On Friday 2nd September 2022, the Bureau of Labour Statistics is set to release the US Nonfarm Payrolls and US Unemployment Rate, here are some views on what to expect:

/BureauofLaborStatistics-0a868acbc1dd4b67a4f0dcfcb2bf040b.jpg)

Wells Fargo

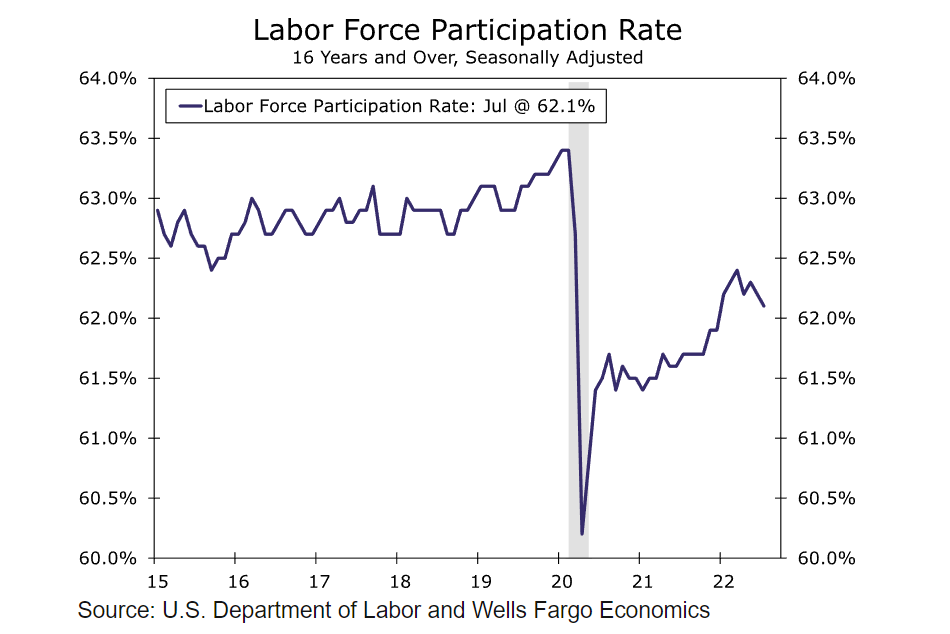

Job growth of more than half a million new jobs per month is consistent with an economy that is experiencing robust economic growth. Yet, other indicators suggest the economy is slowing down, and monetary policymakers are charting a course that brings labor supply and demand more into balance.

As a result, we would be surprised by job growth continuing anywhere near the July pace in the months ahead. We look for nonfarm payrolls to have risen 325K in August.

JPMorgan

Nonfarm Payrolls: 300k

Unemployment Rate: 3.4%

Dr. David Kelly: "High-frequency data suggests a solid jobs report this Friday – between +300,000 and +400,000 on payrolls, no change in the unemployment rate, and wage growth of roughly 0.4%. This could tilt the betting further in favor of 75 basis points."

Strategists: "A reading on the US labor market that spells bad news for the economy is actually a bullish signal for stocks."

Deutsche Bank

Alan Ruskin, Chief International Strategist

Friday's hugely important employment report will validate the case for 50 or 75 basis points.

“If we see strength in jobs, it means the Fed can go 75 and raise rates quickly without risking growth.”

TD

Nonfarm Payrolls: 370k

Unemployment Rate: 3.4%

Head Trading Strategist Shawn Cruz: "The repercussions from Friday are going to make us extra sensitive to a lot of the incoming data, especially around employment."

Goldman Sachs

Nonfarm Payrolls: 350k

Unemployment Rate: 3.4%

Previous Release

On August 5th, at 8:30 AM ET, the BLS released the US Nonfarm Payrolls and US Unemployment Rate figures.

Nonfarm Payrolls soared over average expectations, with a figure of 528,000, on median estimates of 250,000, and a prior read of 372,000.

The US Unemployment Rate came in lower than expected, 3.5%, 10bps lower than the median estimates.

This better-than-expected employment report caused strength in the US dollar, weakness in the S&P 500 and Gold, and increased yields on the US 10-year government bonds.