On September 13th at 8:30 AM ET, the BLS is set to release the latest US inflation print, representing the month of August.

Here are some views on what to expect.

Median expectations for US CPI YoY see it coming in at 3.6%, ticking up from the prior 3.2%. The highest estimate is 3.9%, and the lowest is 3.4%, according to a survey of 42 qualified economists.

While US CPI MoM has a median forecast of 0.6%, up from the prior 0.2%. The highest estimate is 0.7%, and the lowest is 0.4%.

Wells Fargo

YoY Forecast: 3.6%

MoM Forecast: 0.6%

July brought the third consecutive monthly bump in headline CPI, sub 0.2%, before rounding. These softer readings brought the three-month annualized headline pace down to only 1.9%, the smallest clip since June 2020.

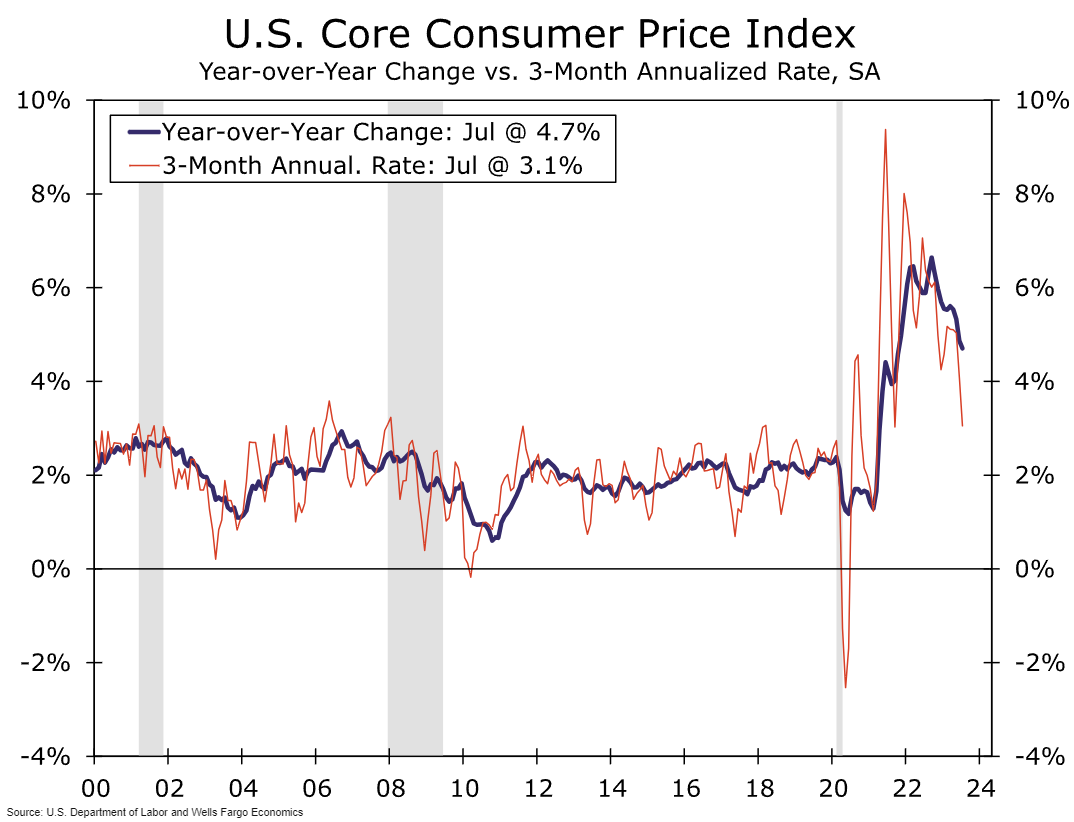

Muted energy price growth explains a big chunk of July’s modesty, given that the CPI survey captured only the very beginning of the recent upturn in gas prices. But even core inflation seems to be pumping the breaks, notching two consecutive monthly upticks of 0.16%. These core prints amount to a three-month annualized rate of 3.1% in July, a steady progression down from 4.1% in June and 5.0% in May.

We forecast Core CPI gained 0.18% in August, equating to a 4.3% year-over-year rate. If realized, the Fed would achieve its elusive 2% target on a three-month annualized basis. Within core, commodities and shelter likely propelled the deceleration. However, we expect a roughly 10% jump in gas prices to lift the headline rate to 0.6%. This would mark the largest monthly jump in headline CPI in over one year, bringing the year-over-year headline rate to 3.6%.

Despite recent progress in core inflation, it strikes us as unlikely that the Fed will be able to meet its 2% target on a sustained basis over the next couple of quarters.

Although we expect core goods prices to decline in August, the disinflationary momentum from normalizing commodity prices is set to fade. The drag from health insurance prices will also likely come to an end in October, setting up core inflation for an acceleration in Q4.

Bank of America

YoY Forecast: 3.6%

MoM Forecast: 0.6%

Blackrock

US CPI data should show more post-pandemic normalization.

We see inflation on a rollercoaster ride ahead as an aging population starts to bite.

JPMorgan

Dr. David Kelly

YoY Forecast: 3.6%

MoM Forecast: 0.5%

Higher oil prices, of course, have an impact on inflation.

Energy accounts for just under 7% of the basket of goods and services used in calculating the consumer price index. We expect that the CPI report for August will feature a month-to-month increase in energy prices of between 4% and 5%, boosting the seasonally adjusted year-over-year increase in headline CPI to 3.6% from a low of 3.1% seen in June.

Citigroup

YoY Forecast: 3.7%

MoM Forecast: 0.6%

Previous Release

On August 10th at 8:30 AM ET, the BLS released the last CPI report, with data representing the month of July.

US CPI YoY came in cooler than expected at 3.2%, on the expected 3.3%, but still up from the prior 3%

US CPI MoM came in broadly as expected at 0.2%, also unchanged from the prior.

The cooler-than-expected YoY figure, on top of the MoM figure that is in line with inflation's return to the Fed's 2% target caused some weakness in the dollar, and strength in the S&P 500, as markets repriced the ferocity of potential future Fed rate moves.