On Wednesday the 20th of September at 2:00 PM ET, the Federal Reserve is set to release its latest interest rate.

According to the CME Fedwatch tool as of 10:00 AM ET Monday 18th September, there is a 99% chance of no change this meeting.

So attention will turn to the Rate Statement and Summary of Economic Projections for clues as to whether this marks the end of the tightening cycle or not, and comments from Chair Powell at the press conference to give any clues on how the data is influencing Fed decision-making.

Regardless, here are some views on what to expect.

ING

At the last Federal Reserve monetary policy meeting in July, the Federal Open Market Committee raised the Fed funds policy rate range 25bp to 5.25-5.5%. The minutes to the decision also showed officials continue to have a bias to hike further since “most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy". At the Fed’s Jackson Hole Conference in late August Chair Powell said that policymakers “are attentive to signs that the economy may not be cooling as expected”, indicating a sense that it may indeed need to do more to ensure inflation sustainably returns to target. Nonetheless, the FOMC minutes also suggested differences of opinion are forming. While all voting FOMC members backed the hike, there were two non-voting members who “indicated that they favoured leaving the target range for the federal funds rate unchanged”. Moreover, “a number of participants judged that it was important that the Committee's decisions balance the risk of an inadvertent overtightening of policy against the cost of an insufficient tightening”.

In recent months we have had some encouraging news on core inflation with two consecutive 0.2% month-on-month prints with a third coming in at 0.278%, much better than the 0.4-0.5% MoM consecutive prints we got over the prior six months. There has also been evidence of moderating labor costs (the Employment Cost index and cooling average hourly earning growth) together with more modest job creation. Yet we have to acknowledge that the activity data has remained strong with the US economy on track to grow at an annualized 3% rate in the current quarter.

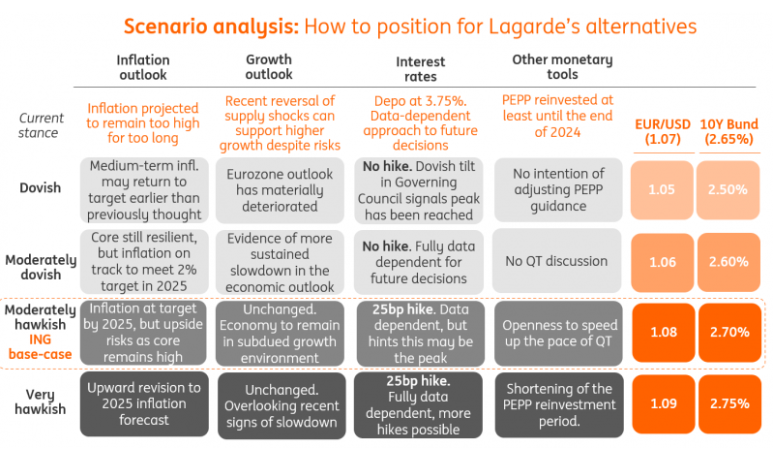

The commentary from officials, including the hawks, such as Neel Kashkari, suggests a willingness to pause again in September (just as it did in June), but to leave the door ajar for a further hike at either the November or December FOMC meetings. Given this situation, economists are universally expecting the Fed funds target rate range to be left at 5.25-5.5% with markets not pricing even 1bp of potential tightening. While the European Central Bank hiked rates but indicated it may be done, the Fed is set to pause, but keep its options open. As with the June hold decision, the Fed is set to suggest that the decision should be interpreted as part of its process of a slowing in the pace of rate hikes rather than an actual pause. While inflation is moderating, it is still too high and with the jobs market remaining very tight and activity holding firm, the Fed can’t take any chances.

JPMorgan

JPMorgan

In the week ahead, the Federal Reserve will report on their view from what should be the top of a tightening cycle. While we do not expect any further rate hike at this meeting, they will release a summary of economic projections, giving their updated perspective on the likely path for economic growth, unemployment and inflation. They will also provide some indication on whether they intend to hike one more time before pausing and how rapidly they intend to cut interest rates in 2024 and beyond. They may even adjust their perspective on where the federal funds rate should be in the long run.

For investors, this will all be important information. However, it is also important to keep an eye on building pressures that have the potential to tip the economy into recession in 2024. While the Fed may plan for a very gentle decline in rates in the years ahead, there is a significant risk of an economic stumble that would precipitate much more rapid easing, as we descend on the other side of the tightening mountain.

