On Wednesday the 22nd of February at 2:00 PM ET, the Federal Reserve is set to release its latest interest rate.

According to CME Fedwatch as of 8:00 AM ET on February 22nd, 86.4% of participants expect a 25 bps hike at this meeting as of 8:00 AM ET this morning.

So attention will turn to the Summary of Economic Projections for clues on potential future policy moves, the Rate Statement, and comments from Powell at the press conference.

Regardless, here are some views on what to expect.

ING

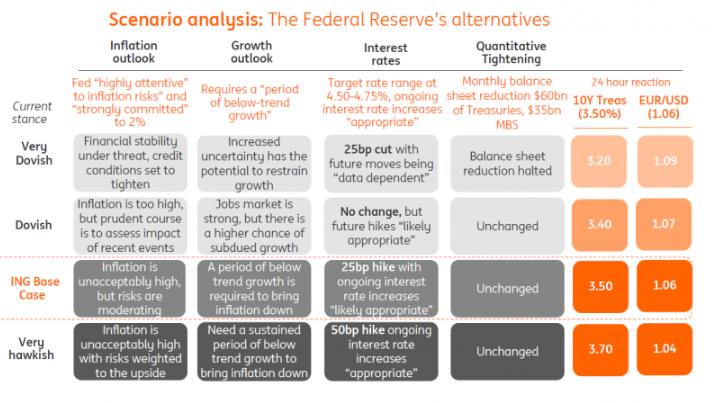

It has been a remarkable few days in financial markets. As recently as 7 March, Fed Chair Jerome Powell opened the door to a 50bp rate hike, citing concerns that “unacceptably high” inflation could last for longer given the tightness of the jobs market. Just two days later and troubles at Silicon Valley Bank prompted fears of contagion and turmoil, leading to a collapse in rate hike expectations for both the 22 March FOMC meeting and the future path of interest rates. In fact, from pricing 100bp of cumulative hikes, we were looking at a potential 75bp of cuts by the end of the summer at one point.

Moreover, there are clearly major hawks on the Fed, hence Chair Powell opening the door to 50bp last Tuesday so we can’t dismiss the possibility of a rate hike. The fact that the ECB was able to raise policy rates by 50bp with limited market reaction also suggests a hike is doable. A 50bp Fed rate hike would though, in the market’s mind, unnecessarily heighten the recession risk in an environment of tightening credit conditions. A surprise rate cut, as predicted by one bank, would signal major concern at the Federal Reserve, which could in turn mean financial market worries turn into a panic that exacerbates recession risks.

It is therefore between a 25bp move and no change on 22 March. The most prudent course of action, in our view, would be to pause to assess the damage, but leave the door open to a potential restart if the fallout is limited and inflation concerns persist. However, it is those inflation concerns that mean the Fed retains a desire to get the policy rate higher, should conditions allow. We also suspect the Fed will want to express confidence in the financial system and one way to do this would be to hike 25bp and signal in their forecasts that they think the Fed funds rate will end the year higher than it currently is.

Blackrock

Short-term government bond yields plunged as the emergence of financial cracks spurred the market’s hopes for sharp rate cuts. Bank shares led losses in Europe and were a drag in the U.S. after the troubles at U.S. medium-sized banks and concerns over a large Swiss financial institution. We think central banks will keep hiking as they both seek to bolster banking systems but distinguish those efforts from the need to keep fighting inflation.

We expect the Fed to press ahead with another rate hike, as the ECB did last week. The Fed’s updated forecasts may prompt markets to price back in rate hikes after the February CPI data showed sticky core inflation. But the Bank of England could pause hikes next week. Global PMIs will help gauge how much rate hikes are denting economic activity.

Wells Fargo

Further hiking the fed funds rate would be a crystal-clear signal of the FOMC's commitment to reducing inflation while also displaying confidence in the measures put in place to stem recent financial market stress.

However, the dust is still settling from the nation's second and third-largest bank failures in history. We look for the FOMC to briefly pause its tightening efforts to ensure the situation is under control. In our view, the last thing the FOMC wants is more financial instability that threatens the banking system and forestalls any additional rate hikes down the road. But, neither a hike nor a pause would surprise us.

If, as we anticipate, the FOMC opts to hold the fed funds rate at 4.50-4.75% at next week's meeting, it could use the "dot plot" to clearly signal that the tightening cycle is unlikely to be over just yet. Between the economic data's recent strength and the presumption that efforts to stem stress in the financial system will be effective, we expect the median dot for 2023 to move up 25 bps to a range of 5.25-5.50%.

JPMorgan

Dr. David Kelly

Continued, over-hawkish talk about inflation has, to some extent painted the Federal Reserve into a corner. Over the last few days, the market has wavered between pricing in one final rate hike from the Fed or no hike at all.

Chairman Powell may feel that he is between a rock and a hard place with financial instability and the Fed’s very active engagement in trying to battle it arguing for no further rate hikes and still elevated inflation arguing for a tighter policy. But, in truth, he is between a rock and a soft place because both inflation and economic growth look very likely to grow softer in the months ahead. Because of this, a wise course of action would be to be less worried and sound less worried about inflation, while assuring the public that the Federal Reserve will do whatever it takes to protect the stability of the financial system.

Previous Release

On February 1st, 2023 at 14:00 PM ET, the Fed hiked its interest rate 25 bps from 4.5% to 4.75% as expected.

This saw whipsawing in the dollar, whipsawing into downside movement on the S&P 500, and upward movement prevailing in the dollar vs the yen.

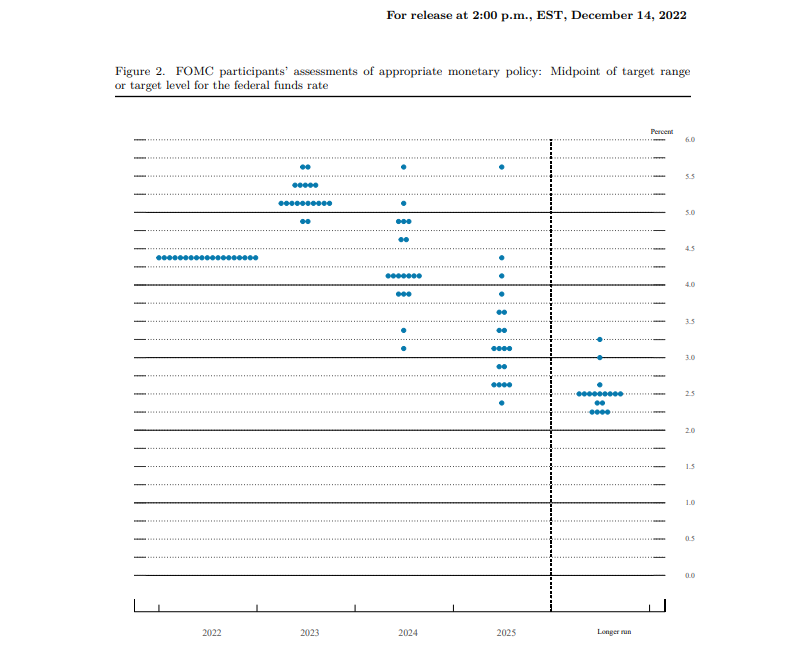

The last Summary of Economic Projections was in December 2022, which showed median FOMC members saw a 5.1% terminal rate, no rate cuts throughout 2023, and downward revisions in US growth.

Today's release will give us a new Summary of Economic Projections, the prior dot plot (as pictured above) was released on December 2022.

Investors will be looking to differences in FOMC members' forward guidance for the path of rates in this coming Summary of Economic projections.