On Tuesday the 13th of December at 8:30 AM ET, the Bureau of Labor Statistics releases the US CPI data for November.

Average analysts' expectations see inflation cooling off from October's figures. Year-over-year is seen moving down to 7.3% from October's 7.7%, with Core CPI year-over-year seen moving down moderately to 6.1% from October's 6.3%.

Here are some views on what to expect:

Wells Fargo

We expect to see that inflation in November decelerated to a 0.2% month-over-month gain, translating to a 7.2% year-over-year pace. Food prices, at the grocery store and at restaurants, likely continued to rise at a strong monthly pace. However, a decline in energy prices and used car prices look to have dampened the overall gain in price level. Stripping out food and energy, we expect core CPI to rise 0.4% for November, still too high, but at least decelerating on a three-month annualized basis.

We expect the decelerating trend in inflation to signal that the Fed's rate hikes are working, but for the overall pace to illustrate that the job is not yet done. This is the last major indicator that the FOMC will receive before its meeting next week.

ING

It is important to remember we get November CPI the day before the FOMC meeting – and the outcome will be important for what the Fed has to say.

If inflation is softer and yields tumble further then the Fed may have to be more forceful and perhaps raise the possibility of accelerating a run-down in the size of its balance sheet via reduced reinvestment of proceeds from maturing assets. The central bank will stick with the hawkish messaging until it is confident inflation is beaten.

Blackrock

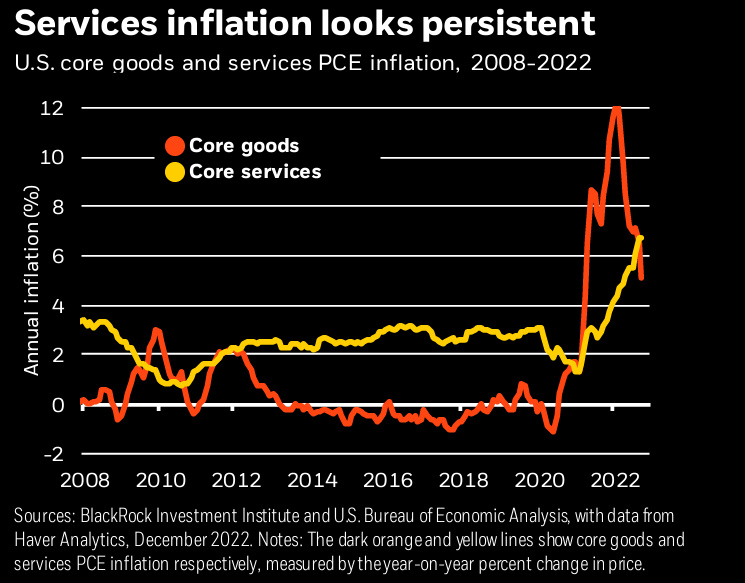

We expect goods prices to fall over the coming months' annualized goods inflation - extending the decline in annualized goods inflation - as consumers continue to switch spending back towards services and retailers sell off stockpiled goods at discounted prices.

But we think services inflation will remain elevated. Taken together, that means inflation is set to remain well above the Federal Reserve's 2% inflation target for quite some time yet.

Bank of America

CPI YoY Forecast: 7.3%

Core CPI YoY Forecast: 6.1%

Citigroup

CPI YoY Forecast: 7.2%

Core CPI YoY Forecast: 6%

Previous Release

The previous US CPI release was on November 10th at 8:30 AM ET, covering data from October.

Year-over-year moved down to 7.7%, lower than the expected 7.9%, and considerably lower than September's read of 8.2%.

Month-over-month remained unchanged at 0.4%, but still lower than the 0.6% that was expected.

The core reads cooled off as well, with Core CPI year-over-year ticking down to 6.3%, lower than the expected 6.5%, while month-over-month came in at 0.3%, on the expected 0.5%.

This cool-off in the CPI numbers triggered upside movement in the S&P 500 and Gold, alongside downside movement in the dollar, and the US 10-year yield.