Wells Fargo

The FOMC has gradually slowed its pace of tightening since late last year, consistent with the policy rate nearing—if not already at—its ultimate destination for this cycle. We look for the FOMC to leave the fed funds rate unchanged at 5.25-5.50% at the conclusion of its upcoming meeting on Wednesday, September 20. Economic activity has continued to hold up relatively well considering the 525 bps of cumulative rate hikes since March of last year. Recent readings of core inflation also suggest that price growth continues to ease on-trend. Core CPI rose at a 2.4% three-month annualized rate in August, its slowest pace in more than two years. Notably, disinflation is broadening beyond just a handful of categories. While still higher than the traditional core, the median CPI moderated to a 3.6% three-month annualized rate in August. Heading into the meeting's blackout period, even relatively hawkish Committee members like Governor Waller and Dallas Fed President Logan signaled comfort with leaving the fed funds target range unchanged at the upcoming meeting. Clues on whether the Committee is inclined to further tighten policy beyond September—making next week's decision another "skip" rather than the start of a prolonged hold—will therefore be of great interest. With inflation continuing to run above target and the labor market cooling off only gradually, we expect the Committee to signal further policy tightening is possible if incoming data warrant it. This message is likely to be delivered through both the post-meeting statement and Chair's press conference.

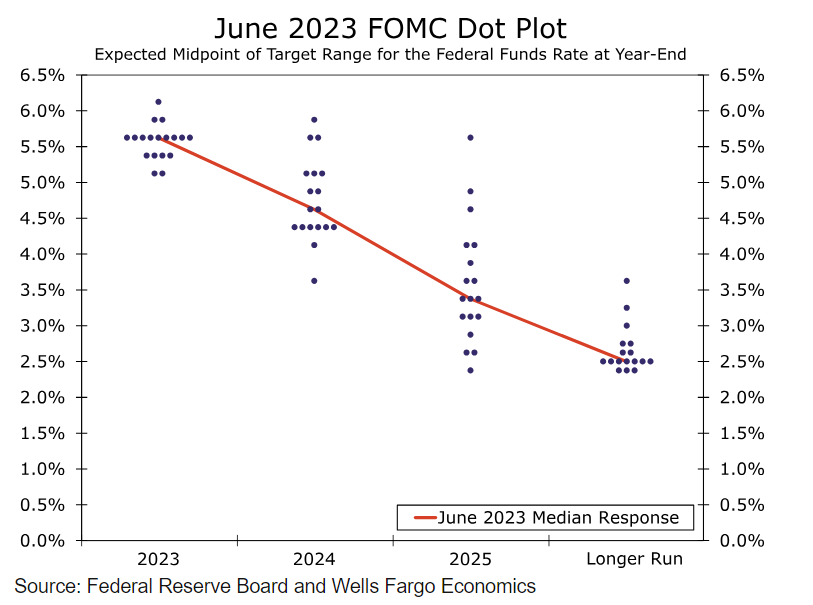

However, we expect the Committee to be closely split on whether additional tightening this year will be the most likely outcome. The September meeting will include an update to the Summary of Economic Projections. In the most recent "dot plot" published in June, projections showed a median fed funds rate of 5.625% at the end of 2023. Assuming that the FOMC does not hike on September 20, that would imply one more hike in November or December. We would not be surprised to see the median projection for 2023 slip to 5.375%, as expected progress on inflation has started to turn into realized progress. To that end, we look for participants to lower their year-end projections for core PCE inflation a couple of ticks, which would be the first downward revision to core inflation projections since 2020 and a sign policymakers are feeling more confident about inflation easing. That said, we also would not be surprised for the median projected fed funds rate to stay at 5.625%. The last thing participants likely want to do is send an overly-dovish signal about the future path of interest rates when the fight against inflation remains incomplete. As such, even if the median projection for the end of 2023 dips, we believe the median dots for 2024 and 2025 will not change much, if at all. Such a result would signal that while the hiking portion of the current rate cycle has likely come to an end, the cutting phase remains some ways off, with policy likely to remain restrictive for the foreseeable future.

Previous Rate Statement Highlights & Dot Plot

"The US banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation."

"The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks."

Previous Release

Previous Release

At the July 26th FOMC meeting it was decided to hike 25 BPS to 5.5% as expected.

This sent the Dollar and Treasuries down whilst the S&P 500 whipsawed, as rhetoric from the Rate Statement, and Fed's Powells subsequent press conference implied that this hike could be followed by a pause at this coming meeting.