On Friday the 8th of December, at 8:30 AM ET, the BLS is set to release the latest US Nonfarm Payrolls and Unemployment Rate numbers for the month of November.

Here are some views on what to expect.

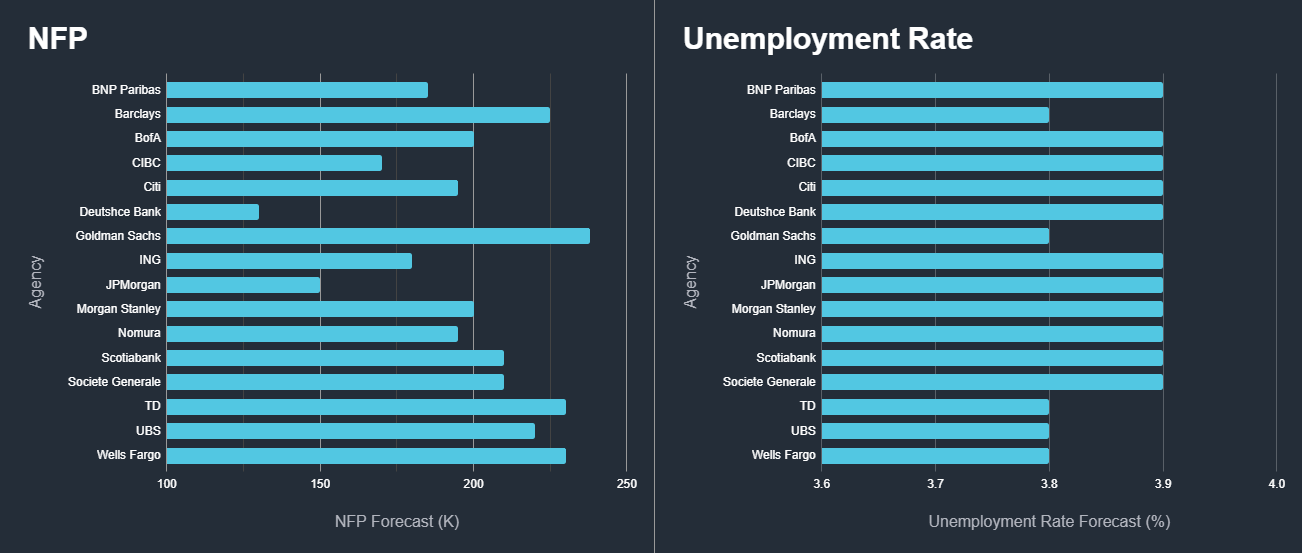

Median estimates see Nonfarm Payrolls at 186K, as per a survey of 66 economists, the highest estimate is 275K and the lowest is 110K, with the average being 182.52K.

As for the Unemployment Rate, the median forecast is 3.9%, with the highest being 4% and the lowest being 3.8%.

Here are the views from some of the largest investment banks:

Wells Fargo

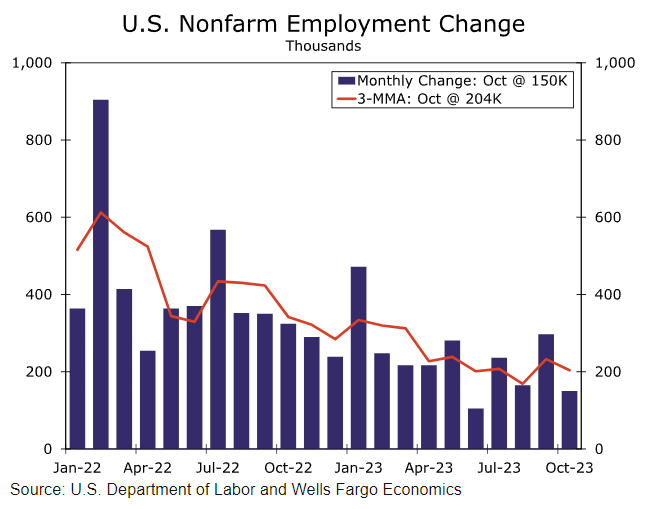

The most recent jobs report provided concrete evidence of labor market softening, an outcome we have been anticipating since the Fed committed to its battle against inflation. The 150K net payrolls added in October was roughly half September’s 297K print. Combined with downward revisions to prior data, October’s outturn solidified a trend decline that reflects a labor market gradually losing steam. Wage growth also continued to cool in October as labor demand and supply move closer toward balance. Average hourly earnings rose 0.2%, the slowest monthly pace in more than a year. On a three-month annualized basis, AHE were up 3.2%, a pace that could be deemed consistent with 2% inflation, if sustained, when factoring in the trend in productivity growth.

The United Auto Workers strike was a one-off factor that dampened payrolls in October. Even excluding auto manufacturing, however, job growth appears to be narrowing. The share of industries expanding headcounts in October fell to its lowest level since April 2020. We anticipate softening labor demand will remain a theme moving forward. That said, the end to UAW and Hollywood actors' strikes looks apt to boost November’s payroll print by close to 45K. Furthermore, a relatively late survey week should help capture more holiday hiring than in prior years, supporting seasonally-adjusted gains. We estimate that employers added 230K payrolls over the month. We also expect the unemployment rate ticked down to 3.8% and look for average hourly earnings to increase 0.3% in November.

JPMorgan

The October Jobs report showed welcomed signs of easing in a tight post-pandemic labor market. Nonfarm payrolls rose by 150K, slightly below expectations, with backwards revisions of 101K tempering strong gains from the prior two months. The underlying details also looked soft. Payroll job gains were narrow in scope and most sectors saw hiring momentum slow, with the private sector only adding 99K jobs. In the household survey, an outsized drop in the number of employed people pushed the unemployment rate up to 3.9%, its highest reading since early 2022. Average hourly earnings rose by a modest 0.2% m/m, in-line with the pre-pandemic trend. Overall, with easing pressures from the labor market, inflation looks set to slide toward the Fed’s 2% target, even without further rate hikes.

ING

Next week’s data highlight will be the November jobs report. October’s was much softer than expected, so there is cope for a bit of a recovery, but the trend is towards weaker hiring, as signalled in the recent Fed Beige Book and the rise in continuing jobless claims. The unemployment rate is expected to stay at 3.9%, but we soon expect it to break above 4%. Subdued wage growth should reaffirm the market’s view that the inflation pressures from the jobs market are weakening fast, aided by improving productivity growth.

BlackRock

The U.S. payrolls report for November is in focus this week. We are looking for signs that job growth is slowing further as the post-pandemic normalization runs its course. Structural labor shortages as the U.S. population ages means the economy will only be able to sustain a fraction of recent job growth without stoking inflation again, in our view.

Previous Release

On November 3rd at 08:30 ET, the BLS released the last Nonfarm Payrolls and Unemployment Rate numbers, representing the month of October.

NFP came in below expectations, at 150K, on estimates of 180K, and a prior of 336K.

However, the Unemployment Rate came in higher than expected, 3.9%, on the estimate and prior read of 3.8%.

As pictured, this caused weakness in the dollar and strength in the S&P 500, as markets pushed forward pricing for Fed rate cuts next year, as cooler-than-expected employment indicates less upside inflation risk.