On Friday the 4th of August, at 8:30 AM ET, the BLS is set to release the latest Nonfarm Payrolls and Unemployment Rate numbers, representing the month of July.

Here are some views on what to expect.

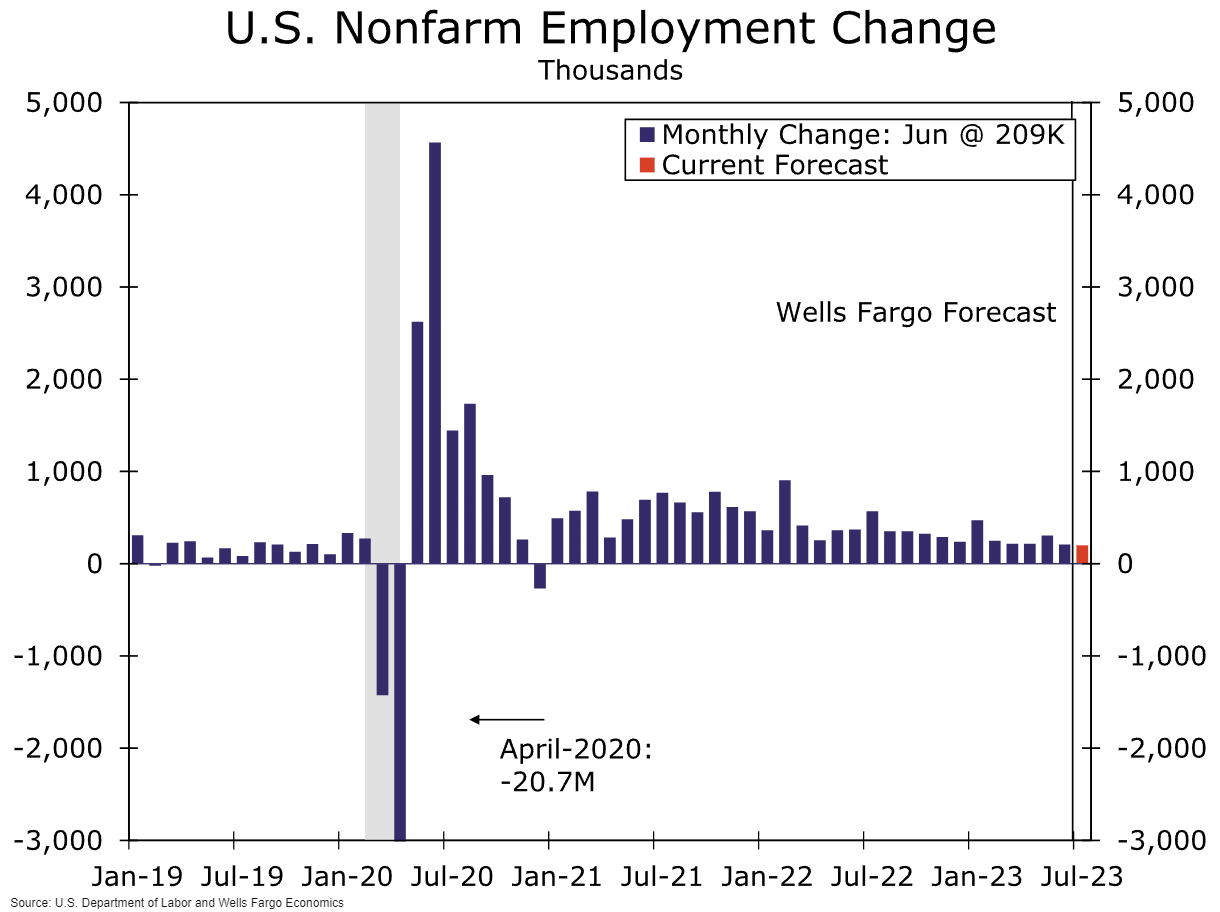

Median analyst forecasts see NFP at 200K, a modest move down from the 209K observed in the June reading. The highest estimate is 300K, with the lowest at 150K. The most common range is between 192K to 204K.

The Unemployment Rate is expected to stay unchanged at 3.6%, with a range of 3.7% to 3.5%.

Wells Fargo

NFP Forecast: 210K

Unemployment Rate Forecast: 3.6%

After 14 straight months of consensus-beating prints, the labor market showed some cracks at last with nonfarm payrolls printing below the Bloomberg consensus at 209K. The miss brought with it downward revisions to job growth in April and May, revealing a slightly slower but still strong pace of employment growth.

