On June 3rd at 8:30 AM ET, the Bureau of Labor Statistics is set to release the US Nonfarm Payrolls and Unemployment Rate figures for May 2022, here are some views on what to expect:

Wells Fargo

With labor supply gaining firmer footing and openings still ample, employment growth is set to remain solid in the coming months. We forecast nonfarm payrolls to rise 325K in May and look for the unemployment rate to decline to 3.5%. A 325K increase, should it occur, would mark a moderation from the job gains seen over the past couple of months.

Regional Fed employment indices improved in May, but at a cooling pace. The job openings rate has also appeared to top out and small business hiring plans have softened. With job openings more smoothly translating into new hires, stiff competition for workers will presumably improve and help quell wage pressures. We forecast average hourly earnings to rise 0.4% month-over-month in May.

ING

The US jobs report should be firm. Once again the main constraint will be a lack of worker supply with nearly two vacancies for every unemployed American. This means wages will continue to be bid higher and the unemployment rate will likely fall to 3.5%.

JPMorgan

NFP Forecast: 375K

Unemployment Rate Forecast: 3.5%

TD Securities

NFP Forecast: 300K

Unemployment Rate Forecast: 3.5%

Citigroup

NFP Forecast: 315K

Unemployment Rate Forecast: 3.4%

Previous Release

The previous BLS release of Nonfarm Payrolls came out on May 6th, 428K, higher than the median forecast at the time of 380K, while the US unemployment rate came in higher than anticipated at 3.6%

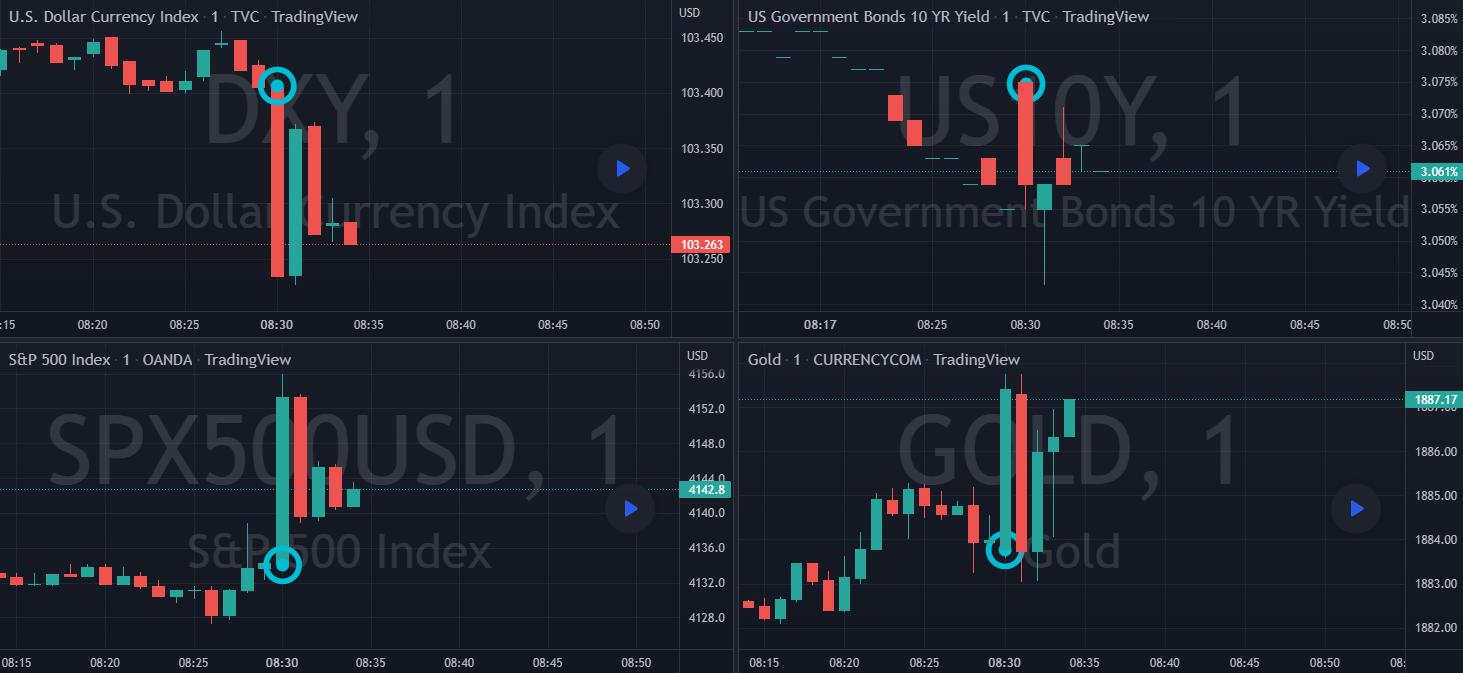

This data saw the dollar initially weaken, while Gold and the S&P 500 strengthened.

What is it?

Nonfarm payrolls track the number of part-time and full-time employees in both business and government. It shows the net amount of jobs created.

What are the fundamental effects?

Wages and salaries from employment make up the main source of household income. The more workers there are, the more they buy and propel the economy forward. If fewer people are working, spending drops off and businesses suffer. Both the Federal Reserve and the markets pay close attention.

US Unemployment Rate

What is it?

The unemployment rate measures the number of unemployed as a percentage of the labor force. In order to be counted as unemployed, one must be actively looking for work.

US Participation Rate

What is it?

Measures the share of the working-age population either working or ready and able for work. The number of people who are no longer actively searching for work would not be included in the participation rate.

US Average Workweek Hrs

What is it?

Measures the average number of hours worked by employees on non-farm payrolls.

US Manufacturing Payrolls

What is it?

It measures the change in manufacturing jobs being created.

US Average Hourly Earnings

What is it?

It measures the change in the price businesses pays for labor, not including the agricultural sector.

How does it affect markets?

CURRENCY - A weaker jobs report softens demand for US currency because it will be bad for American stocks. This makes the Dollar less appealing to foreigners.

STOCKS - Little or no growth in employment is seen as bad for stocks. The worry is households will be less inclined to shop. The weaker sales can shrink corporate profits.

BONDS - A series of weak employment reports reflects a more sluggish economy, which is bullish for bond prices and means interest rates may head lower.