On Friday the 7th of July, at 8:30 AM ET, the BLS is set to release the US Nonfarm Payrolls and Unemployment Rate numbers for the month of June.

Here are some views on what to expect.

Wells Fargo

Nonfarm Payrolls Forecast: 245K

Unemployment Rate Forecast: 3.6%

May's employment report delivered a strong rise in nonfarm payrolls with a 339K gain. However, the household survey added weight to the view that the labor market continues to gradually soften, with household employment contracting by 310K and the unemployment rate ticking up to 3.7%.

We expect nonfarm payroll growth to moderate in June. Demand for workers continues to subside, with initial jobless claims moving up between survey weeks and the four-week average up nearly 20% over the past year. Meanwhile, job postings in June continued to slide. However, cooling in the jobs market remains incremental rather than abrupt. Therefore, we look for what we would consider to be a still robust gain of 245K new jobs in June, but will be closely watching revisions to May given the 22-year low in the survey response rate.

After shooting up 0.3 percentage points in May, we look for the unemployment rate to tick back down to 3.6% in anticipation of some bounce-back in the household measure of employment. The recent trend in average hourly earnings is likely little changed, leading us to expect another 0.3% monthly increase that would push down the 12-month change only slightly to 4.2%.

Barclays

Nonfarm Payrolls Forecast: 225K

Unemployment Rate Forecast: 3.6%

BlackRock

US jobs data is in focus this week. We think labor shortages have made firms reluctant to let workers go, keeping unemployment low even as growth sputters.

The focus in next week’s U.S. job report will be prevailing signs of a resilient labor market even with tight monetary policy. We see labor shortages fueling wage growth and keeping inflation stubbornly high as companies hold on to workers even as demand drops.

That poses the unusual risk of “full employment recessions,” where the unemployment rate stays low.

Citigroup

Nonfarm Payrolls Forecast: 170K

Unemployment Rate Forecast: 3.6%

ING

Nonfarm Payrolls Forecast: 225K

Unemployment Rate Forecast: 3.6%

Last month, the rise in non-farm payrolls was immensely strong at 339,000, but we do expect to see a moderation this month with something closer to the 225,000 mark.

The unemployment rate jumped to 3.7% from 3.4% last month given the household survey data painted a very different picture to the payrolls data – with households reporting that employment actually fell.

We see this reversing part of the jump and coming in at 3.6%. Meanwhile, average hourly earnings should soften a touch with another 0.3% month-on-month print, which would bring the annual rate of wage growth down to 4.2%.

Bank of America

Nonfarm Payrolls Forecast: 250K

Unemployment Rate Forecast: 3.6%

Previous Release

On June 2nd at 8:30 AM ET, the BLS released the US Nonfarm Payrolls and Unemployment rate numbers for the month of May.

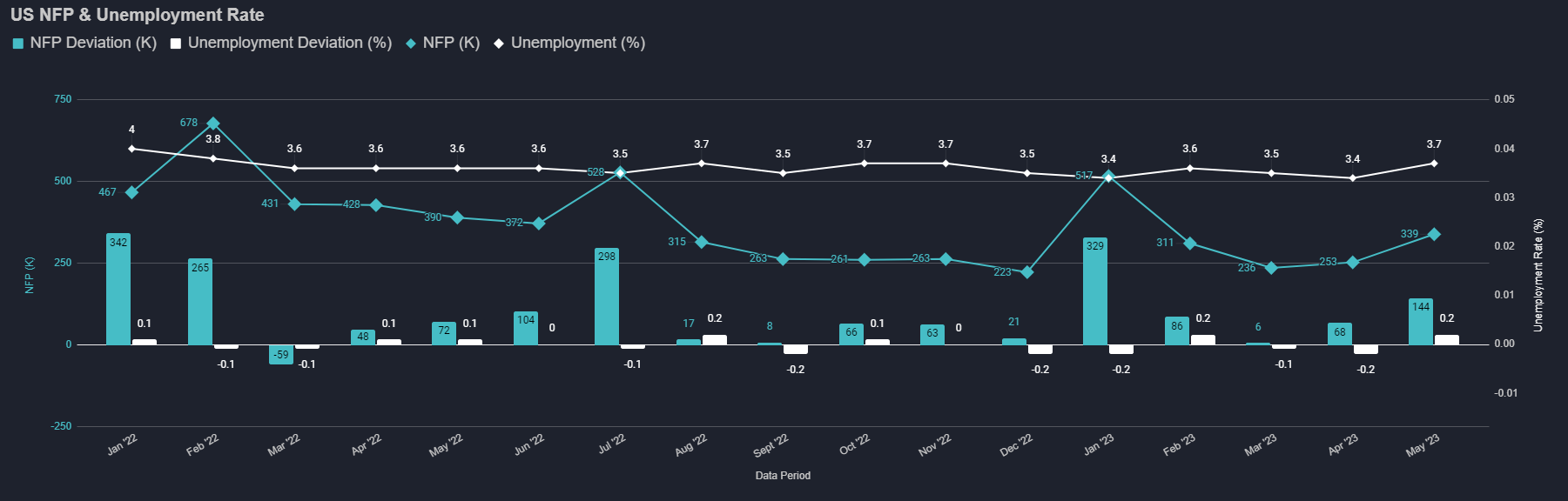

Nonfarm Payrolls heated up higher than expected, coming in at 339K, on median expectations of 195K. With this release, the April figure was also revised up from 253K to 294K.

