On Thursday the 12th of October, the BLS is set to release the latest US inflation print, representing the month of September.

Here are some views on what to expect.

For CPI YoY, the median forecast is 3.6%, on the prior 3.7%. According to a survey of 45 qualified economists, the highest estimate is 4.0%, and the lowest is 3.5%

For the Core CPI YoY, the median forecast is 4.1%, on the prior 4.3%. The highest estimate is 4.2%, the lowest is 4.1%.

HSBC

US CPI YoY Forecast: 3.6%

US Core CPI YoY Forecast: 4.1%

Wells Fargo

US CPI YoY Forecast: 3.6%

US Core CPI YoY Forecast: 4.1%

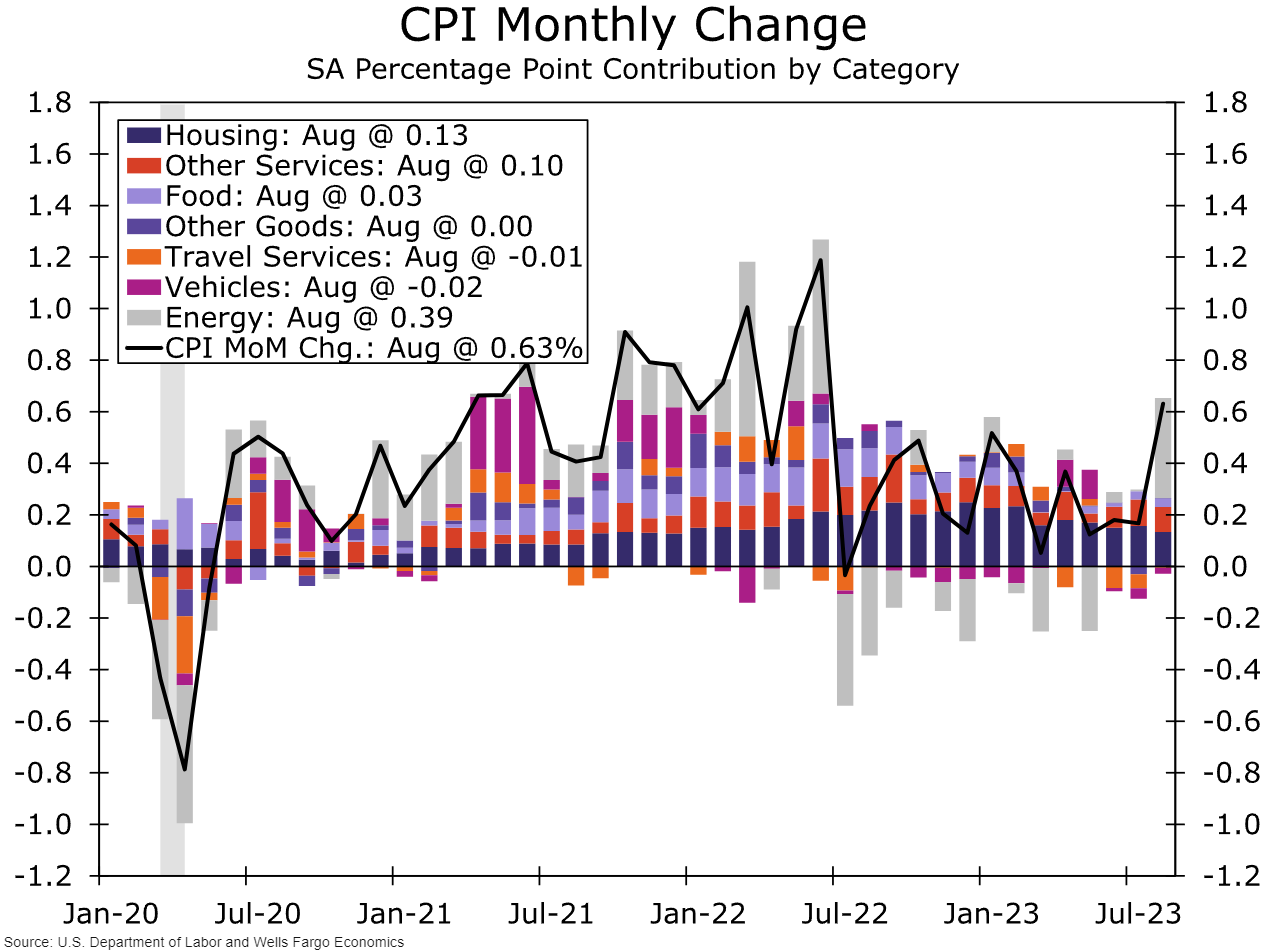

Services inflation has been stickier in this inflation battle. Core services inflation rose 0.4% for the second consecutive month in August. Owner's equivalent rent rose a similar 0.4%.

Shelter inflation has cooled on-trend, but continues to make up a sizable contribution to the monthly measure. Labor market balancing and healing supply chains should serve to quell inflation on the supply-side.

On the demand-side, rising credit costs and weakening real disposable income will likely weigh on spending going forward, making it more difficult for businesses to pass on costs to an increasingly cautious consumer.

We expect headline CPI rose 0.3% in September, helped by gasoline prices smoothing out over the month. Ongoing disinflation in shelter should also provide additional downward pressure on inflation. We forecast the core measure rose a similar 0.3% over the month.

Blackrock

US CPI data this week will help gauge how quickly supply mismatches are unwinding.

Citigroup

US CPI YoY Forecast: 3.6%

US Core CPI YoY Forecast: 4.1%

JPMorgan's Dr. David Kelly

US CPI YoY Forecast: 3.6%

US Core CPI YoY Forecast: 4.0%

We expect a benign report, with headline inflation rising just 0.3% month-over-month and 3.6% year-over-year (compared to 3.7% year-over-year in August) and core CPI climbing 0.2% and 4.0% year-over-year (compared to 4.4% year-over-year in August).

Moreover, wholesale gasoline prices have fallen quite sharply in recent weeks due to falling crude prices and narrower refiner margins.

While fallout from the attack on Israel could reverse this trend, if it doesn’t, then energy prices should subtract from inflation in the months ahead. It is still the case that, despite resilient economic growth, both headline CPI and headline consumption deflator inflation appear to be headed to 2% year-over-year or lower by the fourth quarter of 2024.

ING

We expect to see increases in CPI.

US Energy prices rose through the month as oil prices spiked higher, while higher food commodity prices are also likely to contribute to a fairly chunky 0.4% month-on-month increase in headline prices.

Core rates should be more moderate, with slowing rents potentially having more of a cooling influence.

Nonetheless, we still see the risk of a 0.3% MoM core CPI number, which will keep the more hawkish FOMC vocal on the prospect of another rate rise in either November or December.

The current consensus is for core CPI to rise 0.3% MoM, which is still too high for the Fed, which wants to see 0.1% or 0.2% MoM prints.

Goldman Sachs

US CPI YoY Forecast: 3.6%

US Core CPI YoY Forecast: 4.0%

Previous Release

On September 13th, The BLS released the US CPI numbers representing the month of August.

US CPI YoY came in at 3.7% (Forecast 3.6%, Previous 3.2%). This sent the US Dollar and US 2-Year Treasury Yields up while stocks weakened as it showed that inflation may prove to be stickier than previously thought, and could have prompted further Fed interest rate increases.