On Wednesday the 1st of November at 2:00 PM ET, the Federal Reserve is set to release its latest interest rate.

According to the CME Fedwatch tool as of 11:00 AM ET Monday, October 30th, there is a 98.3% chance of no change at this meeting for the third consecutive time.

So attention will turn to the Rate Statement for clues as to whether the Fed will comment on the effect of geopolitical issues on the economy, alongside how strong US GDP, and the current inflation situation is with respect to the FOMC's outlook for policy and a potential soft landing scenario.

Regardless, here are some views on what to expect. MacroAce prep livestream (Starts November 1st at 1:00 PM ET) - Tune in Here

MacroAce prep livestream (Starts November 1st at 1:00 PM ET) - Tune in Here

ING

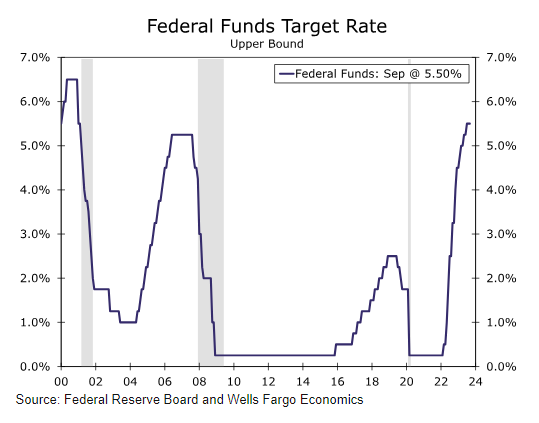

The widely held view amongst economists surveyed is that the US Federal Reserve will leave the Fed funds target range unchanged at 5.25-5.50% for the second consecutive meeting despite 3Q GDP growth coming in hot, the jobs market remaining tight and inflation remaining well above the 2% target.

Markets are similarly seeing little prospect of any change to monetary policy next week in the wake of the recent surge in longer-dated Treasury yields and the tightening of financial conditions it’s prompted.

This is creating even more headwinds for activity in an environment where mortgage and car loan rates are already above 8% and credit card interest rates are at all-time highs. Consequently, if Treasury yields stay at these elevated levels, the need for further policy rate hikes is dramatically reduced.

