On Friday the 6th of October, at 8:30 AM ET, the BLS is set to release the latest US Nonfarm Payrolls and Unemployment Rate numbers.

Here are some views on what to expect.

For Nonfarm Payrolls, the median forecast is 170K, according to a survey of 64 qualified economists. The highest estimate is 250K, and the lowest is 190K, with the largest number of bets placed at 150K.

The median estimate for the US Unemployment Rate is 3.7%, with the highest estimate at 3.9%, and the lowest at 3.6%. The largest number of bets is placed at the median level of 3.7%

Wells Fargo

NFP Forecast: 150K

Unemployment Rate Forecast: 3.7%

When the Fed started its hiking cycle 18 months ago, the intent was to spur enough of an economic slowdown to cool inflation without sparking a significant rise in unemployment.

So far, it appears that policymakers have made progress toward those ends. The labor market has loosened from its historic strength over the past couple of years, while inflation continues to trend lower.

Meanwhile, the unemployment rate to date remains sub-4%. The problem? Current trends suggest that inflation is unlikely to reach the Fed’s 2% target on a sustained basis over the next few quarters, meaning that the Fed will likely keep interest rates elevated for some time.

As high interest rates continue to take a bite out of labor demand, we expect additional labor market cooling.

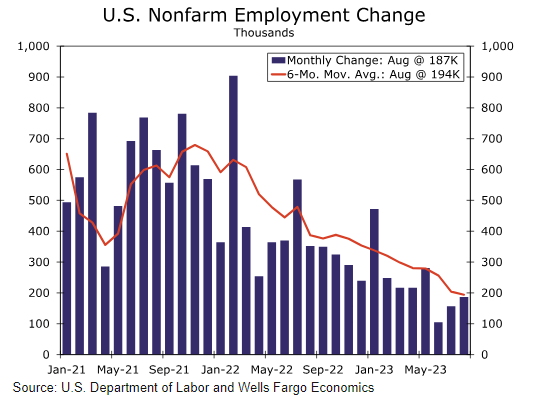

We forecast that the US economy added 150K jobs in September, a step down from 187K in August. While initial jobless claims have remained exceptionally low, demand for new workers has steadily waned with job openings having lurched lower and small business hiring plans hovering near six-year lows.

Notably, strike activity should not bear heavily on this month's change in nonfarm payrolls, with the United Auto Workers walk-off and the Hollywood writers' deal both occurring too late in the month.

Looking beyond payrolls, we anticipate that the labor force ebbed a bit in September after last month’s jump. If realized, this would nudge the unemployment rate a tick down to 3.7%.

Meanwhile, the trend in average hourly earnings growth continues to gradually ease as turnover settles down and the supply and demand for labor have moved toward a better balance.

We estimate that average hourly earnings growth picked up slightly to 0.3% in September, although that would be enough to push down the three-month annualized pace of wage gains below 4%.

JPMorgan

NFP Forecast: 175K

Unemployment Rate Forecast: 3.7%

The August Jobs report provided further evidence that the labor market is softening.

Nonfarm payrolls rose by a stronger-than-expected 187K. However, revisions cut 110K jobs for the last two months, suggesting a slowdown in hiring.

A large increase in the labor force pushed the unemployment rate higher to 3.8%, while wage growth came in below expectations, gaining 0.2% m/m and 4.3% y/y.

Overall, this report still shows decent momentum in the labor market and a recession this year seems unlikely. That said, a more balanced labor market and easing wage pressures should allow core inflation to move lower, reducing the need for the Fed to hike further.

Citigroup

NFP Forecast: 240K

Unemployment Rate Forecast: 3.6%

Blackrock

Our assessment is that we are set for “full-employment stagnation.” Most of the inflation and wage growth we’ve seen to date reflects the mismatch associated with the pandemic.

That is now reversing well and inflation is set to fall further. But as the process of resolving the mismatch ends and labor shortages start to bind, we expect inflation to go on a rollercoaster ride, rising again in 2024.

A smaller workforce means the rate of growth the economy will be able to sustain without resurgent inflation will be lower than in the past.

Morgan Stanley

NFP Forecast: 180K

Unemployment Rate Forecast: 3.7%

ING

NFP Forecast: 175K

Unemployment Rate Forecast: 3.7%

Consensus expects another steady 170-180k headline increase in jobs and the unemployment edging back to 3.7%.

Average hourly earnings are expected to tick up to 0.3% month-on-month.

On the face of it, these numbers will not reverse the Federal Reserve's hawkish stance, nor the strong dollar.

Previous Release

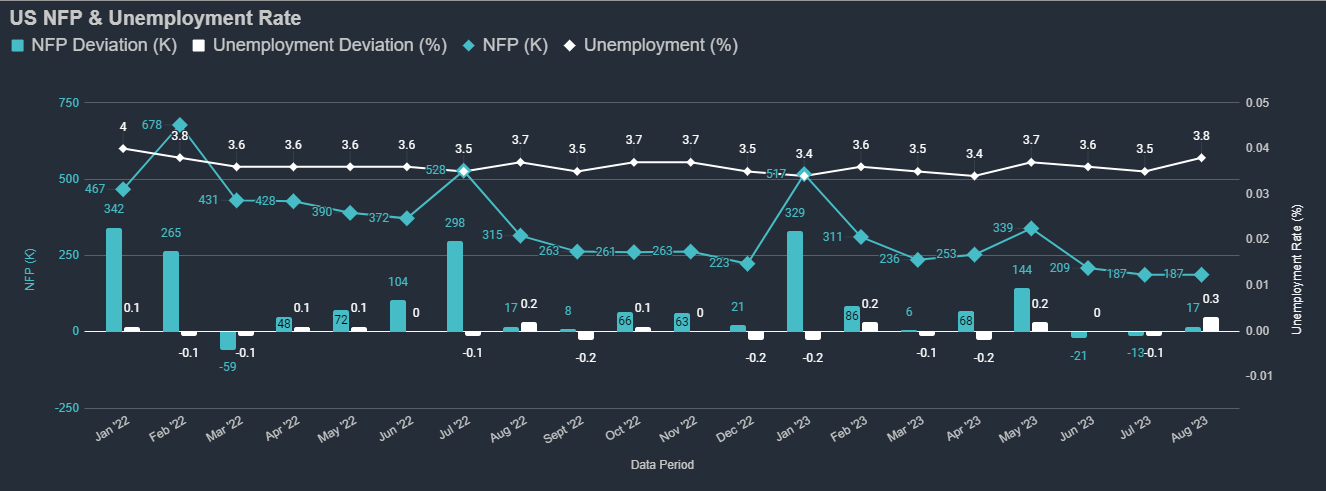

On September 1st at 8:30 AM ET, the BLS released the last Nonfarm Payrolls and Unemployment Rate numbers, representing the month of August.

Nonfarm Payrolls came out at 187K, hotter than estimates of 170K, and the same as the prior read.

The Unemployment Rate came out at 3.8%, higher than the expected 3.5%, and the prior read of 3.5% as well.

This caused weakness in the Dollar and the US 2-year government bond yields, and strength in the S&P 500, as traders digested the large positive deviation in the Unemployment Rate over the smaller positive deviation in the Nonfarm Payrolls number.

This release also caused Fed Swaps to price in lower odds of another rate hike this year, and shift full pricing of a rate cut to May from June, as they saw the rising Unemployment Rate as a signal that the Federal Reserve's high interest rates were having the desired effect of slowing down the economy.