ECB Interest Rate Prep

Deutsche Bank

The prospect of half-point adjustments has also been raised by Deutsche Bank.

HSBC

Whatever course is ultimately adopted, there will be "no substantial pushback on market expectations" next week, according to HSBC Securities European Economist Fabio Balboni, who believes that a hawkish narrative may assist the ECB to reduce the risk of second-round effects by dampening wage demands.

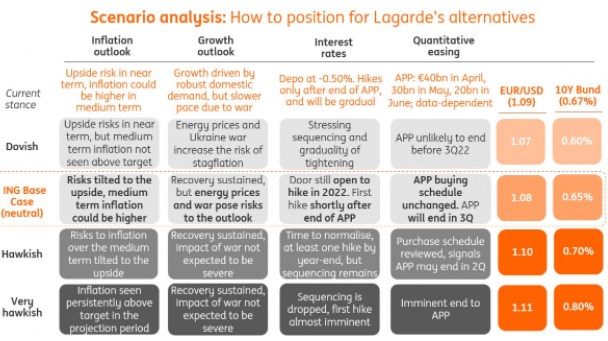

ING’s View

The ECB April meeting should not be one for major policy shifts, given the lack of hard data to judge the impact of the Ukraine conflict on the eurozone’s economy and lingering uncertainty around how the war will evolve. In our view, reiterating the Asset Purchase Programme (APP) scheduled reduction announced in March (€40bn in April, €30bn in May, €20bn in June), with a somewhat firmer commitment to end APP after June, as well as data-dependency, appears the only viable option for now.

Financial Times

Investors are pricing in 0.6 percentage points of rate rises by the ECB before the end of this year, which would take its main deposit rate back into positive territory for the first time since 2014, up from its current all-time low of -0.5%.

Several ECB policymakers have said they expect the central bank to raise rates this year and some, such as ECB’s Knot and ECB’s Wunsch have said it could do so twice this year.