On Wednesday the 13th of December at 14:00 ET, the Federal Reserve is set to release its latest interest rate decision.

According to the CME Fedwatch tool, as of 08:00 AM ET Monday, December 11th, there is a 98.4% chance of no change at this meeting for the third consecutive time.

So attention will turn to the Rate Statement and Summary of Economic Projections for clues as to whether the economy is behaving as the Fed predicted, and comments from Chair Powell at the press conference to give any ideas on how the data is influencing future Fed decision-making.

Regardless, here are some views on what to expect.

Median economist expectations expect US interest rates to remain unchanged at 5.5% for the third consecutive meeting.

Wells Fargo

It appears that the Federal Reserve's tightening cycle has come to an end. Since the summer, the FOMC has been keeping its options open regarding the possibility of additional rate hikes.

However, recent economic data and comments suggest less need and desire to exercise that option. We see the Committee leaving the fed funds target range at its current level of 5.25–5.50% at the conclusion of its upcoming meeting on December 13.

If realized, the third consecutive hold would suggest that rather than the FOMC merely hiking at a slower pace, the Fed funds rate probably has reached its terminal level of this cycle.

With the Committee seeming to settle into a prolonged hold, the conversation around the future policy path will shift toward when—and under what circumstances—the FOMC eventually cuts rates.

We have maintained since the FOMC last raised the fed funds rate at its July 26 meeting that the increase was likely the last of this hiking cycle, a view not always shared by market participants.