However, the household survey-driven Unemployment Rate came in higher than expected, at 3.7%, on median expectations of 3.5%.

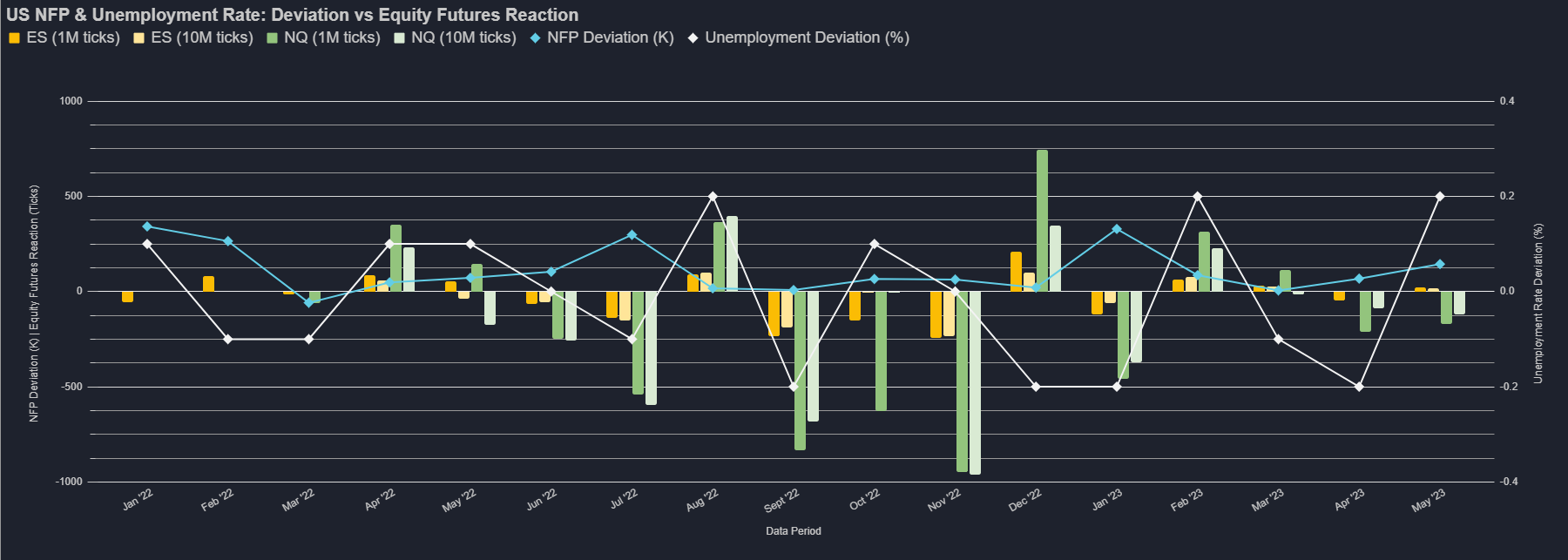

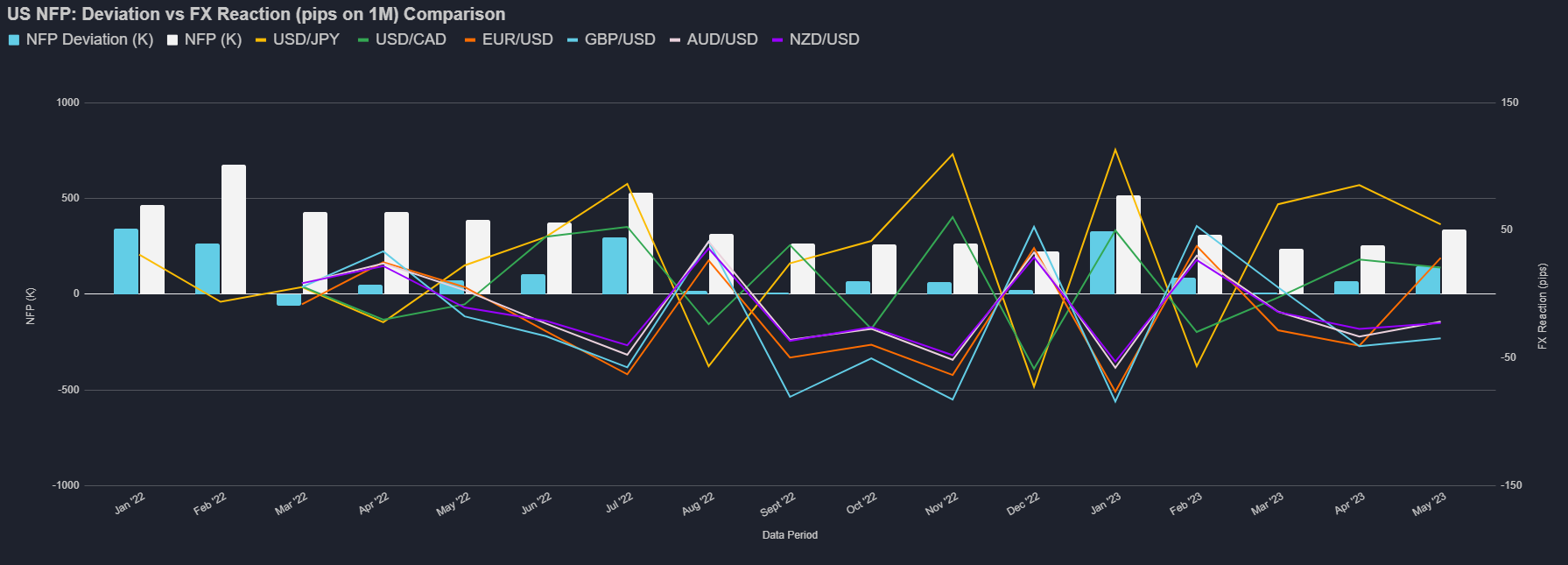

This caused strength in the dollar, and a whipsaw in the S&P 500, as investors grappled between the labor market