On Thursday the 10th of August at 8:30 AM ET, the BLS is set to release the US CPI numbers for the month of July.

Here are some views on what to expect.

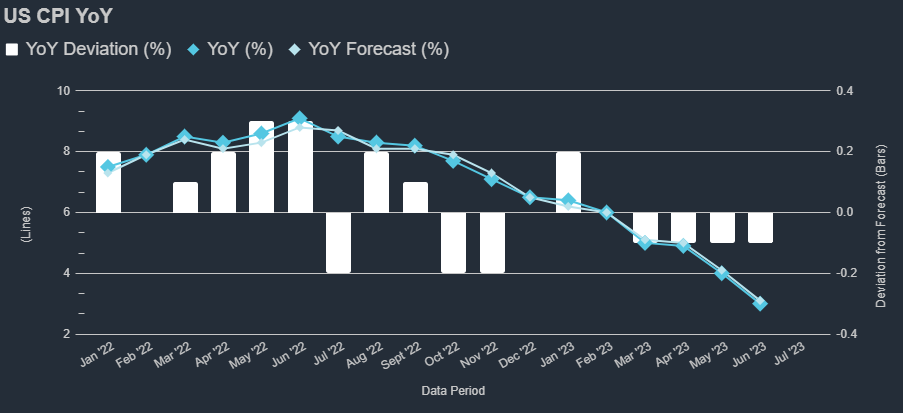

According to median analyst estimates, US CPI YoY is expected to rise to 3.3%, from its prior of 3%. The highest estimate is 3.5%, with the lowest at 3.1%.

The Core YoY read is forecast to drop to 4.7% from 4.8%. With high estimates of 4.9% and lows of 4.6%.

Wells Fargo

CPI YoY Forecast: 3.3%

Core CPI YoY Forecast: 4.7%

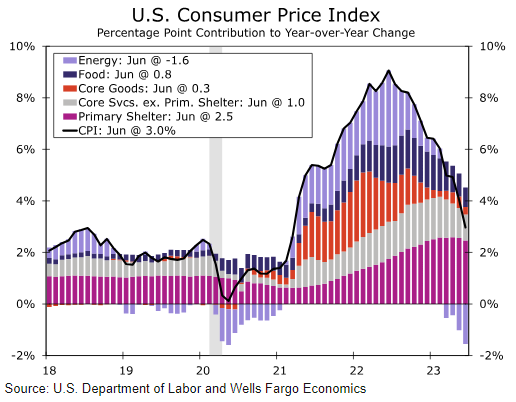

Consumer price inflation is steadily moderating. Headline CPI rose just 3.0% year-over-year in June, the lowest annual rate since March 2021.

A large portion of this downdraft can be attributed to slowing food inflation and an outright decline in energy prices relative to their highs in the summer of 2022.

Core inflation has been a much tougher nut to crack, registering a firmer 4.8% annual rate.

But even core CPI started to demonstrate some downward momentum in June, driven by softer goods prices and the ongoing disinflation from primary shelter.

We expect the disinflationary trend to continue in July and estimate a 0.2% bump in both the headline and core measures over the month.

Looking under the hood, we expect faster deflation for vehicles and other goods in July, counteracted by slightly firmer services prices for travel and medical care. If realized, these prints would translate to a 3.3% annual headline rate and a 4.7% annual core rate.

Through the monthly noise, inflation appears set on a downward path. However, progress in the coming months will likely be slower and noisier than June’s print alone would suggest.

We expect monthly gains in core inflation to pick up slightly in Q4 as the disinflationary momentum from waning goods prices fades and health insurance prices rebound toward the end of the year.

UBS

CPI YoY Forecast: 3.2%

Core CPI YoY Forecast: 4.7%

ING

CPI YoY Forecast: 3.3%

Core CPI YoY Forecast: 4.8%

Unfortunately, there is a little bit of upside risk for year-on-year figures after their recent slowdown, but this reflects falling energy costs last summer dropping out of the annual comparison.

