On June 15th at 2 PM ET, the FOMC is scheduled to release the US interest rate decision, here are some views on what to expect: Wells Fargo

Wells Fargo

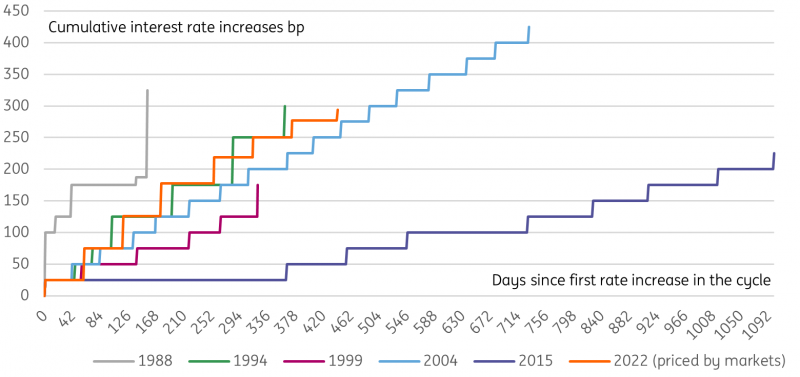

Prior to Friday, June 10th, we shared the universal consensus that the FOMC would hike 50 bps at the June meeting. But, the higher-than-expected inflation print for May now has us looking for a 75 bps rate hike.

This expectation was reinforced by press reports on June 13th, that seem designed to recalibrate market expectations regarding the potential magnitude of the rate hike.

Wells Fargo Economist Bryson, after incorporating recent information on June 14th:

"We have revised up our call for the June FOMC Rate Decision, (Upper Bound) to 1.75% from 1.5%"

We also look for a meaningful upward shift in the so-called "dot plot," which would indicate that Fed policymakers believe even more monetary tightening is appropriate in coming quarters.

We look for the median dot to shift up to 3.375% at the end of this year and to 4.125% at the end of next year.

We also expect the FOMC will raise its inflation forecast for 2022 while also paring down its GDP growth forecast for this year.

ING

Published Friday, June 10th.

With the near-term growth story looking robust and inflation remaining well above target, the Federal Reserve is set to hike by another 50bp and confirm that a further 50bp move in July remains on the cards. Another hawkish set of Fed dot plots should keep the dollar supported near the highs of the year.

The Federal Reserve is widely expected to follow up May’s 50bp interest rate increase with another 50bp hike at the forthcoming FOMC meeting, taking the Fed funds target range to 1.25%-1.5%. During the press conference, Fed Chair Jerome Powell is set to confirm that a third consecutive 50bp hike in July is the most likely path ahead.

The Fed is also expected to continue to allow $30bn of Treasury securities and $17.5bn of agency mortgage-backed securities to mature and roll off the balance sheet, increasing to $60bn of Treasuries and $35bn of MBS by September.

Chart Source: Federal Reserve

However, there is a debate as to what happens thereafter. Some officials want the Fed to continue with 50bp hikes to ensure inflation is brought under control, but this risks moving policy deeply into restrictive territory and heightening the chances of a recession. Others argue that there is already evidence of the growth outlook weakening and inflation pressures tentatively softening, which could justify a pause in September.

Citigroup

Citi CFO Mason cited by the WSJ

“If you look at the market today, we’re looking at a rate increase that could be as high as 75 basis points in the next two meetings.”

Wall Street Journal

The Fed is likely to consider a 0.75-percentage-point rate rise this week.

Officials had signaled plans to raise interest rates in half-point increments before the recent deterioration in data.

Barclays

75 bp hike to 1.75%

Deutsche Bank

50 bp hike to 1.5%

Previous Release

The last US interest rate decision was released on May 4th at 2 PM ET. It came in as expected, a 50 bps hike to 1%.

This saw the DXY weaken, while Gold and the S&P 500 strengthened.

This saw the DXY weaken, while Gold and the S&P 500 strengthened.

Fed's Powells Prior Comments

In the press conference with the Fed's Chairman Powell, after the US interest rate decision on May 4th, he noted:

A 75-bps rise is not something we are considering right now, if we see what we expect to see, then it will be 50 bps on the table at the next two meetings. Increases of 25 basis points would likely follow moves of 50 basis points.

Inflation has shocked to the upside, and more may be on the way. We have an excellent probability of a softish landing. There's nothing in the economy that implies we're on the verge of a recession.

However, Powell made some more comments after this on May 12th, where he said:

If things get better than we expect we're prepared to do less, if worse, we're prepared to do more. With perfect hindsight, it would have been better for us to have raised rates sooner. Whether we can execute a soft landing or not may actually depend on factors that we don’t control.

And Powell's comments became more hawkish still as he spoke at a WSJ event on May 17th:

We need growth to slow so supply can catch up, if we don't see that, we'll have to move more aggressively. We are going to look meeting by meeting, data by data, at financial conditions and the economy. We will go until we are at a place where financial conditions are appropriate, and inflation is coming down, it's going to be a challenging task to tame inflation. We need to push ahead with rate hikes.