On Friday the 1st of September, at 8:30 AM ET, the BLS is set to release the latest US Nonfarm Payrolls and Unemployment Rate numbers.

Here are some views on what to expect

Median analyst expectations for US Nonfarm Payrolls are 170K, in a survey of 64 qualified economists, the highest estimate is 230K, and the lowest is 120K. The highest amount of estimates are within the range of 147K and 150K.

As for the Unemployment Rate, the median forecast sees it unchanged at 3.5%, The highest estimate sees it at 3.6%, and the lowest, which is the general consensus, sees it at 3.5%.

JPMorgan

NFP Forecast: 125K

Unemployment Rate Forecast: 3.6%

The July Jobs report showed that the labor market continued to moderate.

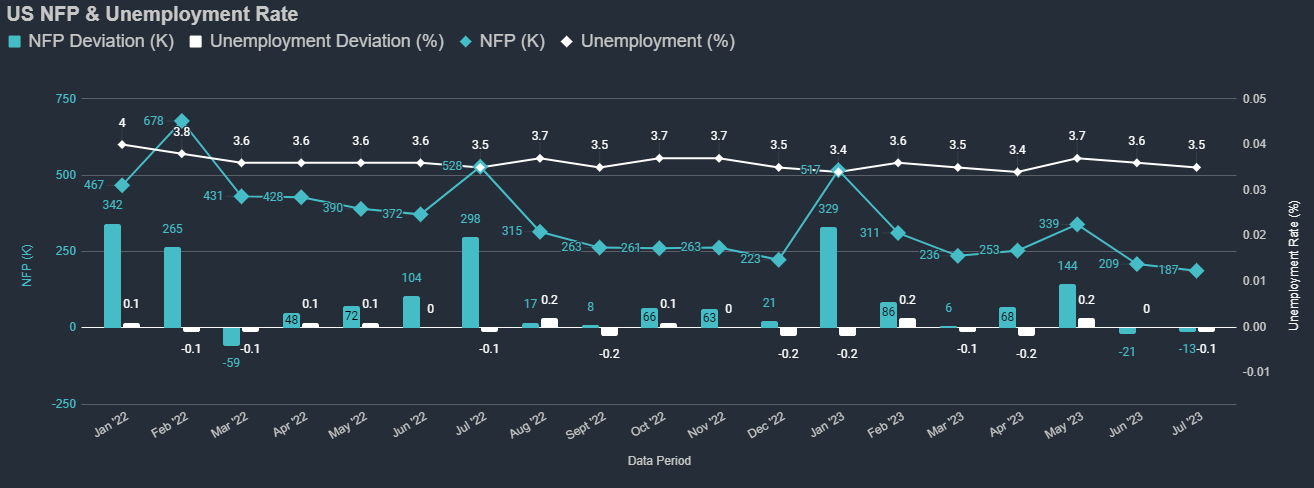

Nonfarm payrolls rose by a weaker-than-expected 187K, while revisions cut 49K jobs from gains for the last two months. Total employment as measured by the household survey rose by a more robust 268K, a similar pace as last month, and this allowed the unemployment rate to nudge down to 3.5%.

Wage growth was stronger than expected at +0.4% m/m, now up 4.4% from a year ago. Looking ahead, this report is unlikely to change the prospects for further tightening, as the July and August CPI reports will be more important in determining the Fed’s outlook.

Citigroup

NFP Forecast: 130K

Unemployment Rate Forecast: 3.5%

Wells Fargo

NFP Forecast: 160K

Unemployment Rate Forecast: 3.6%

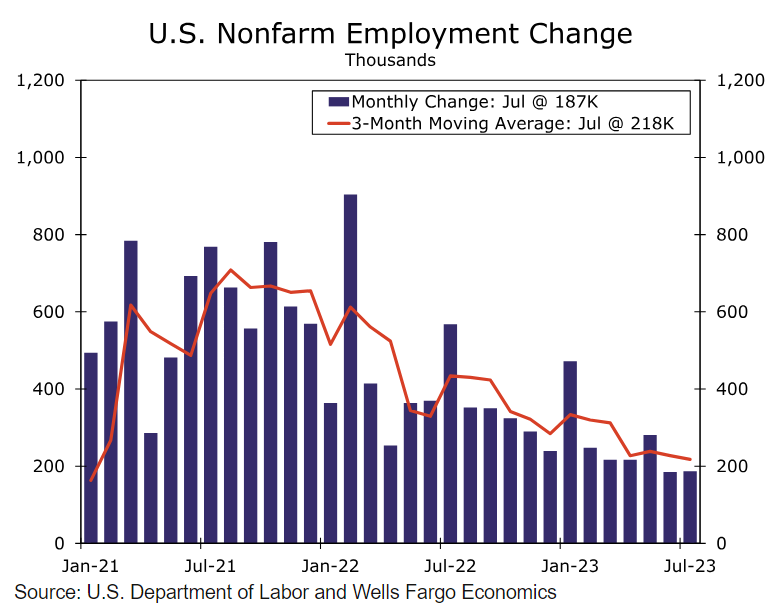

A revision to already published data released this week suggests that there were fewer nonfarm jobs added than initially reported. That suggests employers added jobs at a slightly slower rate in 2022 and early 2023 than already-released data initially suggested. The revisions do not change what was already understood: that job growth, while more resilient than most expected, has slowed since the frenetic pace of hiring in the wake of the pandemic.

In our view, the more salient point has less to do with the nuances of the revisions and more to do with the fact that the fastest rate hikes in a generation have yet to have taken a meaningful bite out of employers’ desire to add to payrolls.

This is a widely anticipated reading on the jobs market for August.

We expect to see that employers added 160K to nonfarm payrolls during the period. The sturdy gain in income growth for July taken in tandem with the still-elevated pace of job and wage growth suggests rates could remain higher for longer than some market participants presently expect.

ING

NFP Forecast: 175K

Unemployment Rate Forecast: 3.5%

The data have yet to prove the smoking gun that can mark the end of the Federal Reserve's hawkish stance. Stronger trends will only start to develop should we see a large downside miss on the August NFP jobs data or a sharp rise in the unemployment rate.

That would undermine the thesis that strong employment consumption can keep the Fed in hawkish mode for a lot longer than most think.

Morgan Stanley

NFP Forecast: 155K

Unemployment Rate Forecast: 3.5%

Previous Release

On August 4th at 8:30 AM ET, the BLS released the last US Nonfarm Payrolls and Unemployment Rate report.

Nonfarm Payrolls came in at 187K, below expectations of 200K, but slightly higher than the revised prior of 185k

The Unemployment Rate ticked down below expectations to 3.5%, from the prior 3.6%

This caused weakness in the dollar, some whipsawing that led to slight strength in the S&P 500, and some weakness in the US 2-year government bond yield, which is most sensitive to Fed policy.

This occurred as markets saw this as an indicator that the jobs market was cooling down enough to pare down bets on future Federal Reserve tightening.