However, the Federal Reserve will be focused on the month-on-month readings which we are hopeful will come in at 0.2% MoM for headline and core for both CPI and PPI. This is what we need to see consistently to bring inflation back to the 2% target, and the Fed can take comfort that inflation pressures are softening, reducing the need for further interest rate increases.

Blackrock

All eyes are on US inflation this week after softer-than-expected data in the last CPI print.

We see persistent wage pressure keeping core inflation sticky.

JPMorgan

CPI YoY Forecast: 3.4%

Core CPI YoY Forecast: 4.8%

The disinflationary trend gathered steam in June, with headline inflation gaining 0.2% M/M seasonally adjusted and 3.0% Y/Y non-seasonally adjusted, representing only a third of last June’s peak inflation of 9.2%.

Core CPI also eased, rising 0.2% m/m seasonally adjusted and 4.8% y/y non-seasonally adjusted. In the details, declines in airline fares and used car prices contributed most to the easing.

Inflation in auto services remained strong, but moderation in owners’ equivalent rent helped core inflation.

Moving forward, base effects may make further declines in Y/Y inflation more modest. That said, we expect to see further easing in shelter costs and auto services ahead, allowing inflation to remain closer to 3.0% for the rest of the year before moving toward 2% in 2024.

Citigroup

CPI YoY Forecast: 3.3%

Core CPI YoY Forecast: 4.7%

Previous Release

On July 12th at 8:30 AM ET, the BLS released the US CPI numbers for the month of June.

This saw CPI YoY drop an entire 1 percent from the May reading to 3% from the prior 4%, and still below the expectations of 3.1%.

Core CPI YoY dropped to 4.8%, from the prior 5.3%, also below the expectations of 5%.

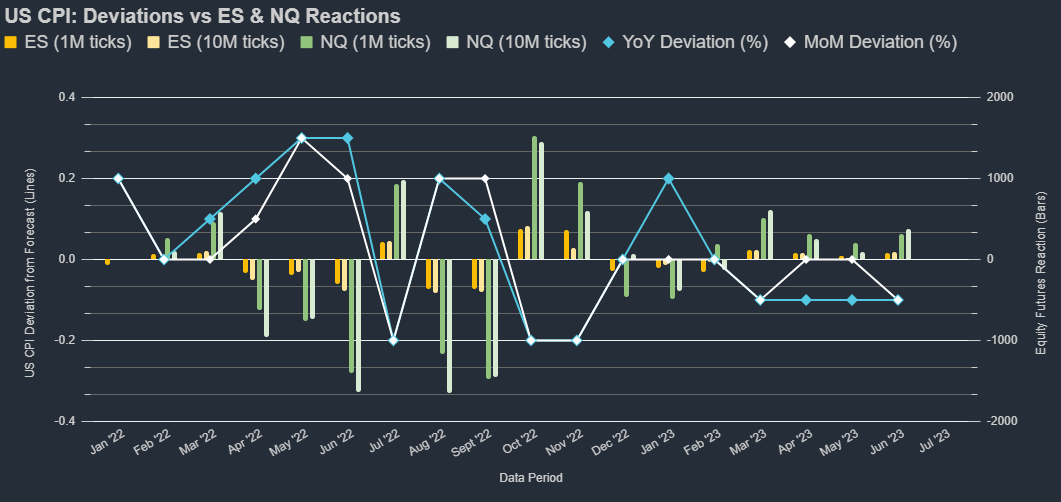

Market reactions after 1 minute showed the following movements:

