On Friday the 2nd of June, at 8:30 AM ET, the BLS is set to release the US Nonfarm Payrolls and Unemployment Rate numbers for the month of May.

Here are some views on what to expect.

Median analyst estimates for Nonfarm Payrolls are 195K, with the highest estimate at 250K, and the lowest at 100K.

The majority of estimates see it at around 200K-205K.

The median forecast for the US Unemployment Rate is 3.5%, from the prior 3.4%. The highest estimate sees 3.6%, and the lowest sees 3.3%.

Blackrock

US jobs data this week should show a tight labor market is keeping wage pressures elevated. We think that keeps inflation sticky and above policy targets.

JPMorgan

Dr. David Kelly

US NFP Forecast: 205K

US Unemployment Rate Forecast: 3.4%

Wells Fargo

US NFP Forecast: 210K

US Unemployment Rate Forecast: 3.5%

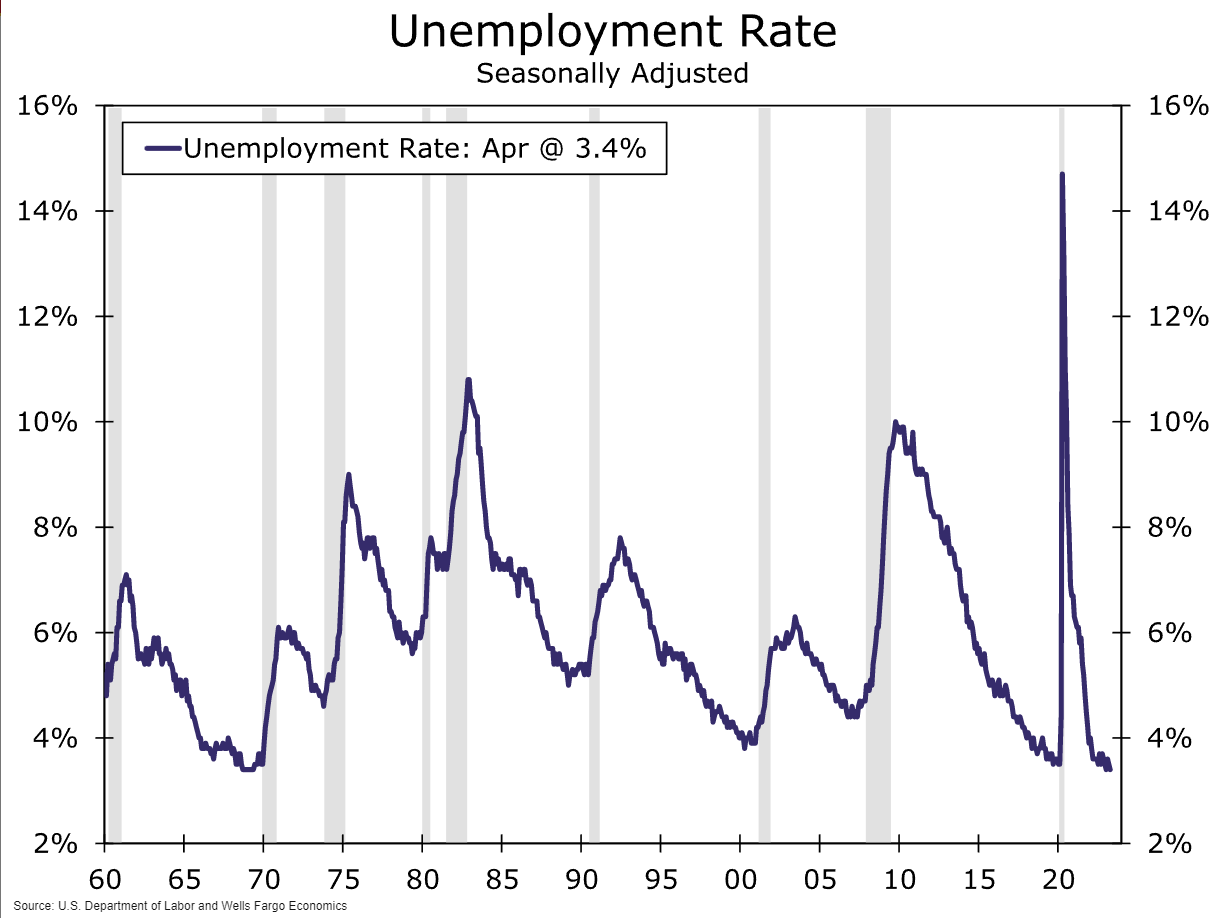

Downward revisions to the prior two months took some shine off of the reading as job growth over February and March was revised lower by a combined 149K jobs. In addition to the strong gain in jobs, the unemployment rate ticked down to 3.4% again, matching the lowest rate in 53 years.

Our expectation is that Nonfarm Payrolls increased by 210K in May. We believe it is important to keep a close eye on wage growth and labor force participation numbers.

The labor force has grown at a healthy pace over the past year, and a further deceleration in wages alongside expanding supply would be an encouraging sign in the Federal Reserve's fight to get inflation back to 2%.