We suspect payrolls in July continued the trend of moderating but still healthy labor market growth. Demand for workers in the private sector has waned somewhat, with private sector employment increasing by 149K in June, the smallest monthly gain since 2020.

We look for a softer, but still robust, addition of 210K new jobs in July as the labor market moves closer into balance.

We also look for the Unemployment Rate to stay flat at 3.6%. Wages appeared to be cooling on trend, but faster-than-expected wage growth in June and upward revisions to prior months have forced a reassessment. Overall, we expect average hourly earnings to increase by 0.3% over the month.

ING

NFP Forecast: 200K

Unemployment Rate Forecast: 3.6%

JPMorgan's Dr. David Kelly

NFP Forecast: 228K

Unemployment Rate Forecast: 3.5%

Friday’s employment report could show payroll job gains in excess of 200,000 for the 31st consecutive month, potentially pushing the unemployment rate back down to 3.5%.

However, a modest pickup in both labor force participation and legal migration over the past year has allowed for strong hiring without further sharp reductions in the unemployment rate and we expect unemployment to remain in a range of 3% to 4% for as long as the economic expansion continues.

Crucially, this very tight labor market has not led to an explosion in wages. In fact, average hourly earnings for production and non-supervisory workers, which rose by 7.0% in the year ended in March of 2022, only rose by 4.7% year-over-year this June. We expect this statistic to moderate further going forward, falling to roughly 4% by the end of 2024.

Blackrock

US jobs data this week is likely to show still-low unemployment, confirming a tight labor market.

We think the Fed may be misreading the economy’s strength based on low unemployment: That shouldn’t be taken as the usual sign of a buoyant economy, but rather a result of structural worker shortages holding back growth potential.

We think this perceived strength raises the risk that the Fed hikes more than markets expect and then cuts as it generates too much weakness – rather than just holding tight.

Societe Generale

NFP Forecast: 190K

Unemployment Rate Forecast: 3.5%

Citigroup

NFP Forecast: 290K

Unemployment Rate Forecast: 3.5%

Goldman Sachs

NFP Forecast: 250K

Unemployment Rate Forecast: 3.5%

Last Release

On July 7th, at 8:30 AM ET, the BLS released the last Nonfarm Payrolls and Unemployment Rate data representing the month of June.

In June 2023, the US NFP report showed 209,000 jobs were added, falling below the forecast of 230,000 and lower than the previous month's figure of 339,000.

The US Unemployment Rate remained at 3.6%, in line with the forecast and slightly lower than the previous rate of 3.7%.