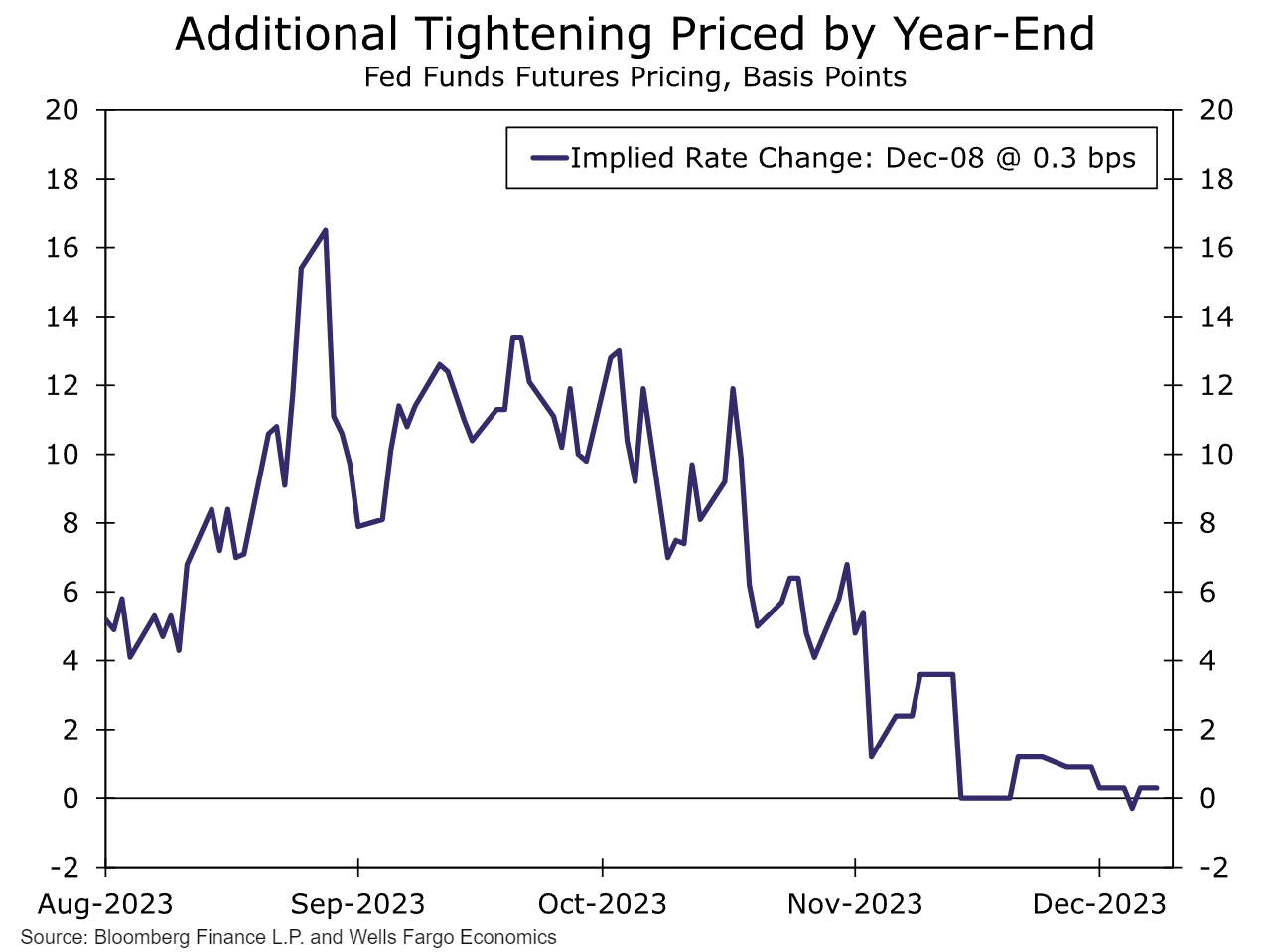

As recently as October, market pricing suggested that another 25 bps hike was slightly more likely than not, a bet bolstered in part by Committee members' own projections in September.

As shown in the nearby chart, market pricing for an additional hike before year-end has fallen close to zero over the past two months.

The declining odds of one additional hike this year come as both sides of the Fed's mandate are moving toward their longer-run desired levels. Notably, inflation has made encouraging progress toward returning to the FOMC's 2% target.

In October, core PCE inflation, the Fed's preferred benchmark for price growth, fell to 3.5% year-over-year, nearly a two-and-a-half-year low. The latest monthly readings suggest the recent pace has downshifted even further, with core prices in October up at a three-month annualized rate of only 2.4% relative to July.

ING

The Federal Reserve is widely expected to leave the fed funds target range at 5.25–5.5% at the upcoming FOMC meeting.

Softer activity numbers, cooling labor data, and benign MoM% inflation prints signal that monetary policy is probably restrictive enough to bring inflation sustainably down to 2% in coming months, a narrative that is being more vocally supported by key Federal Reserve officials.

Today, markets are clearly of the view that interest rates have peaked with 125bp of rate cuts priced through next year. Underscoring this shift in sentiment, we have seen the US 10-year Treasury yield fall from just shy of 5% in late October to a low of 4.1% on December 6th. In that regard, the steep fall in Treasury yields in recent weeks is an easing of financial conditions for the economy, and there is going to be some concern that this effectively unwinds some of the Fed rate hikes from earlier in the year.

For example, mortgage rates have been swift to respond, with the 30-year fixed-rate mortgage dropping from a high of 7.90% in late October to 7.17% as of last week.

We think the Fed will eventually shift to a more dovish stance, but this may not come until late in the first quarter of 2024. The US economy continues to perform well for now, and the jobs market remains tight, but there is growing evidence that the Federal Reserve’s interest rate increases and the associated tightening of credit conditions are starting to have the desired effect.

Blackrock

We see central banks pushing back against market hopes for rate cuts at this week’s meetings.

We expect structurally higher interest rates in the new regime.

Previous Release

On November 1st at 14:00 ET, the Federal Reserve kept interest rates unchanged for the second consecutive meeting, at 5.5%.

This caused some whipsawing across the markets but resulted in weakness in the US 2-year yield.

Here are some of the key excerpts from the rate statement that came with this rate decision:

"Recent indicators suggest that economic activity expanded at a strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low. Inflation remains elevated."

"The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and expectations, and financial and international developments."