On Wednesday the 12th of July at 8:30 AM ET, the BLS is set to release the US CPI numbers for the month of June.

Here are some views on what to expect.

According to median analyst estimates, US CPI YoY is expected to drop to 3.1%, from its prior of 4%. The highest estimate is 3.3%, with the lowest at 2.8%, the MoM read is forecast to rise to 0.3% from 0.1%.

Core CPI YoY is expected to fall to 5%, from 5.3%. The highest estimate is seen at 5.1%, with the lowest at 4.8%.

Wells Fargo

CPI YoY Forecast: 3.1%

Prices have materially eased in recent months. The CPI edged up 0.1% in May as energy prices retreated. Food inflation firmed but remained well below last year's run rate. Excluding food and energy, the core CPI rose 0.4%, bringing the year-ago percent change to 5.3%. Core goods inflation was boosted by a heady gain in used vehicle prices, while core services continued to see a gradual deceleration in shelter prices.

We forecast the headline CPI to rise a modest 0.2% in June. Favorable base comparisons due to last year's surge in energy and food prices should set up the year-over-year rate to fall nearly a full percentage point to 3.1%. We look for the core CPI to downshift alongside a decline in core goods prices. The ongoing improvement in supply chains has helped to ease pressure on goods, and we expect vehicle prices to contract in June. At the same time, core services are likely to stay firm. Shelter inflation is only slowly cooling off, while medical care and recreational services have scope to rebound in June. The Fed will welcome the continued moderation in price growth, though the road back to 2% inflation remains long.

ING

CPI YoY Forecast: 3.1%

The upcoming data flow centers on inflation and here we expect to see some good news with lower energy costs, softening food prices, a topping out in housing rents and falling vehicle prices set to partially offset strength in the core services ex-housing component that the Fed is so fearful of.

A 0.3%MoM reading for headline and core inflation would see the annual rate of headline inflation slowing to 3.1% from 4% and core (ex-food and energy slowing to 5% from 5.3%). While this will do little to alter the likelihood of a July hike, it could at the margin provide a little relief and see longer-dated interest rate expectations tick a little lower.

JPMorgan's Dr. David Kelly

CPI YoY Forecast: 3.2%

We estimate that headline CPI inflation was 0.3% in June, compared to 1.2% in the same month a year ago. This should cut the seasonally-adjusted headline rate to 3.2% in June, compared to 4.1% in May and a 40-year high of 8.9% in June of last year.

Energy prices may have edged up slightly in June relative to May on a tick up in gasoline and natural gas prices. However, both should show dramatic year-over-year declines and stability in global energy commodities, along with gradual improvements in refining capacity, could lead to relatively stable consumer energy prices going forward.

Adding it all up and looking forward, following a sharp decline to 3.2% in June, we expect year-over-year CPI inflation to move sideways for the rest of 2023 before falling steadily to 2.0% by the end of 2024.

Cleaveland Fed Inflation NowCasting

Previous Release

On June 13th at 8:30 AM ET, the BLS released the last US CPI print for the month of May.

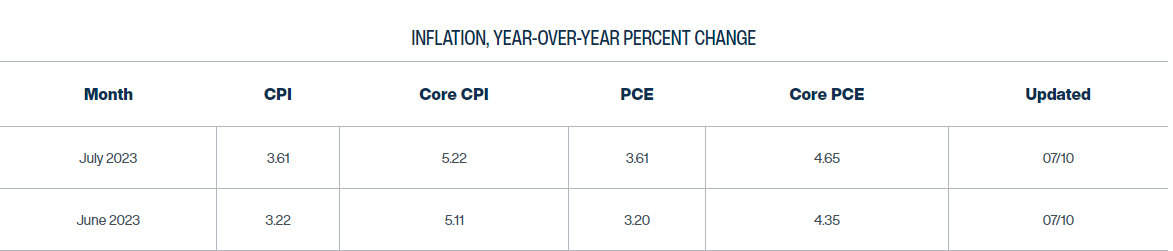

This Release saw the headline CPI YoY decline to 4% from the prior of 4.9%, as well CPI MoM did decline to 0.1% (in line with expectations) from 0.4%.

The Core CPI YoY moderated to 5.3% from its prior of 5.5% and the Core MoM remained at 0.4%, in line with the median forecast.

The Headline CPI YoY cooling off coupled with the MoM figure declining, Caused upside in the S&P 500 and downside in the DXY.