On Wednesday the 1st of February at 2:00 PM ET, the Federal Reserve is set to release its latest interest rate.

According to CME Fedwatch as of 07:50 ET on February 1st, 98.7% of participants expect a 25 bps hike at this meeting. So attention will turn to the Rate Statement, and comments from Powell at the press conference.

Regardless, here are some views on what to expect.

ING

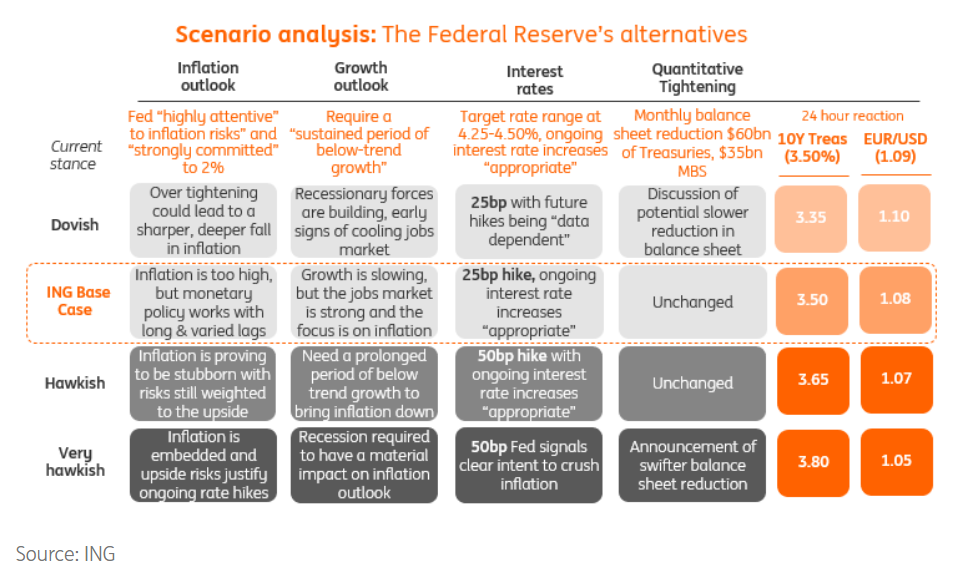

Having raised the Fed funds target range by 425bp in 2022, including 75bp and 50bp moves, expectations are firmly centered on the Federal Reserve opting for a more modest 25bp interest rate increase on Wednesday taking the target range to 4.5-4.75%.

Officials are unlikely to switch to a “data dependency” narrative just yet, fearing that adopting too dovish a line could fuel market expectations for eventual rate cuts. There is constant speculation on the likelihood of the Fed deciding to under-hike the rate on the reverse repo facility, to bring it to flat to the fed funds floor.

We think that the Fed will probably hike once more after this, on the 22nd of March, but that will mark the top for the policy rate. We are concerned that signs of a slowdown will spread and intensify with a recession our baseline forecasts.

Blackrock

We see the Fed pushing up rates further and pushing back against market expectations for rate cuts.

The US services PMI and payrolls data will give the latest view on recession risks.

We think further resilience in activity and the labor market could embolden the Fed. Then we see them keeping rates high. But markets are pricing rate cuts in 2023 even as the Fed insist they will stay the course.

Bank of America

A downshift in rate hike pace and shifts in Fed communication are indicating a more data-dependent stance that will likely be seen as marginally dovish.