ES increased by 74 ticks, NQ market increased by 316 ticks

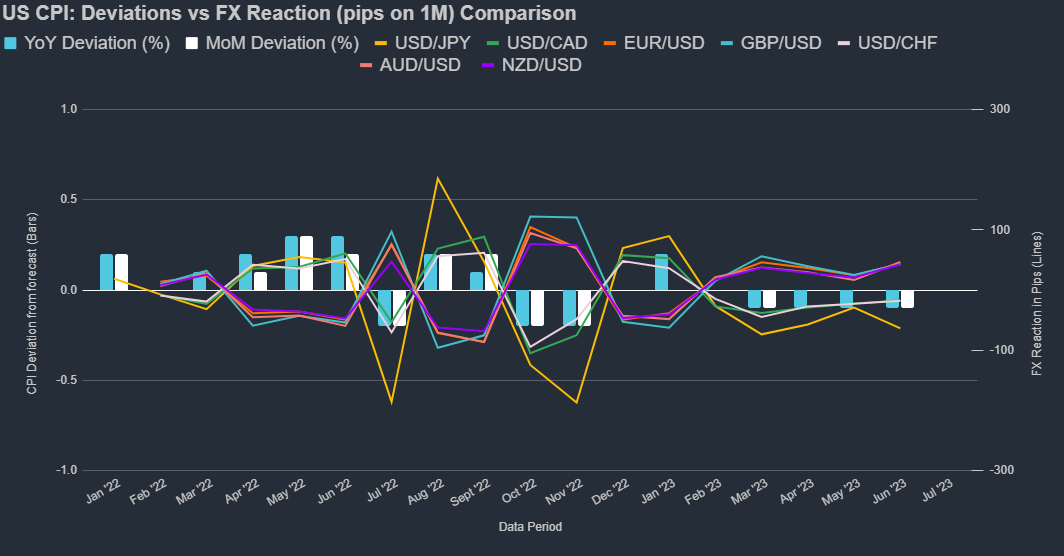

USD/JPY currency pair decreased by 63.5 pips

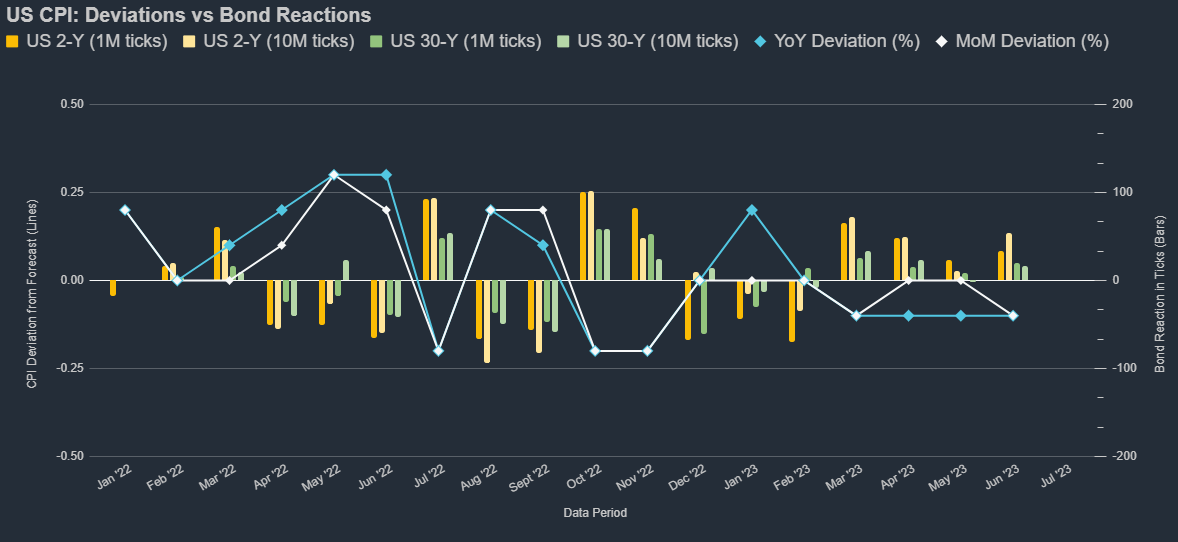

US 2-year bond market increased by 34 ticks.