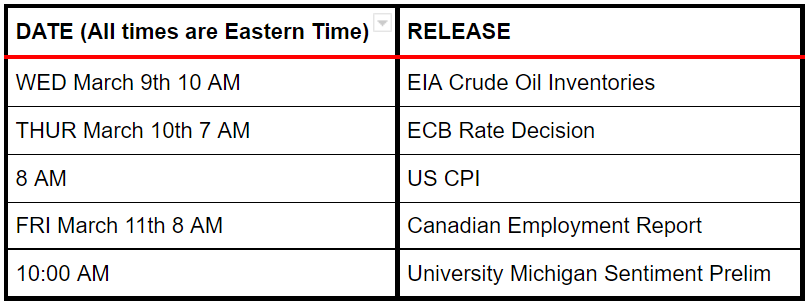

Economic Releases For the Week

Below are the times when the room will start. Meeting room links will be posted on the FinancialJuice site at least 30 mins before the room is due to start.

In January, inflation in the United States reached a four-decade high as strong consumer demand collided with pandemic-related supply disruptions. Price pressures are not expected to ease in February. Economists predict that the consumer-price index rose again last month as demand remained strong and energy and other commodity costs rose further. Thursday's report will be one of the last major data releases before the Federal Reserve's policy meeting on March 15th-16th, where officials are expected to raise interest rates in an effort to curb inflation.

Last year, the United States' trade deficit reached a new high, highlighting both strong domestic demand and reliance on foreign suppliers. That pattern may continue in 2022. Economists predict another record monthly trade deficit in January as American consumers continued to spend, businesses worked to replenish inventories, and inflation drove prices to new highs.

Inflation in China is likely to have slowed further in February. According to economists polled, PPI is expected to rise 8.6% from a year ago in February, slowing from a 9.1% increase in January. Annual consumer price inflation is likely to remain flat as low food prices offset rising commodity costs.

After Russia's invasion of Ukraine sent commodity prices soaring, further snarled supply chains, and raised the risk of broader economic and geopolitical fallout, the European Central Bank might lower its forecast for economic growth while raising its outlook for inflation. The ECB faces a quandary at its policy meeting as it attempts to balance competing risks of overheating consumer prices (inflation is already at a record high) and stagnant economic activity.

Russia-Ukraine conflict is still dominating the markets as talks between Russia and Ukraine are underway as of writing. Markets at the open Sunday night had seen an initial risk-off reaction with the S&P 500 declining, DXY, Gold and Crude OIl futures strengthened.