On Tuesday the 14th of November, the BLS is set to release the latest US inflation print, representing the month of October.

Here are some views on what to expect.

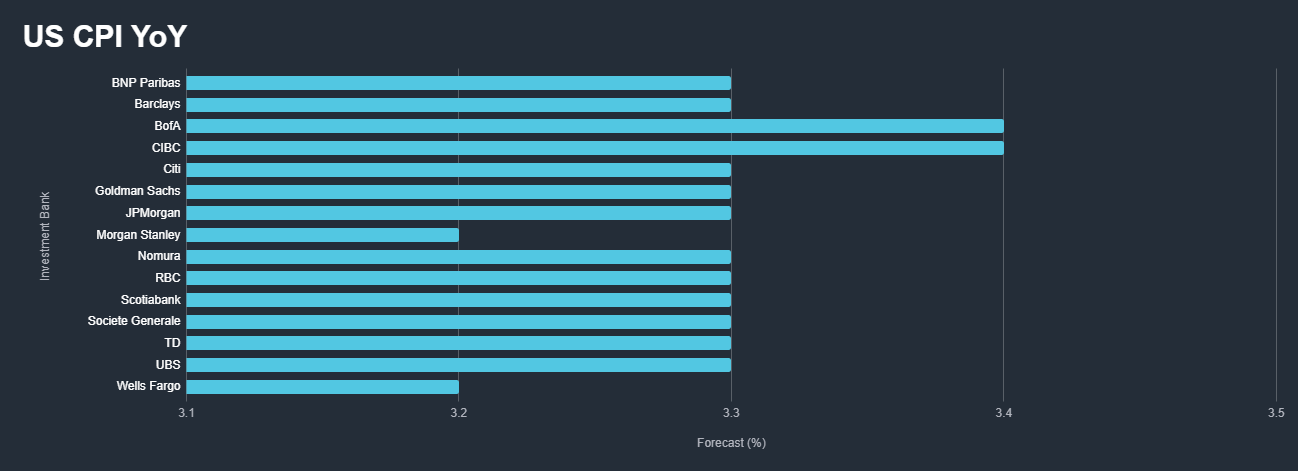

For US CPI YoY, the median forecast sees it moving down to 3.3%, from 3.7%. According to a survey of 45 economists, the highest estimate is 3.4%, and the lowest is 3.2%

The median forecast for US CPI MoM is a move down to 0.1% from 0.4%. The highest estimate is 0.2%, and the lowest is 0%.

Blackrock

Most of the inflation and wage growth we’ve seen to date reflect the mismatch associated with the pandemic. That is now reversing, and inflation is set to fall further.

But as the process of resolving the mismatch ends and labor shortages start to bind, we expect inflation to go on a rollercoaster ride, rising again in 2024.

A smaller workforce means the rate of growth the economy will be able to sustain without resurgent inflation will be lower than in the past.

We see central banks being forced to keep policy tight to lean against inflationary pressures. This is not a friendly

backdrop for broad asset class returns, marking a break from the four decades of steady growth and inflation known

as the Great Moderation.

Wells Fargo

Since the end of September, gas prices have steadily fallen, and food inflation has appeared to move sideways.

These dynamics underpin our call for the headline CPI to increase only 0.1% in October. If realized, that would be the smallest monthly gain since May.