Wells Fargo

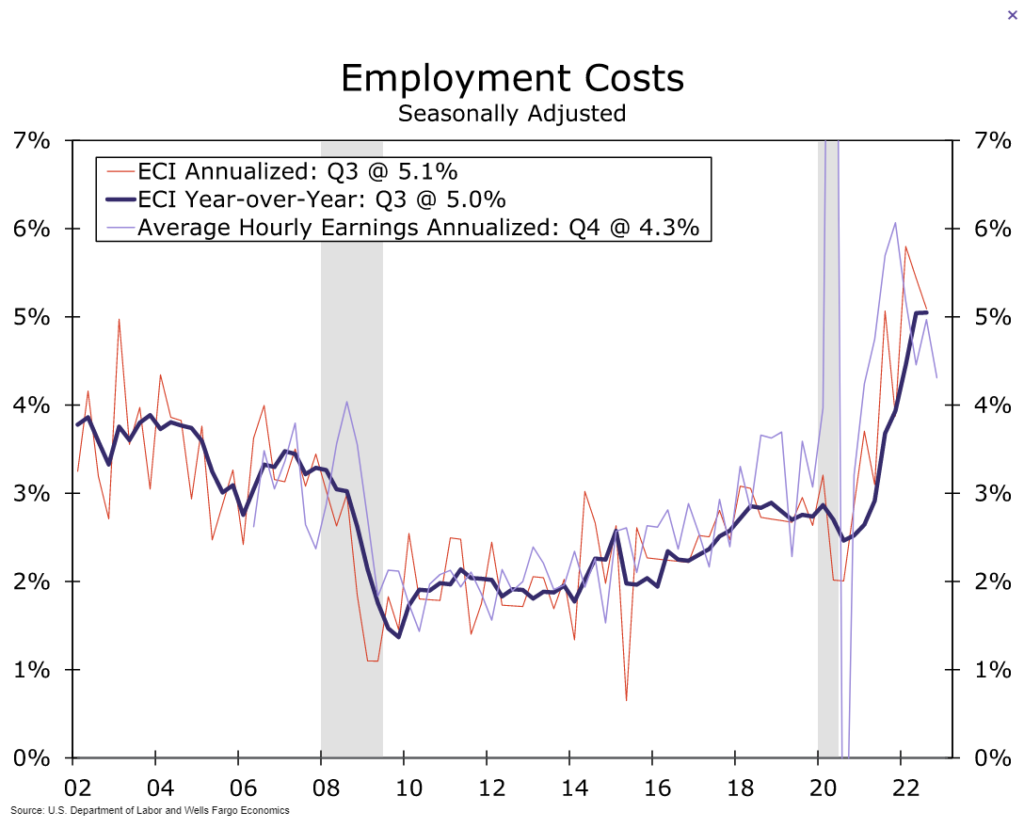

Consumer prices declined in December and increased at just a 1.8% annualized rate over the three months to the end of the year. Some of that slowdown relates to falling energy prices and smaller food price increases. Core CPI, which strips out volatile food and energy prices, rose at a 3.1% three-month annualized rate in December. Although this is still above the Fed's 2% inflation target, it is much improved from the 6.6% peak in core CPI. Ultimately, this meeting should signal that the Fed's work on this hiking cycle is nearer completion but not yet done.

Our current expectations are for a total of 75 bps more cumulative tightening, bringing the target range for the fed funds rate to 5.00%-5.25%.

If our forecast is correct, then we would still have two more 25 bps rate hikes at the March and May FOMC meetings.

Morgan Stanley

Markets are priced for two more 25bp hikes, one more than our economists’ base case. Our scenario analysis, looking at 5y and 10y yields as a function of the terminal rate, and pace of rate cuts, suggests that convergence to our base case of a 4.625% terminal rate should lower 5y and 10y yields by 20bp and 15bp, respectively.

If Powell opens the door even slightly to the idea that the terminal rate mark to market is lower than it was in December, we think that markets could start gravitating to even lower yields and we expect the march decision for a 25bp hike to become a 50/50 probability versus 80/20 right now.

Previous Release

On December 14th, 2022 at 14:00 PM ET, the Fed hiked its interest rate 50 bps from 4.25% - 4.75% as expected.

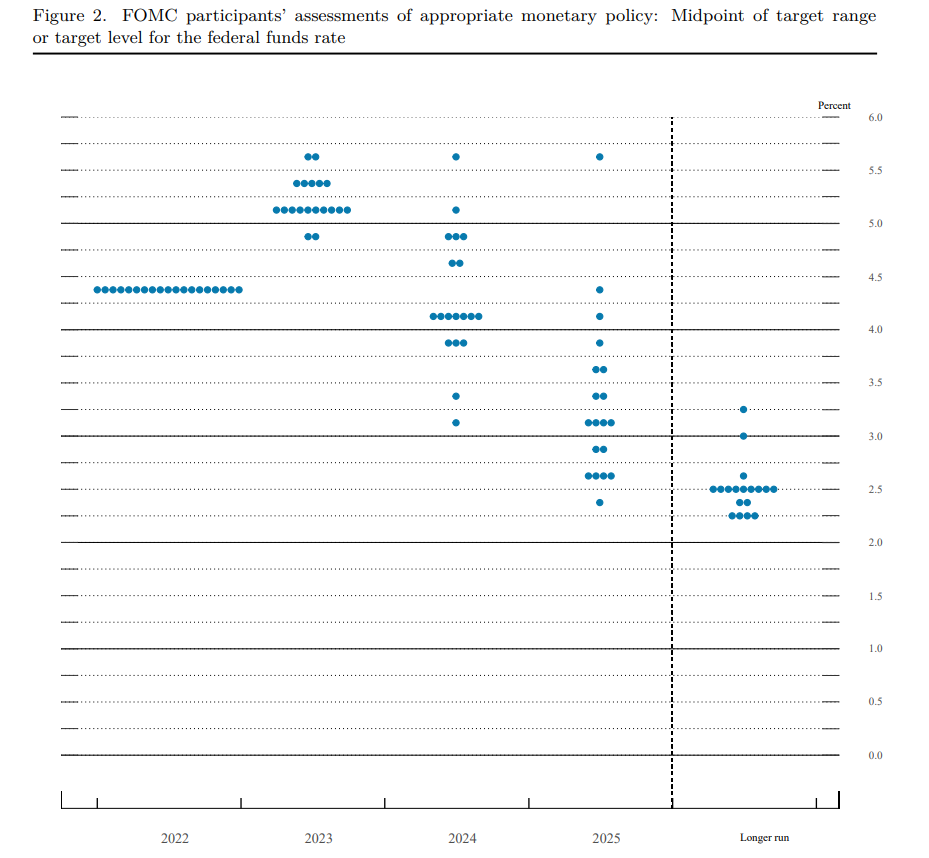

They also released their rate statement, and the December Summary of Economic Projections, which showed median FOMC members saw a 5.1% terminal rate, no rate cuts throughout 2023, and downward revisions in US growth.

This caused weakness in stocks and gold whereas the dollar and bond yields saw a positive reaction.

Previous Rate Statement

"Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures."

"The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time."

"In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt, and agency mortgage-backed securities"

December SEP: Dot Plot