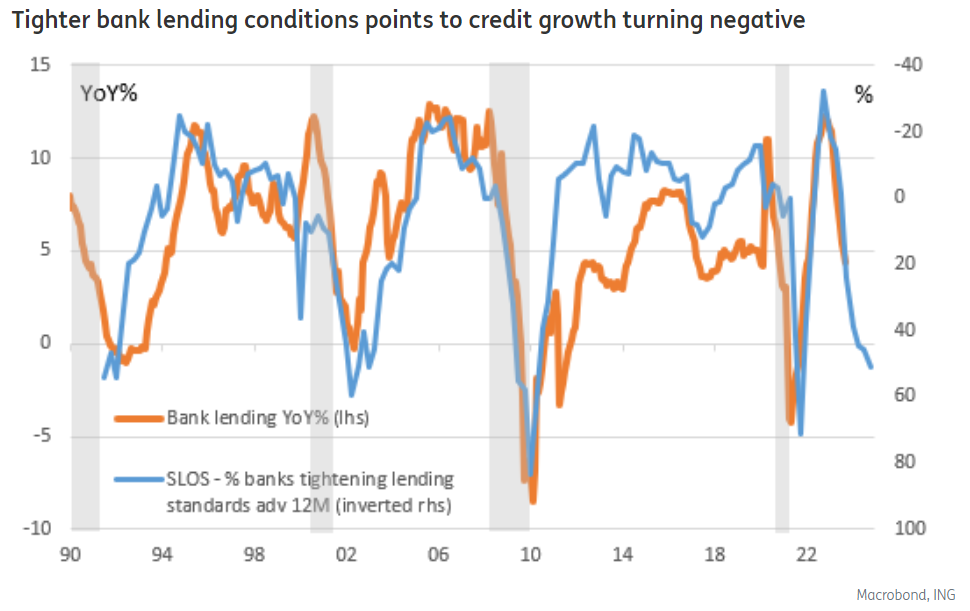

Fed Chair Powell also continues to emphasise the “long and variable lags” between implementing a change to policy interest rates and its effect on the real economy. At his speech to the Economic Club of New York earlier this month, he acknowledged that “given the fast pace of the tightening, there may still be meaningful tightening in the pipeline.” Throw in the fact banks have also tightened lending standards significantly, notably becoming increasingly selective in regards to who to lend to, how much to lend and on what terms, and this points to bank lending turning negative before the end of the year. Historically, in an economy where credit is such a critical driver of activity, this has always corresponded with a recession.

With conflicting signals in some of the business surveys becoming more apparent and geopolitical concerns intensifying and potentially dampening economic activity, some better news on inflation buys policymakers time.

They can afford to wait and assess the impact of recent developments and decide whether monetary policy is indeed restrictive enough to bring inflation back to 2% over time.

We think it is and that Federal Reserve interest rates have peaked. Officials will not want to give the market the excuse to backtrack on the recent repricing of “higher for longer” policy interest rates.

They will continue to leave the door open for additional policy rate rises should data justify it, fearing that a signal that policy has peaked could tempt traders to drive market rates lower in anticipation that the next move would be rate cuts. Such action could potentially reignite inflation pressures, but we doubt it.

Consumer spending remains the most important growth engine in the economy, and with real household disposable income flat-lining, savings being exhausted and consumer credit being repaid - and this is before the recent tightening of lending and financial conditions is fully felt—we see the primary risk being recession.

If right, this will depress inflation pressures even more rapidly than the Fed is anticipating, giving it the scope to cut policy rates in the first half of next year.

Wells Fargo

We expect the Federal Open Market Committee (FOMC) to leave the target range for the federal funds rate unchanged at 5.25%-5.50% at the conclusion of its meeting Wednesday. While this week's third quarter GDP report signaled continued economic resilience—real GDP accelerated to a 4.9% annualized clip in the quarter—we don't expect it changes much regarding the outcome of next week's meeting.

Strong Q3 growth was largely anticipated and recent comments by Fed officials suggest that most Committee members are comfortable leaving the stance of monetary policy unchanged at the upcoming meeting.

That said, most policymakers indicated at the September FOMC meeting that they thought another 25 bps rate hike would be appropriate by the end of this year.

While inflation is moving back toward the FOMC's 2% target, there is further progress to be had.

We believe the FOMC will want to keep its options open for further tightening, and thus think the post-meeting statement will maintain the language that signals some additional policy tightening may be appropriate.

We continue to anticipate the terminal rate of this cycle has been reached, though we acknowledge it is possible the FOMC hikes rates an additional 25 bps before the end of the year.

JPMorgan

In a widely anticipated move, the FOMC voted to leave the federal funds rate unchanged at a range of 5.25% to 5.50% at its September meeting.

The updated “dot plot” remained hawkish, with the median FOMC member now expecting only two cuts in 2024.

This likely stems from the Fed’s expectation for continued economic resilience. In the Summary of Economic Projections, real GDP growth expectations rose meaningfully for 2023 and 2024.

Elsewhere, the median forecast for the unemployment rate fell to 3.8% while the core PCE forecast ticked lower. Overall, the Fed appears to be forecasting a “soft-landing” scenario. However, with plenty of headwinds facing the current economic expansion, the risk of overtightening could challenge this outlook.

Previous Release

The results of the previous FOMC meeting were released on September 20th, where the Fed kept rates unchanged at 5.5%, for the second consecutive meeting.

In the release of the Summary of Economic Projections that came alongside the prior FOMC interest rate, Fed projections implied one more 25-basis-point rate hike this year and 50 bps of rate cuts in 2024, versus 100 bps of 2024 cuts in the June projections.

This caused strength in the dollar and US 2-year government bond yields, and weakness in the S&P 500.

This occurred as the decision for no change was widely expected, but the projections were more hawkish than were priced in by the markets.