On Wednesday the 14th of June at 14:00 PM ET, the Federal Reserve is set to release its latest interest rate.

According to CME Fedwatch as of 09:00 ET Tuesday the 13th of June, there is currently 96.2% chance of a pause this meeting.

So attention will turn to the Rate Statement for clues as to whether this will be the first pause in this cycle or not, and comments from Powell at the press conference.

Regardless, here are some views on what to expect.

ING

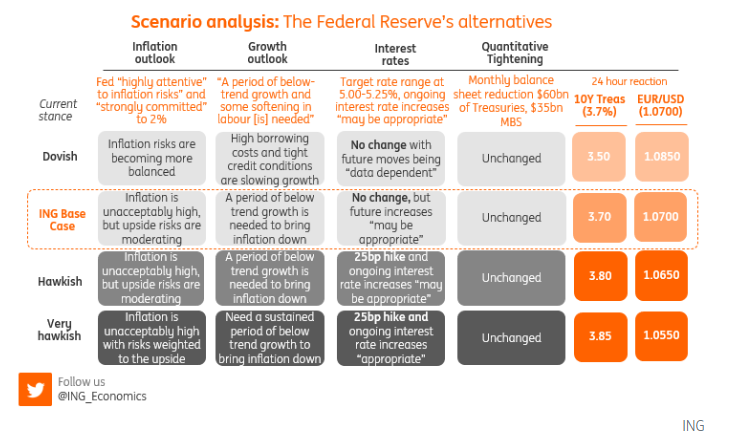

Market pricing has shifted massively over recent weeks, but we think the most likely outcome remains the Fed leaving policy rates unchanged on 14 June. There will be some dissent and a shock inflation reading could make it a very close decision. Either way, the Fed will leave the door open to further rate moves. Just over a month ago, Federal Reserve Chair Jerome Powell hinted that after 500bp of rate hikes over a 14 month period, interest rates may finally have entered restrictive territory and the Fed could pause at the June meeting to take some time to evaluate the effects. Markets took this as a signal that we may already be at the peak with the fear that the combination of high borrowing costs and tighter lending conditions could prompt a recession with inflation falling swiftly back towards target. On 4 May, Fed funds futures contracts were pricing in 86bp of interest rate cuts by year end and the target range heading below 4% at the January 2024 FOMC meeting.

We believe there will be a majority on the committee who think they have tightened policy a lot and it makes sense to wait. This was certainly the commentary from senior Fed officials such as Governor Philip Jefferson and Philadelphia Fed Governor Patrick Harker, that while “there is still significant room for improvement” the Fed is “close to the point where we can hold rates in place and let monetary policy do its work”. Moreover, recent data releases have been sending very mixed messages, which suggests it may make sense pause to evaluate.

JPMorgan

On Wednesday, the Fed should provide more clarity on the trajectory of rates after vacillation in market expectations over the past month, which we illustrate in this week’s chart. As of Friday, the federal funds futures market was pricing in a 28% probability of a hike in June and a 54% chance of a skip in June followed by a hike in July. Since the FOMC last met, expectations have oscillated due to resilient growth, moderating inflation, diminished threats from regional banking turmoil, a solution to the debt ceiling standoff and mixed messages in the public pronouncements of Fed officials.

Given a gradual slowdown in growth and inflation and the fact that we have yet to see the full effect of the cumulative 500bps of hikes so far, the Fed would be well advised to pause at this point. Nevertheless, another hike is still clearly on the table and, if the Fed doesn’t hike this week, Chairman Powell will likely emphasize that skipping a rate hike now does not necessarily imply that the Fed is done raising rates. However, regardless of the Fed’s decision and messaging this week, we expect to see rate cuts within the next year that should improve the backdrop for investors across a broad range of assets.

Wells Fargo

At the conclusion of the Federal Reserve Open Market Committee (FOMC)'s meeting on May 3, there were signs that the most aggressive tightening cycle since the 1980s was nearing its end. Policymakers voted unanimously to raise the fed funds rate by 25 bps to 5.00%-5.25%, a 15-year-high. Yet, the Committee was careful to keep its options open about additional rate hikes. Rather than noting that it anticipated "ongoing increases" or even "some additional policy firming," the post-meeting statement merely laid out the factors the FOMC would consider in determining how much additional tightening "may be appropriate" (emphasis ours). Monetary policy works with a lag, and with 500 bps of policy rate hikes behind us, the Fed may take the chance to wait and see, at least for another month.

We see the most likely outcome for next week's meeting as the FOMC making no change to its policy rate but making clear that another hike at its July 26 meeting remains a distinct possibility. This would allow a compromise between officials who believe further tightening is necessary and those who believe it is time to be patient and let the medicine of the past year fully take hold. We think this balanced approach will be enough to stave off any dissenting votes, but the uncertain outlook and increasingly fractured views within the FOMC have increased the odds that one or more dissents could occur at one of the upcoming meetings.

Citi Group - 25 bp hike.

Goldman Sachs - Pause.

Societe Generale - Pause.

The May FOMC Rate Statement Highlights

Economic activity expanded at a modest pace in the first quarter. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

Previous Release

On Wednesday the 10th of May 2023 at 14:00 PM ET, the Fed hiked its interest rate 25 bps from 5% to 5.25%, as expected.