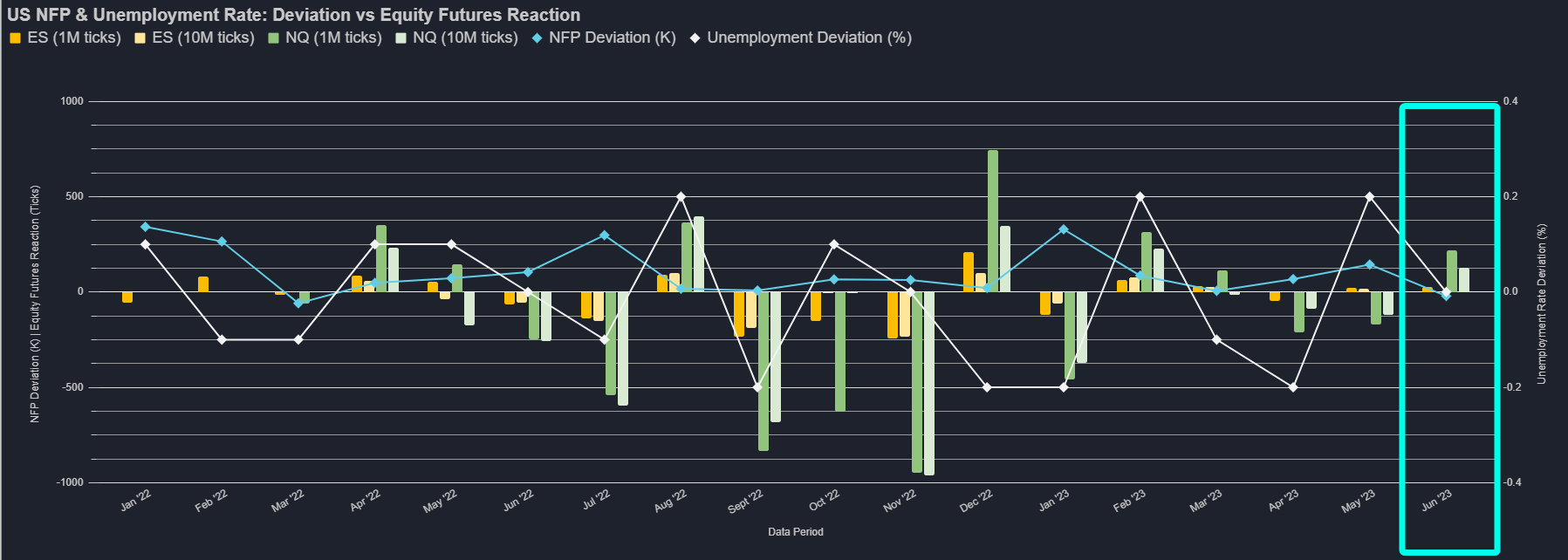

The market reactions after 1 minute of the NFP release were as follows:

ES increased by 28 ticks.

NQ rose by 219 ticks.

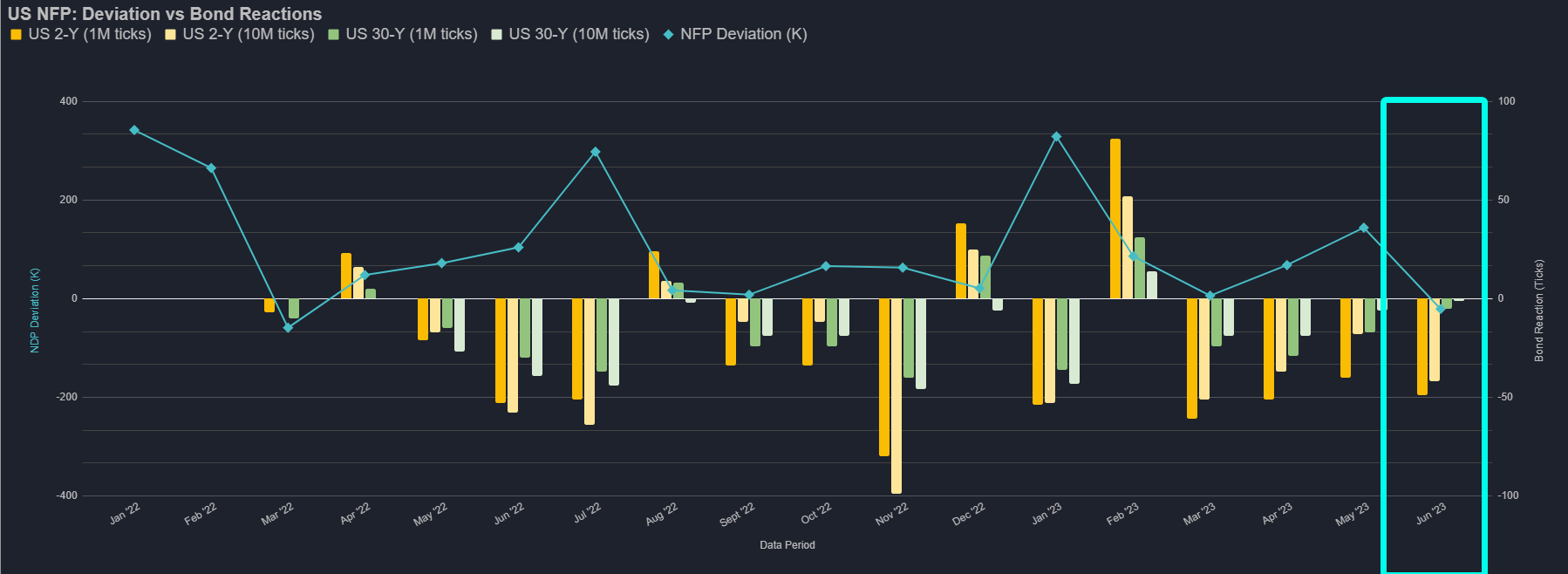

US 2-Year Bond saw a decrease of 49 ticks.