being strong enough to withstand more rate hikes, and decreased likelihood of a recession in the US.

Previous Market Reactions

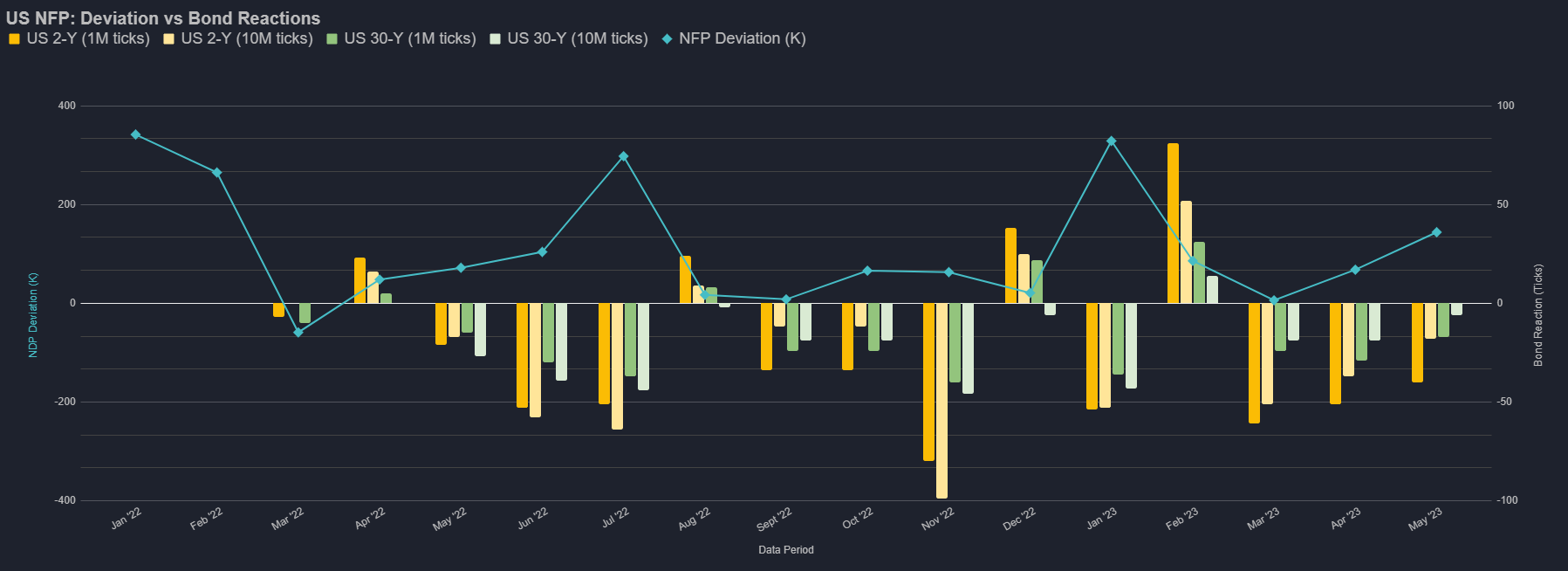

The above charts show NFP's deviation from its forecast for the last 17 months, compared to the market reactions in equity futures, FX, and bonds respectively.