On Friday the 3rd of November, at 8:30 AM ET, the BLS is set to release the latest US Nonfarm Payrolls and Unemployment Rate numbers.

Here are some views on what to expect.

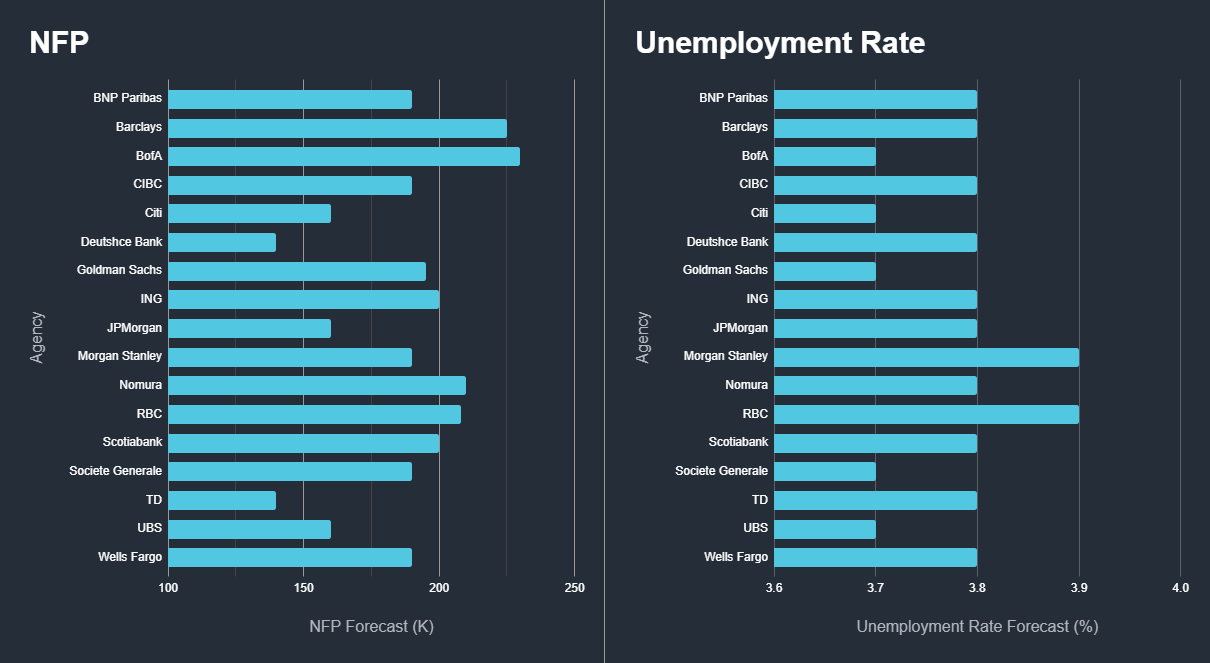

Median estimates see Nonfarm Payrolls at 180K, as per a survey of 61 economists, the highest estimate is 235K and the lowest is 125K, with the largest number of bets seeing 190K.

As for the Unemployment Rate, the median forecast is 3.8%, with the highest being 3.9% and the lowest being 3.7%.

Here are the views from some of the top investment banks.

Wells Fargo

Nonfarm Payrolls Forecast: 190K

Unemployment Rate Forecast: 3.8%

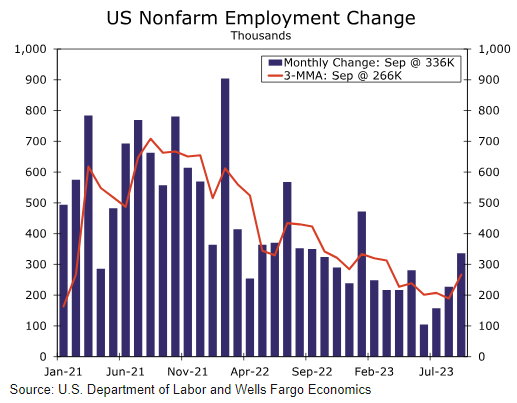

The labor market remains remarkably tight. Employers added a whopping 336K workers in September, and there were upward revisions to the prior months' data as well. But even with the surprising strength in recent job gains, the labor market has shown some signs of moderating. Job openings and hiring plans have moved lower, demand for temporary help has fallen, and the average work week is back to pre-pandemic levels. We expect the pace of hiring to slow in October, and we forecast employers added 190,000 jobs last month.

The hiring figures will ultimately be somewhat depressed by strike activity. The UAW strike began in mid-September but was after the survey week for the September payroll report. Those workers will now show up as a reduction in employment in October as they are no longer included on company payrolls. That said, there should be only a minimal impact on the unemployment rate, as workers on strike are still considered “employed” in the household survey, on which the unemployment rate is based. We forecast the unemployment rate to hold steady at 3.8% in October.

We also anticipate wage growth will continue to cool in October. Growth in the labor force has helped restrain wage growth even as hiring has remained hot in recent months.

We forecast that average hourly earnings rose by 0.3% in October, which would still translate to the slowest pace of annual wage gains in two years. We'll get a deeper look at how labor costs fared in the third quarter in the updated Employment Cost Index data, released Tuesday.

JPMorgan

Nonfarm Payrolls Forecast: 158K

Unemployment Rate Forecast: 3.7%

Very low unemployment, combined with slow growth in the working-age population, should limit job growth. We expect this week’s jobs report to show payroll job gains of roughly 160,000 in October—less than half of the 336,000 increase reported for September.

The September Jobs report showed that the labor market remains resilient, with strong hiring momentum but a notable lack of upward wage pressure. Non-farm payrolls rose by 336K, well above expectations of 170K, with upward revisions of 119K jobs to the prior two months.

Job gains were widespread but most significant in the sectors that have had the hardest time finding workers, pointing to a continued normalization in the labor market. Average hourly earnings rose by a modest 0.2% m/m, bringing the year-over-year rate down to 4.2%, despite strong job gains.

The unemployment rate remained at 3.8% as modest labor force growth was matched with a gain in workers. Overall, this report clearly shows a picture of labor market strength but also underscores the economy’s ability to maintain unemployment below 4% with only moderate wage growth.