On Wednesday the 26th of July at 2:00 PM ET, the Federal Reserve is set to release its latest interest rate.

According to the CME Fedwatch tool as of 07:00 AM ET today (Wednesday 26th July), there is a 98.9% chance of a 25bp hike this meeting.

So attention will turn to the Rate Statement for clues as to whether this will be the final hike in this cycle or not, and comments from Powell at the press conference to give any clues on how the data is influencing Fed decision-making.

Regardless, here are some views on what to expect.

ING

Forecast: 25 bps Hike to 5.5% from 5.25%

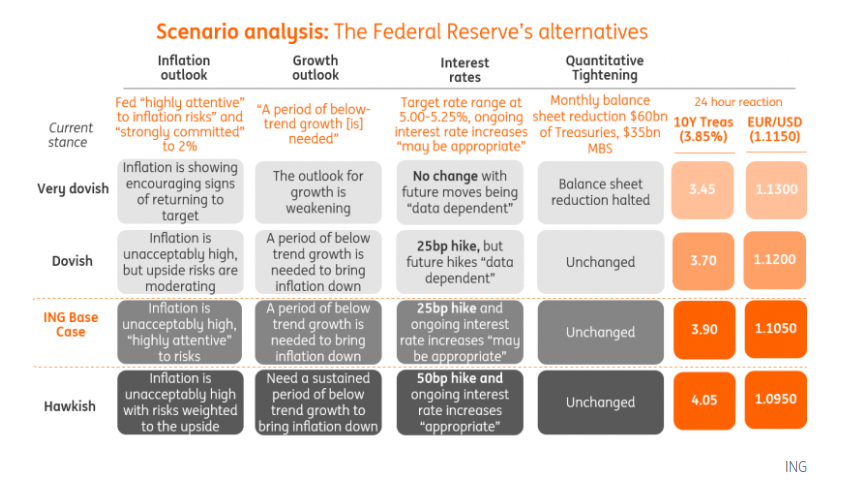

The Federal Reserve is set to resume its policy tightening on 26 July. Inflation is moderating but remains well above target and with a tight jobs market and resilient activity, officials may feel they can't take any chances. The Fed will continue to signal the prospect of further hikes, but with the credit cycle turning, we doubt it will carry through. After 10 consecutive interest rate hikes over the previous 15 months, the Federal Reserve left the Fed funds target rate unchanged at 5-5.25% in June. While it was a unanimous decision, there was hawkish messaging in the accompanying press conference and updated Fed forecasts, signaling a broad consensus behind the idea of two more rate rises later in the year.

Fed Chair Jerome Powell stated that the long and varied lags in monetary policy meant that the decision should be interpreted as a slowing in the pace of rate hikes rather than an actual pause. While inflation is moderating, it is still far too high, and with the jobs market remaining very tight, the Fed can’t take any chances. The commentary since then remains consistent with this messaging, with broad support among officials that the 26 July Federal Open Market Committee (FOMC) announcement will be for another 25bp rate rise, taking the Fed funds range to 5.25-5.5%. Fed funds futures contracts are pricing 24bp with economists nearly universally expecting a 25bp hike.

The no change and 50bp hike options seem very remote possibilities given comments from officials. The dilemma is whether the Fed hikes 25bp and sticks with the view that it needs to signal the likely need for one or more rate hikes or whether it moves more to a data dependency stance.

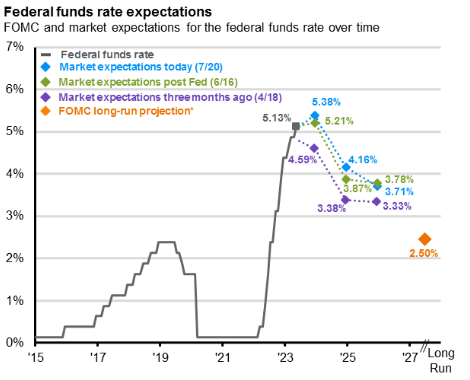

The US rates curve has been re-pricing in recent weeks to reflect the relative robustness of the economy, primarily by pricing out many of the rate cuts that had been discounted. The liquid portion of the strip out to early 2025 is now not tending to dip below 3.75%.

Adding a 30bp term premium to this suggests that the US 10yr yield could easily be closer to 4%. It’s far from a perfect model, but it does help to explain why the 10yr yield has not collapsed lower, and in fact, we rationalize this as a factor that can force US yields higher as a tactical view.

It goes against the consensus out there that the inflation story is behind us but is rationalized by the reality of relative contemporaneous macro robustness. For this reason, we maintain a moderate bearish stance on the directional view, expecting market rates to remain under moderate rising pressure. A hawkish Fed pushes in the same direction, preventing the strip from becoming too inverted.

Black Rock

The Federal Reserve is set to hike rates again this week, yet markets have been taking this in stride.