ING

US NFP Forecast: 195K

US Unemployment Rate Forecast: 3.5%

US interest rate hike expectations have been flying all over the place in the past three weeks. The market has now settled on around a 25% chance of a 25bp hike on 14 June, but a strong jobs reading on Friday could easily swing things back in favor of a hike

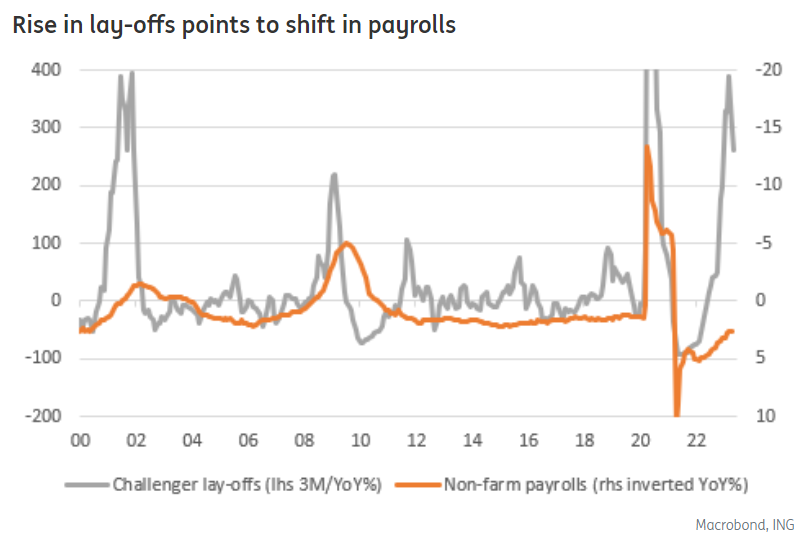

At the moment, the consensus is for the economy to add 195,000 jobs in this report, which is lower than the 253,000 seen in April.

In fact, none of the 69 organizations surveyed by Bloomberg expect payrolls to come in stronger than last month, which is a little surprising.

In terms of the numbers we have seen, we know that job openings remain incredibly high and are in fact larger than the total number of Americans that regard themselves as unemployed. This means that a lack of people with the required skill sets continues to restrict hiring.

Blackrock

US NFP Forecast: 200K

US Unemployment Rate Forecast: 3.4%

Employment Report history this week

This week also saw the release of the US JOLTS Job Openings report on Wednesday and the US ADP Private Payrolls report on Thursday.

The US JOLTS number for April came in above expectations, at 10.103 million, above estimates of 9.4 million, and March's 9.59 million.

And the US ADP report also came in considerably higher than expectations, with the latest read representing the month of May coming in at 278,000, on median expectations of 170,000, but still less than April's 296,000.

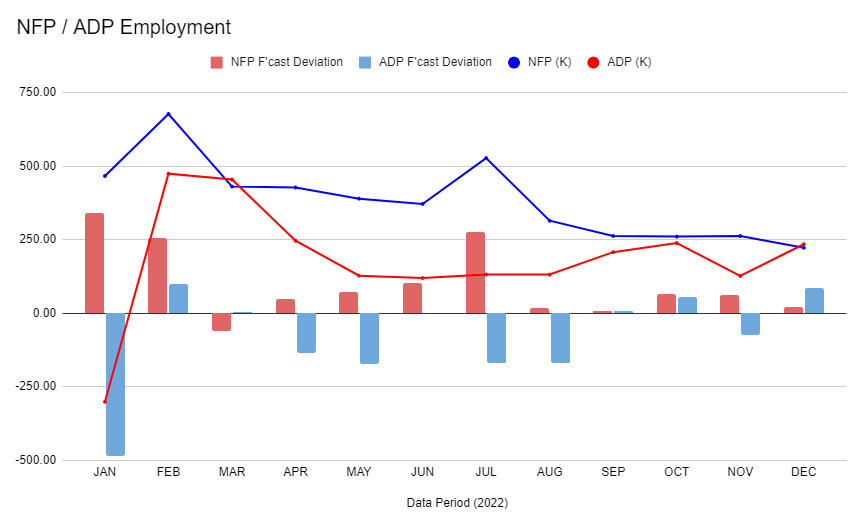

Although some analysts look to these employment reports preceding the critical Nonfarm Payrolls read as an indicator, history would urge caution when using these reports as predictive.

Throughout the year 2022, there was little to no correlation report to report between the two, other than in the overall trend. Interestingly, throughout those 12 data points, ADP came in below expectations the majority of the time, while Nonfarm Payrolls came in higher than expectations every time but once.

When it comes to the JOLTS number, keep in mind that the data period represented lags behind ADP and NFP by one month, despite being released in the same week.

Prior Report

On May 5th at 8:30 AM ET, the BLS released the last Nonfarm Payrolls and Unemployment Rate report.

Nonfarm Payrolls for the month of April came in hot at 253,000, on estimates of 185,000.

With the release of this report, we also saw the prior March report revised down from 236,000 to 165,000.

However, the Unemployment Rate number cooled off to 3.4%, on median estimates of 3.6%, and the prior read of 3.5%.

This caused strength in the dollar and the US 2-year yields, and some downside choppiness in the S&P 500.

The hot NFP number caused bets for an interest rate hike at the Fed's next meeting to increase.

NFP vs Unemployment Rate

The divergence between Nonfarm Payrolls and the Unemployment Rate is not uncommon, as the information is derived from different sources, using different methodologies. The Unemployment Rate is typically calculated using household surveys in which people are asked about their employment status. Nonfarm payrolls, on the other hand, is based on data collected from businesses and government agencies through establishment surveys.

Also, the percentage of the labor force that is unemployed is used to calculate the Unemployment Rate. It is important to note that the labor force includes people who are actively looking for work.

Even if the number of Nonfarm Payrolls remains relatively stable, changes in labor force participation, such as people entering or leaving the labor force, can have an impact on the Unemployment Rate.