The Bull Flag is considered one of several price action patterns that lead to a continuation of the bullish trend. Typically they present immediately following an impulsive move in the market & represent a short consolidation before the continuation of the trend. In general Flags are found frequently in all markets, time frames, & price ranges. They also tend to be easy to identify, very reliable & therefore, a trader favorite.

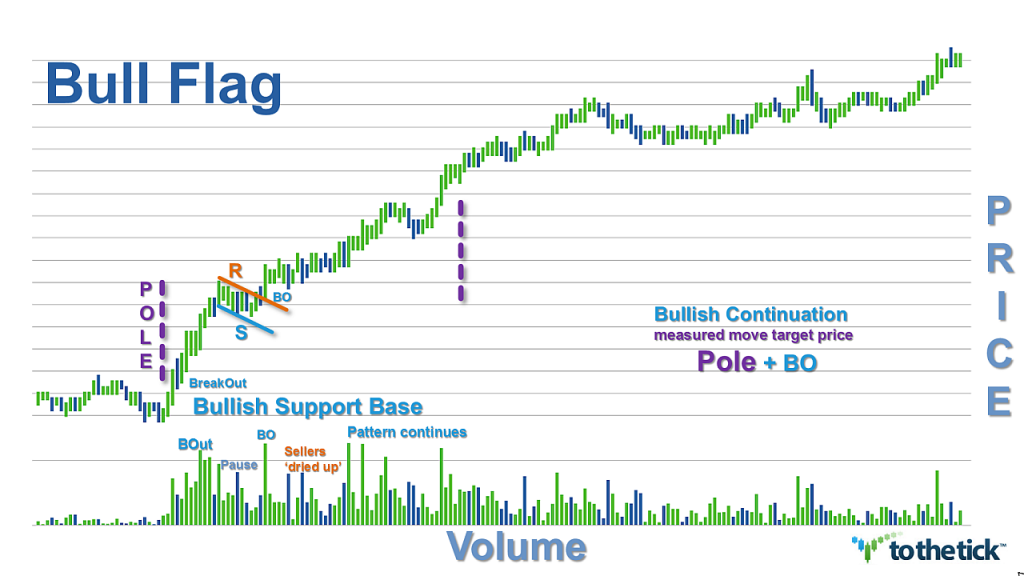

Visually Flags are a 2 part structure: a Pole with a base & a tip tilted toward price & then a small parallelogram or rectangle attached to the Pole tip facing right. They are characterized with parallel or near-parallel trend lines drawn to represent the immediate support & resistance. Ideally the Bull Flag portion will be ‘tilted’ or sloped downwardly opposite of the prevailing trend direction during formation which is believed to offer traders an ‘edge’. However, a good Bull Flag is not limited to have a tilt as it can be totally horizontal, or even sloped upward representing ‘nuances’ for traders to consider.

The bullish continuation pattern has 3 phases:

1) Background: A Strong impulsive, thrusting action with a surge in volume & price establishes a clear picture of the controlling bullish trend direction. This action is represented visually by a Pole with tip pointing up. Higher & more drama the better as the Pole is the Key to recognizing the potential for the continuation of the pattern. The Pole represents trend direction as well as its strength & often this pattern is initiated as a new breakout in price from an established base of support & buyers are in control. This pattern has ‘1 rule: all Flags must have a pole.’

2) The second phase is a pause for consolidation of the action both in volume & price and is represented by the Flag. As traders we like to see this phase very short in duration with only 2 or 3 swings while our price action is range bound maintaining the parallel or near-parallel shape & the volume is ‘resting’.

- Usually the difference between Flags & Rectangles &/or Channel price patterns is their size or duration. Typically Flags are relatively short in duration and therefore small.

3) The pattern confirms as a bullish continuation pattern if the action creates a new bullish breakout with a surge again from the bulls in both volume & price. The immediate upper resistance outlined by the Flag is the area traders look to see confirm the breakout. Typically the action will mimic the volatility & energy experienced with the Pole creation.

Options for Trading the Bull Flag as a bullish continuation pattern:

Aggressive traders may trade long:

- with each failed swing low effort on support: recommend wait for couple of swings

- less aggressive option: wait for the 1st confirmed failure of price to make it back to the support line

Conservative traders will enter a trade long:

- once the upper resistance line has been broken

- once the new breakout has confirmed

False breakouts do happen & confirmation needed is always a traders’ choice. Several methods that apply here for either intrabar &/or close bar options offered in sequence: breakout above resistance price, line holds retrace as new support, price clears breakout swing high price, price clears Pole tip price, larger chart combination.

Stop placement considerations can be aggressively raised after the breakout of the price.

Measured Move Targets based on structure of Pole & the Bull Flag:

Aggressive with Momentum & Volume: duplication of the original move or trader choice measurement of the Pole:

- Pole measure (added to) BreakOut price = target

- Pole measure = (Pole Tip price (minus) Pole Base price)

Example Bull Flag as a bullish continuation pattern: