On Tuesday the 12th of December, the BLS is set to release the latest US inflation print, representing the month of November.

Here are some views on what to expect.

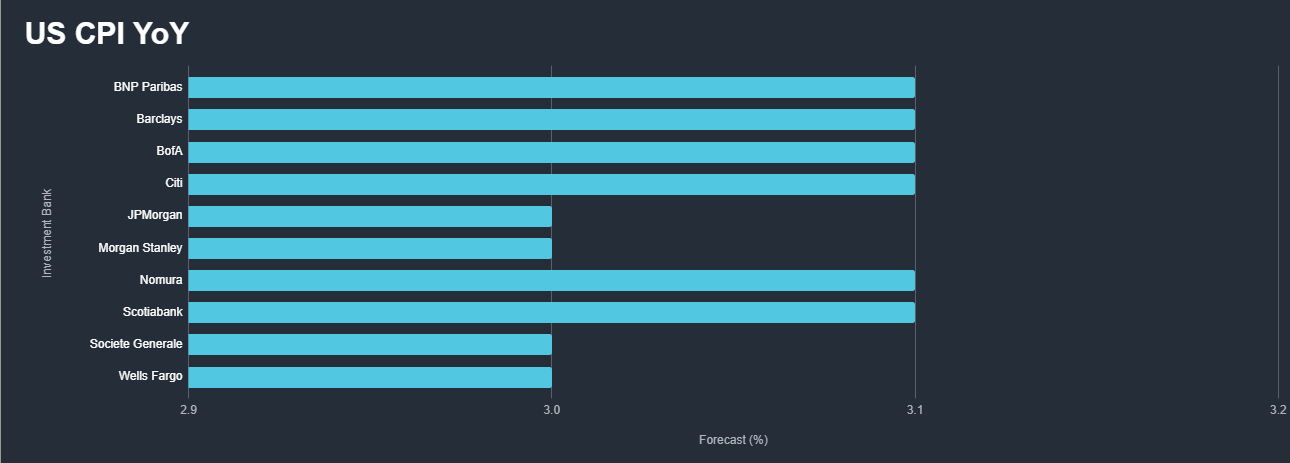

For US CPI YoY, the median forecast sees it moving down to 3.1%, from 3.2%. According to a survey of 44 economists, the highest estimate is 3.3%, and the lowest is 3.0%

The median forecast for US CPI MoM is a move down to 0.0% from 0.0%. The highest estimate is 0.3%, and the lowest is -0.1%.

Here are the views of some of the largest investment banks:

Wells Fargo

We expect lower gasoline prices to hold the headline rate of inflation flat in November and forecast the core CPI, which excludes food and energy, to rise 0.3%, signaling slower progress on underlying inflation.

A miss to the upside may drive a market reaction spurring higher yields, but we ultimately doubt the CPI data will materially change the outcome of the Fed meeting, where it's essentially universally expected the FOMC will elect to keep rates on hold (more on that in Interest Rate Watch).

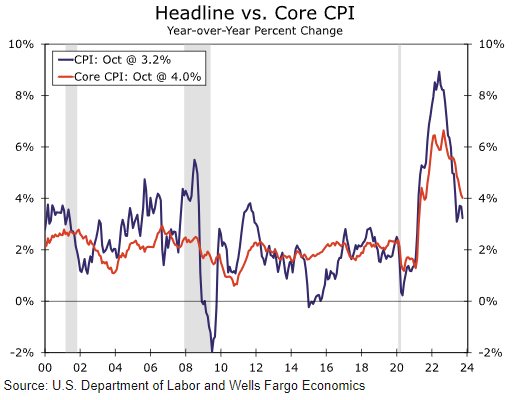

If our CPI forecast is realized, the annual rate of headline inflation would slip to its lowest level since March 2021, while the core rate would remain unchanged from a month earlier at 4.0%.

Some payback after volatile travel-related declines in October will be responsible for some of the rise in core inflation. But other areas should decelerate further, including primary shelter and goods prices, which look set to decline for the sixth-straight month.

While inflation pressure continues to subside, there is still ground to cover before declaring victory.

JPMorgan

Food prices soared in recent years due to fiscal stimulus and disruptions caused by the pandemic and Russia’s invasion of Ukraine. However, these effects have now faded and, with sluggish global growth, food prices should only move modestly higher over the next two years.

Futures markets are even more bearish on energy prices, predicting a gentle slide in oil prices over the next two years.

For shelter, rents negotiated in the market place have been rising at only a 1.2% annual rate over the past six months.

With very slow demographic growth, a squeeze on the budgets of lower and middle income households and a significant increase in the supply of new multi-family housing, we expect rents to continue to grow only very slowly.

This is particularly the case since the average rent on a new lease is still significantly higher, relative to disposable income, than it was before the pandemic.

Turning to everything else, core goods prices have risen by just 0.1% over the past year and, with supply chain issues largely resolved, this could continue into 2024 and 2025.

Meanwhile, a large reason for sticky core services inflation has been huge price increases in auto insurance and auto maintenance and repair.

We expect these trends to fade going forward since new light vehicle prices have been rising at less than a 1% annualized rate over the past nine months. We also don’t expect a significant flow through from higher wages as wage growth decelerated to a pace of just 4.1% year-over-year in October, just 0.9% above the CPI inflation rate.

Tracking this forward, we expect headline CPI inflation to fall to 2.3% year-over-year by April of 2024 before embarking on a slower downward path for the rest of the year and into 2025.

DBRS Morningstar

The November Consumer Price Index report is expected to show continued moderation of inflation pressures, leaving the door open for the Federal Reserve to cut interest rates in 2024.

“Generally speaking, inflationary pressures are softening significantly,” says José Torres, senior economist at Interactive Brokers.

Core CPI is expected to remain steady at 4% on an annual basis. On a monthly basis, economists expect a reading of 0.3%, compared with 0.2% in October. Core inflation excludes volatile food and energy prices, and has been much slower to fall than headline inflation. Such a change is a significant deceleration compared with earlier this year, according to Andrew Patterson, senior international economist in Vanguard’s Investment Strategy Group. But he says, “The Fed still has more work to do.”

Previous Release

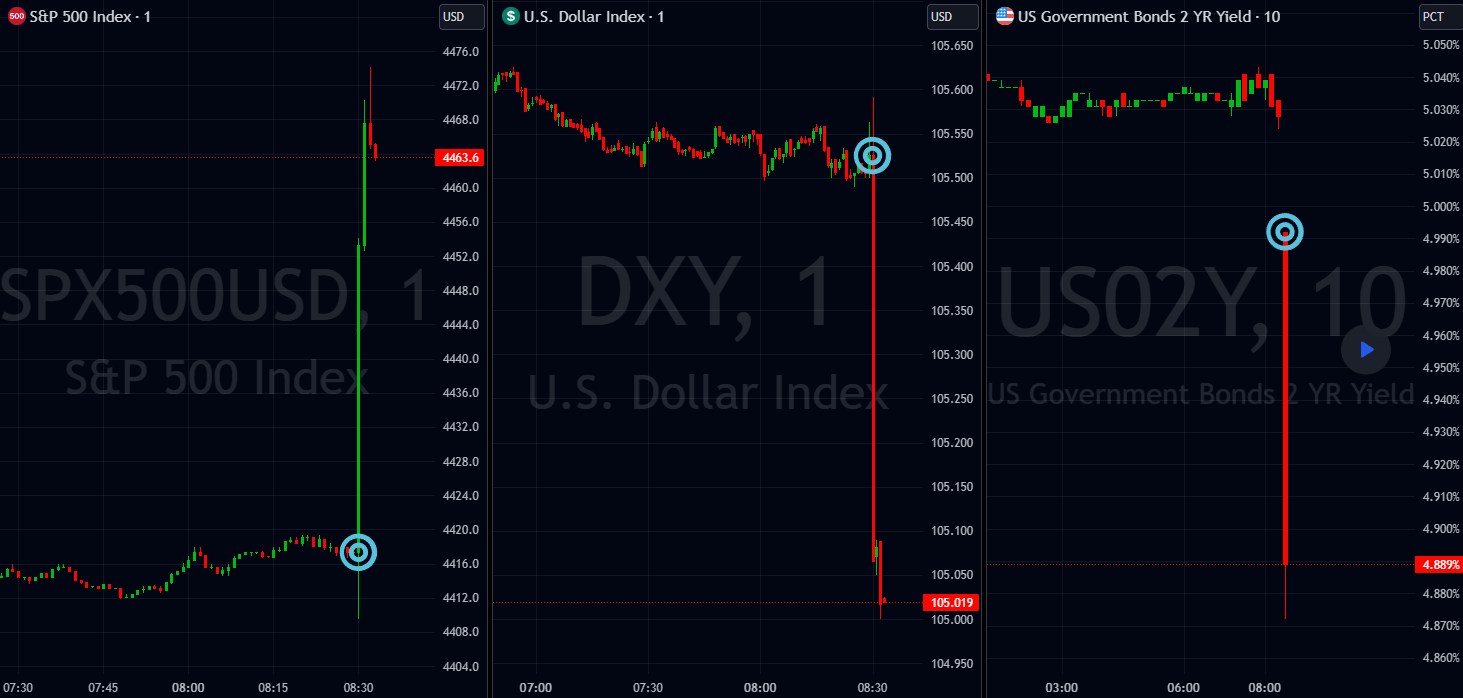

On November 14th, the BLS released the US CPI numbers representing the month of October.

US CPI YoY came in at 3.2%, on the forecast of 3.3% and the previous 3.7%, while the US Core CPI YoY came in at 4%, on the forecast 4.1% and the prior 4.1%.

This caused strength in the S&P 500 and weakness in the dollar and US government bond yields, as market participants noted this cooling of inflation as indicative of US interest rate cuts earlier than previously expected.