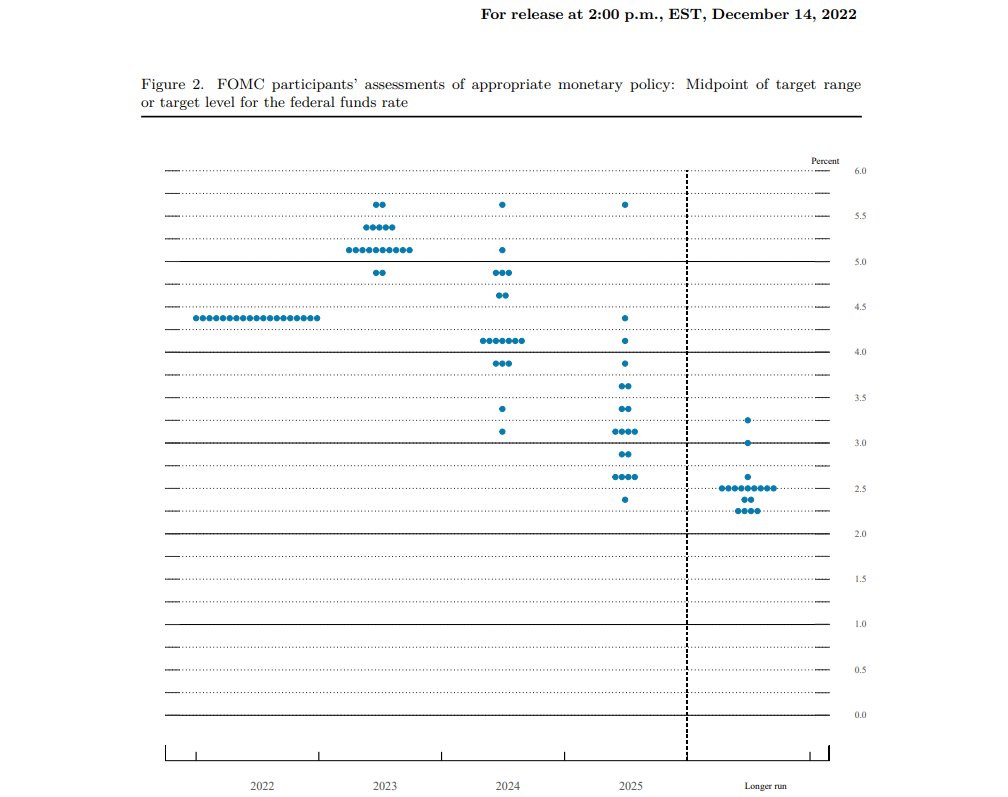

The Summary of economic projections outlined that rates would have to go considerably higher than was projected in the previous September SEP, which was outlined in the dot-plot:

This shows that the median view of the Fed funds rate in 2023 is 5.1% against the 4.6% that was seen in the September projections.

This upward revision in the terminal rate caused strength in the dollar, and weakness in the S&P 500 and gold.

(Reaction pictured below at 2 PM ET, the time of release for the US interest rate, statement, and SEP)

The dot plot outlined also that we will have to wait until 2024 until we see signs of rate cuts, and some hawks skew the median to the upside into 2025.

Fed's median view of Fed funds rate at end-2024 of 4.1%, previously 3.9%

2025 sees 3.1%, previously 2.9%.

Average policymakers saw the long-run rate at 2.5%, unchanged from the September SEP.

The SEP also outlined downward revisions to the US GDP growth over the next 3 years.

Median Fed officials see US GDP growing 0.5% in 2023, against 1.2% in the September SEP

1.6% in 2024, previously at 1.7%

1.8% in 2025 (prev 1.8%)

And longer-run at 1.8%, unchanged

The committee moderately adjusted its expectations for core Personal Consumer Expenditures for the next 2 years

Median Fed officials see core PCE inflation at 3.5% in 2023, against 3.1% in the September SEP

2.5% in 2024, previously at 2.3%

2.1% in 2025, unchanged

Fed officials saw the jobless rate increasing over the next year

The median Fed officials also see the 2023 year-end US jobless rate at 4.6% in 2023, previously at 4.4% in the September SEP

4.6% in 2024, previously 4.4%

4.5% in 2025 previously 4.3%

Longer-run at 4.0%, unchanged.

The SEP indicates that the Fed has reacted to a slower drop in inflation than they had previously expected and that they see a large moderation in UD GDP growth.

Fed Chair Powells Press Conference

ES pared some of its losses from the SEP as Powell spoke, these are some of the key comments from Powell in his presser:

"I can't promise that we won't raise our peak rate estimate at a future meeting."

"We would have expected faster progress on inflation by now."

"Inflation will fall due to the goods sector and, by the middle of next year, in housing services as well."

"Having moved so quickly we think the appropriate thing to do is to move to a slower pace of rate hikes, which will allow us to better balance risks."

"I don't believe SEP qualifies as forecasting a recession but the economy will have very slow growth."

"50 basis points is still a historically large increase; there is still some way to go."