On Wednesday, November 2nd at 2 PM ET, the FOMC release their latest US interest rate decision.

Here are some views on what to expect:

Wells Fargo

We expect the FOMC to announce a 75 bps increase in the target range for the federal funds rate.

This move is widely anticipated by economists and market participants alike, and it would be a major surprise if the committee deviated from 75 bps. If realized, this move would mark the fourth consecutive 75 bps rate hike and the fastest pace of monetary policy tightening since the early 1980s.

In our view, the most important aspect of the November FOMC meeting will be how the post-meeting statement and press conference frame policy considerations ahead.

We expect Chair Powell to reiterate that quelling inflation remains the FOMC's utmost priority and that the FOMC will "keep at it until the job is done." Over the past three months, core CPI inflation has registered a 6% annualized pace, well above the Fed's 2% inflation target.

Bank of America

While we are wary of reading too much into the Fed pivot narrative with inflation and labor data remaining too strong, a premature downshift for the Fed would likely suggest a compression in front-end vol and support BEs.

"Regarding breakevens, the difficult demand backdrop heading into year-end could drive an illiquid selloff, causing real yields to cheapen further."

BMO

Our bias for a deeper 2s/10s curve inversion remains intact, as the Fed is unlikely to adopt the global slowdown narrative as quickly as the market.

ING

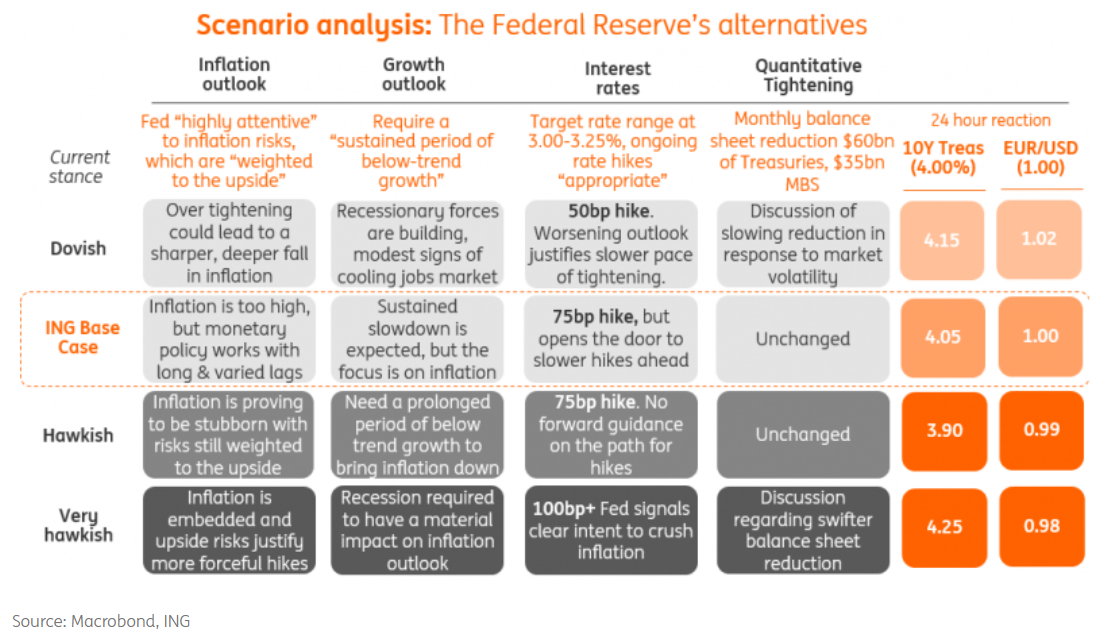

Market expectations are firmly behind a fourth consecutive 75bp interest rate hike from the Federal Reserve next week. The key story is whether the Fed opens the door to a slower pace thereafter or if the hawks’ focus on core inflation momentum signals a fifth 75bp move in December.

A 50bp hike is predicted by a tiny minority of analysts, a view that got some traction following recent comments from a couple of doves on the committee about the perceived risks of over-tightening policy and creating an unnecessarily deep recession. However, the general view is that this is more of a story regarding the size of rate hikes at subsequent meetings. Still, it certainly dampened any talk of a 100bp rate rise. No analyst is forecasting such an outcome based on consensus survey responses, unlike at recent meetings.

Citi

It is still too early from a risk/reward standpoint for 2s10s steepeners, which have historically performed best when entered at the time of the Fed's most recent rate hike.

A complete pause by the Fed is not feasible until at least February, and that may be a challenge if the NFP remains strong.

Barclays

We maintain our view of a higher terminal rate but recommend shifting the short view a bit out from SFRH3 to SFRM3. The strength of the US data argues against extrapolating a reduction in the pace of hikes to a lower terminal rate.

With 10-year yields already 90 basis points below the peak terminal rate, absent a significant recession on the horizon, they are likely to remain range-bound in our view and are likely to rise, should the terminal rate be marked higher.

JPMorgan

Dr. David Kelly

We expect, (as does the futures market), that the Fed will raise the federal funds rate rates by 75 basis points. However, market attention will be focused on how they characterize the current economic situation and provide guidance on future moves.

Their September statement made literally no reference to any easing of inflation pressures. However, with energy prices well below their peaks, global food commodity prices easing, and global supply chain issues diminishing, they will likely feel compelled to acknowledge some improvement while, no doubt, stressing that inflation remains too high. This, on its own, might be seen as slightly less hawkish.

Morgan Stanley

The declining second derivative of economic data will give the Fed an off-ramp from the 75bp pace of rate hikes we've seen in the last three FOMC meetings (and is likely in December)

Previous Release

These charts show what happened from the Release on the 21st of September 2022, where the Federal Reserve hiked interest rates by 75bps for the 3rd consecutive time as expected. This caused the Dollar to strengthen as well as the 10yr-yield to increase, on the other hand, we saw the S&P500 and Gold decline.