Soft June US core inflation has revived hopes for rate cuts in 2024. This can fuel a bull run across assets for some time – until it runs into the disconnect between fast-falling inflation and stronger-than-expected economic activity.

JPMorgan

Forecast: 25 bps Hike to 5.5% from 5.25%

Both parts of the Fed’s mandate continue to trend in the right direction, we expect the Fed to hike another 25bps on Wednesday. The market clearly agrees and is pricing in a 96% probability of a hike.

Regardless, the end of the Fed hiking cycle looks closer than it did earlier this year, with this week’s chart showing the market expects no further hikes for the remainder of the year assuming we get a hike Wednesday.

However, the market appears too pessimistic in its outlook for rate cuts with only one full cut expected in 1Q24 and a cumulative 125bps for the year.

The Fed often raises rates on an escalator, before being forced to take an elevator down, with rates falling on average 275bps within the first year of cuts. As rates move lower, the investment climate becomes more appealing for all long-term asset classes. Investors may want to extend fixed income duration as expectations for policy rates in 2024 and 2025 may be too high given a softening in growth momentum and rapid decline in inflation.

Wells Fargo

Forecast: 25 bps Hike to 5.5% from 5.25%

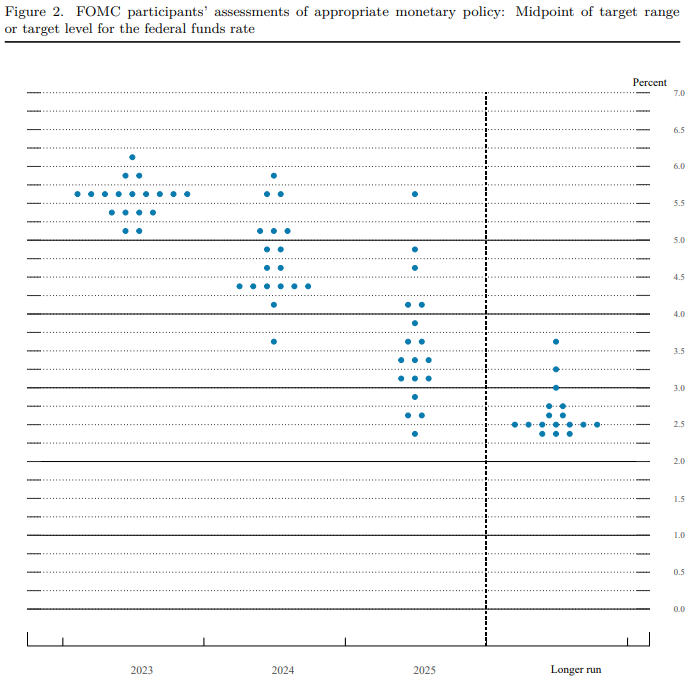

When the FOMC last met on June 14, the Committee left the fed funds rate unchanged for the first time in 10 meetings. However, the FOMC signaled that its tightening cycle was unlikely to be over. The dovish policy decision was delivered with a hawkish message via the Summary of Economic Projections, which showed the median expectation of where the fed funds rate would end this year 50 bps higher than in the prior quarterly SEP, released in March.

However, with the FOMC having raised rates 500 bps in a little over a year, the Committee believed it prudent to hold the policy rate steady in June in order to "assess additional information" on how the economy was weathering the cumulative and lagged effects of policy changes. After the doves got their way in June, we expect the hawks to get theirs in July. We look for the FOMC to raise the fed funds target rate of 25 bps to a range of 5.25%-5.50%. Notably, inflation has shown further signs of easing since the FOMC last met, with the core CPI posting its smallest monthly gain since early 2021. However, with inflation running a well-above target for about two years, we believe it will take more than a single report for the FOMC to be confident that inflation is on a sustainable downward path back to 2%.

Markets appear braced for the likelihood of further tightening in July, with futures pricing a 96% probability of another 25 bps increase. But doubts linger about whether the Committee will go through with a subsequent hike later this year; the odds of the target range reaching 5.50%-5.75% this cycle currently stands at a little under 40% based on current fed funds futures. We have our own doubts about whether the FOMC will deliver another hike after its July meeting. The pause in June signals a significant number of officials are quite weary of the lagged effects of policy tightening undertaken already. At the same time, we expect to see the trend in core inflation to continue to ease over the next few months, which, when combined with more sluggish spending, investment, and hiring will lead the Committee to settle in for an extended pause. However, we expect the post-meeting statement and Chair Powell in his press conference to signal that rate hikes beyond July remain possible in order to stave off any premature easing in financial conditions that could ultimately make it more difficult to tame inflation.

Previous Rate Statement Highlights & Dot Plot

"Economic activity has continued to expand at a modest pace. Job gains have been robust. The unemployment rate has remained low."

"Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The U.S. banking system is sound and resilient."

Previous Release

At the June 14th FOMC meeting it was decided to keep rates at 5.25% as expected, which sent the Dollar and Treasury Yields up whilst the S&P 500 went down.