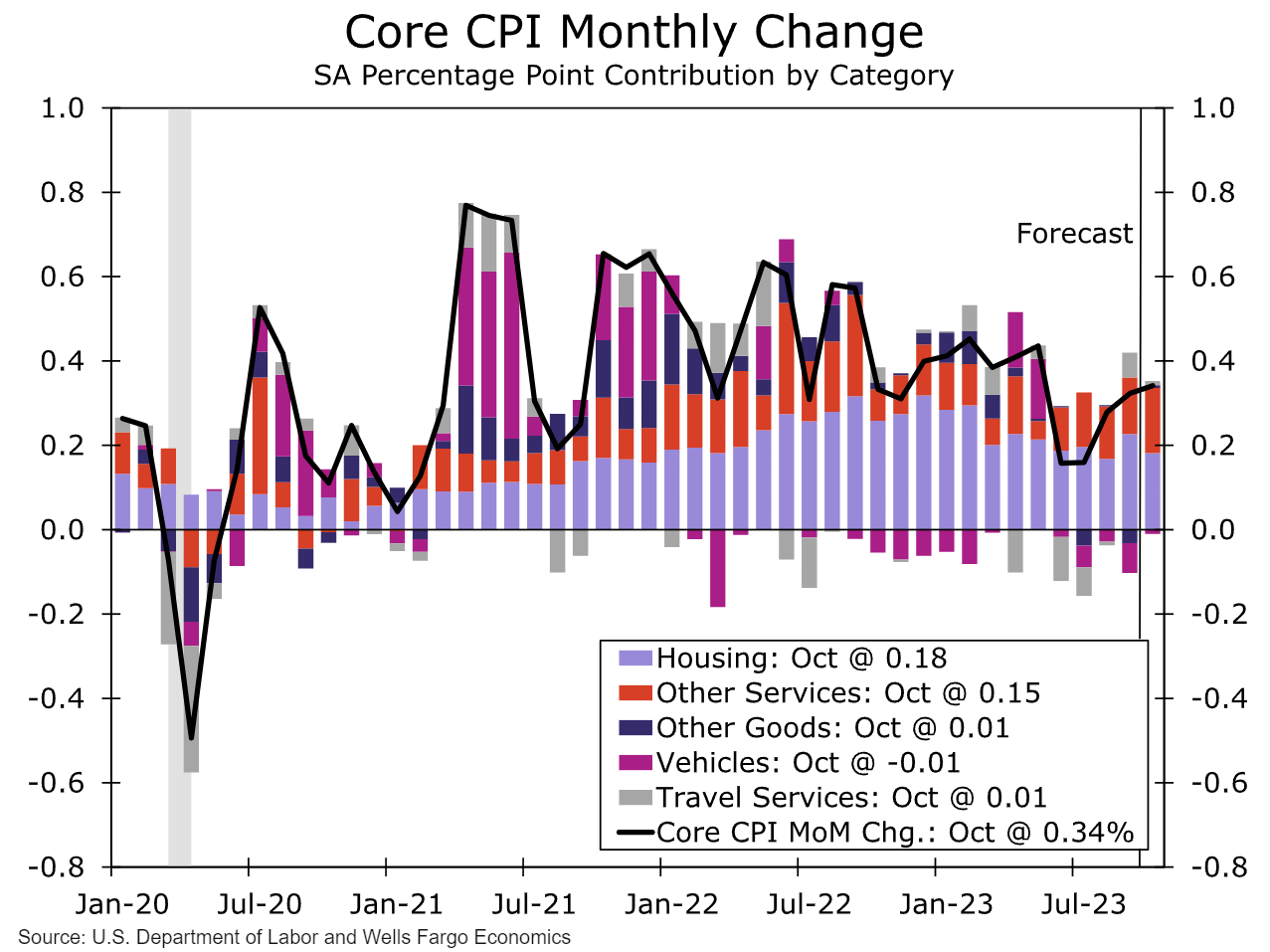

Yet, the modest rise will likely be overshadowed by continued strength in the core CPI, which we expect to increase by 0.3% for the third straight month.

Core services excluding shelter (I.E., "super-core" CPI) is poised for another solid gain, helped along by health insurance reversing its deflationary trend and firmness in transportation services. Core goods prices are shaping up to be a small drag, as partial rebounds in auto parts, apparel, and medical goods look likely.

Through the monthly moves, we expect inflation to continue to gradually cool.

Consumer spending is set to moderate from its breakneck pace in Q3 amid weaker income and less pronounced job gains. Less robust demand will pressure businesses' pricing power in the coming year.

JPMorgan

Dr. David Kelly

We expect year-over-year inflation to continue to fall steadily in the coming months.

This week should see further evidence of this trend, with declines in year-over-year inflation as measured by import, producer, and consumer prices.

On the CPI front, we expect headline inflation of just 0.1% (month-over-month), with the year-over-year rate falling from 3.7% to 3.3%.

While lower energy prices and softer shelter inflation should drive this slowdown, the exact reading will depend a lot on the government’s measurement of auto and health insurance costs, both of which have followed highly stylized and dramatic paths over the past year.

More broadly, however, the path to lower inflation remains intact.

October’s global composite PMI came in at 50.0, its lowest reading since January, while supply chain pressures continue to ease.

New data on global food commodity prices, energy prices, hotel rates, and used car prices suggests weakening inflation, as does a continued moderation in wage growth in the October jobs report.

ING

Federal Reserve Chair Jerome Powell again acknowledged last week that monetary policy is “restrictive”, but remains unsure as to whether it's restrictive enough for inflation to return sustainably to 2%. We think it is, and we do not expect any further Federal Reserve interest rate hikes from here on out.

This view should receive some support from upcoming data, including both consumer and producer price inflation along with retail sales and industrial production data for October.

The steep plunge in gasoline prices will have a major influence and could allow headline CPI and PPI to come in flat on the month, while also depressing the values of retail sales to the extent that we get a negative month-on-month reading.

We already know that vehicle sales were down on the month and that credit card spending has also been subdued, pointing to a soft spending number. Industrial production is also subject to downside risk given that the ISM manufacturing index is in deep contraction territory.

Core inflation readings may come in a bit higher with 0.3% MoM increases, though. This may keep markets on edge to some extent, but over the coming months, we expect to see slowing housing rents exert a greater influence – and this should lead to US consumer price inflation slowing to 2% by next summer. See our latest note on the outlook for US inflation for all the details.

Previous Release

On October 12th, the BLS released the US CPI numbers representing the month of September.

US CPI YoY came in at 3.7%, on the forecast of 3.6% and the previous 3.7%, while the US Core CPI YoY came in at 4.1%, on the forecast 4.1% and the prior 4.3%. This sent the US Dollar and US 2-Year Treasury Yields up while stocks weakened as it showed that inflation may prove to be stickier than previously thought, and could have prompted further Fed interest rate increases.

This sent the US Dollar and US 2-Year Treasury Yields up while stocks weakened as it showed that inflation may prove to be stickier than previously thought, and could have prompted further Fed interest rate increases.